Analysis of the Technical Architecture of Lombard Protocol

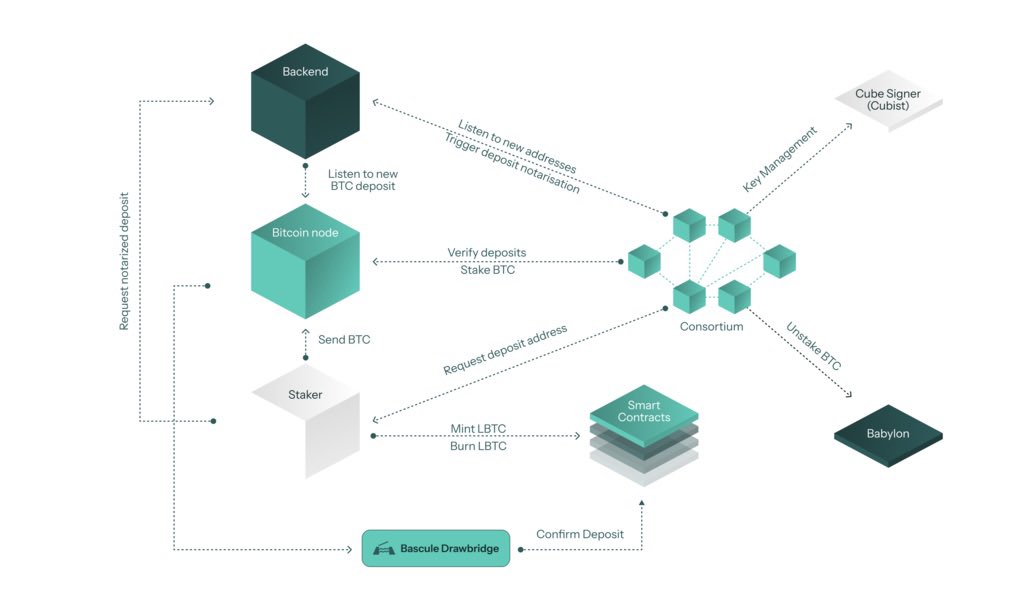

As BTCfi gradually moves out of the conceptual stage, Lombard, which has not yet undergone TGE but has already attracted over $1.6 billion in TVL, is building a complete and scalable Bitcoin capital market protocol. One of its core pillars is this rather complex yet efficient technical architecture system! It’s a bit complicated, but I’ve tried to simplify it:

1|LBTC Minting Process

The mapping from BTC to on-chain BTC revolves around a dual-layer mechanism of Security Consortium and Trustless Relayer:

🔻 Users initiate a staking request on the front end, and the Security Consortium allocates a dedicated BTC address (the destination chain, receiving address, and cooperation code are all encoded within)

🔻 After the user completes the BTC transfer, the Relayer listens for on-chain actions and notifies the Consortium for multi-signature verification

🔻 Once verification is complete, the Relayer obtains the signature and mints LBTC on the destination chain. This part requires no user interaction and is completed automatically

🔻 If the Relayer encounters an issue, the user can manually complete the minting process using the signature to ensure censorship resistance

▰▰▰▰▰

2|LBTC Redemption Process

This process exchanges LBTC back for on-chain BTC. The user calls the redemption method of the LBTC contract, destroys a specified amount of LBTC, and fills in their BTC address. Multi-layer security strategies prevent single points of failure and malicious operations:

🔻 The Relayer listens for the destruction action and notifies the Consortium for review

🔻 After passing the review, the redemption request enters the BTC transaction queue. At this point, the system will wait for Babylon to release the corresponding BTC (usually within 7-9 days)

Ultimately, CubeSigner constructs the actual BTC transfer transaction, which must meet:

Multi-signature, time lock expiration, and daily/weekly withdrawal limits

▰▰▰▰▰

3|Cross-Chain Bridging

Lombard's bridging mechanism combines Chainlink CCIP and secondary verification from the Consortium, balancing the universality of CCIP with the security of the Consortium, providing highly reliable multi-chain transfer capabilities:

🔻 Users initiate bridging on the source chain and prepay all Gas costs

🔻 The Relayer captures the transaction and reports it to the Consortium for review

🔻 After approval, Chainlink obtains the authorized signature from the Consortium and executes the bridging on the target chain

▰▰▰▰▰

4|BTC Delegation Strategy

Changes in the total amount of LBTC will affect the staking status of BTC on Babylon:

🔻 If the minting volume of LBTC increases, the protocol will add new BTC to Babylon daily

🔻 If LBTC decreases (user redemption), the system will dynamically withdraw BTC for redemption, ensuring liquidity meets the 7-9 day withdrawal window

This mechanism ensures that LBTC is always backed by actual BTC, while the system's liquidity is well-matched and not prone to bank run risks.

▰▰▰▰▰

Summary

Lombard is not just issuing a wBTC alternative; it has systematically designed asset mapping, cross-chain infrastructure, settlement processes, security strategies, and on-chain fund management.

This comprehensive capability, similar to Circle + EigenLayer + LayerZero, is a key factor that distinguishes it from BTCfi protocols like Babylon and Stacks. If we believe BTCfi is the next $10 billion TVL-level track, then projects like Lombard, with clear technical architecture, orderly capital flow, and flexible mechanism design, will be core supporting forces.

Several indicators worth continuous attention include:

※ TGE timing and token distribution mechanism

※ Number of chains and activity level of cross-chain bridge deployment

※ Stability of liquidity ratio with Babylon

※ Whether the circulation growth of on-chain LBTC keeps pace with demand

The future of BTCfi may not rely on issuing another BTC, but rather on builders like Lombard to leverage Bitcoin ecosystem liquidity.

Show original

6.02K

136

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.