Arbitrum Weekly Data Observation and Interpretation

As the most active Layer 2 on Ethereum, Arbitrum has shown strong ecological growth momentum in the past week. Not only are the numbers impressive, but more importantly, it has gradually transformed from a mere "scaling tool" into an ecological platform with an endogenous economic system and strong capital-raising capabilities.

We analyze its performance from the following dimensions:

1. Timeboost: Turning "block sorting rights" into a cash cow for DAOs

The Timeboost sorting mechanism launched by Arbitrum has generated a net income of $2.62 million for DAOs within 3.5 months, accounting for 96% of total revenue, all of which is pure profit.

This mechanism essentially has users paying for "transaction priority." Through private mempool bidding, users can seize opportunities, while Arbitrum DAO profits from this. This not only optimizes user experience but also turns sorting rights into a monetizable resource.

This is currently the most creative "on-chain native profit model" among all L2s. It shows that L2s do not have to rely on airdrops or financing to sustain themselves; Arbitrum is exploring a truly sustainable ecological self-circulation. And this is just the beginning; as trading activity increases, the earnings from Timeboost will only become more stable, ensuring long-term development for the DAO.

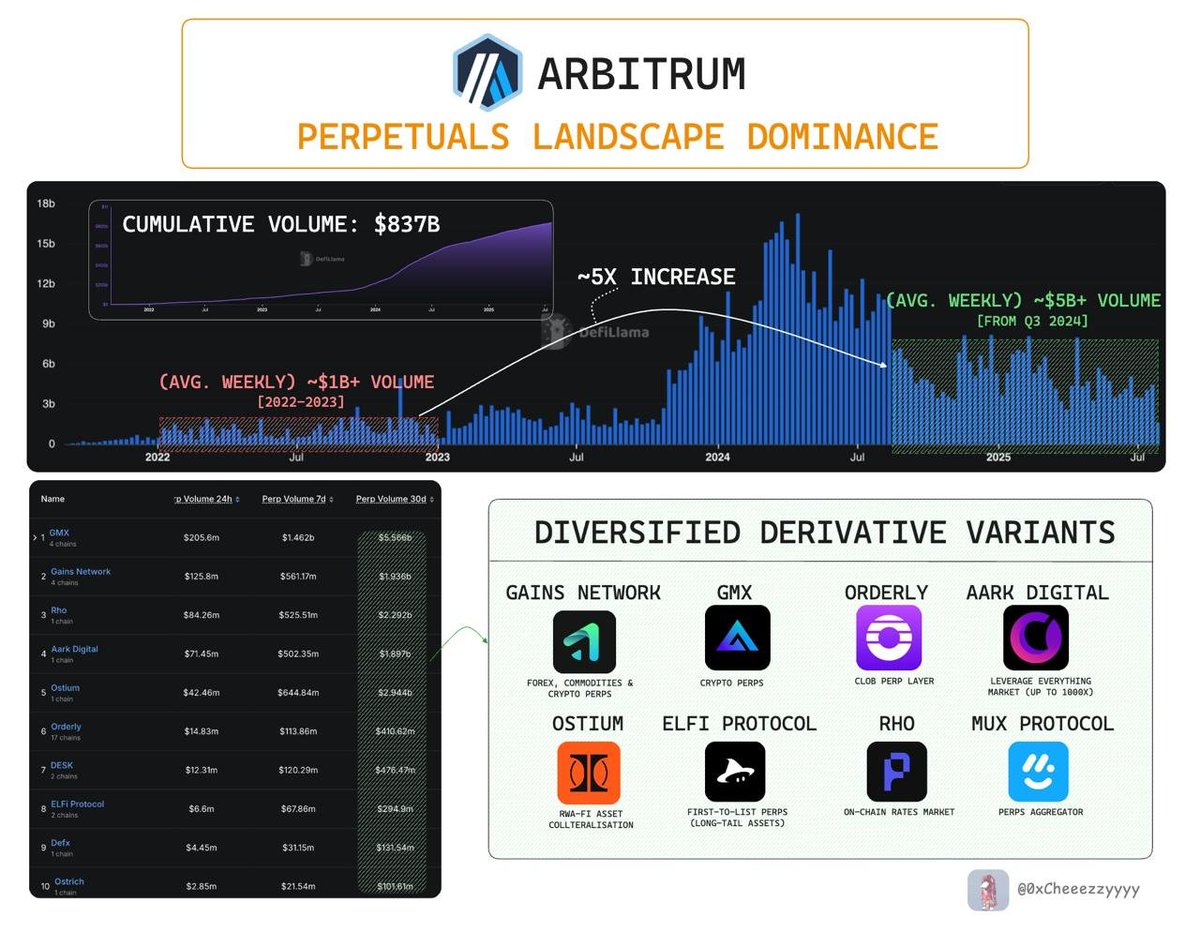

2. Perpetual Contract Ecosystem: Behind the $837 billion trading volume is a dual validation of liquidity and confidence

Arbitrum has become the most active derivatives trading venue among Layer 2s, with a cumulative perpetual contract trading volume exceeding $837 billion, driven by major platforms like GMX, Gains, and Hyperliquid, forming a derivatives ecosystem with significant depth and activity. Among them:

▶️ GMX offers no-slippage trading + multi-asset GLP pools, with a TVL exceeding $100 million;

▶️ Gains Network and Hyperliquid continue to make strides in UI and market coverage.

Derivatives are the advanced form of DeFi, and attracting institutions and high-frequency traders is the standard for measuring whether an L2 has "professional trading infrastructure." Arbitrum has clearly passed this test; additionally, the extremely high trading volume indicates that users not only come but also stay.

3. Spiko Finance: Using government bonds to make RWA a hot topic

@Spiko_finance's EU government bond token launched on Arbitrum has surpassed $150 million in AUM, making it the fastest-growing among all deployed chains. There are two important supports behind this:

DAO support: Arbitrum DAO invested $35 million in ARB to promote RWA projects;

Technical adaptation: Arbitrum's high throughput and low gas characteristics perfectly match the high-frequency trading needs of RWA.

The core of RWA is trust; if the chain is not chosen well, traditional asset parties will not participate. Spiko's explosive growth on Arbitrum is an important stepping stone for Arbitrum in "bridging traditional finance with DeFi." Don't forget that there may also be a large number of institutions participating quietly behind this.

Arbitrum July Comprehensive Data Summary:

TVL exceeds $2.5 billion, firmly ranking among the top L2s

Stablecoin circulation reaches $6.6 billion, with strong capital activity

DAO treasury reaches $1.2 billion, available for long-term ecological incentives

Cross-chain bridge net inflow of $1.9 billion, far exceeding chains like Avalanche and Unichain.

Arbitrum is everywhere 🫡

@arbitrum @arbitrum_cn #Arbitrum

Show original

20.66K

51

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.