$DOGE, $XRP, and $SOL lead the decline. Is the altcoin season cooling off? Don't rush to conclusions; this might be the beginning of the second half.

➤ After a night of pullback, the market atmosphere has changed.

Yesterday, the altcoin sector suddenly cooled down across the board:

◼️ $DOGE plummeted nearly 9%

◼️ $XRP dropped over 6.7%

◼️ $SOL fell below $185, with a 24h decline of 6.5%

Many people's first reaction is: "It's over, is the altcoin season finished?"

But looking at the data and structure, things might not be that simple.

➤ Why are altcoins leading the decline? Behind it is the invisible tether of $BTC.

The trigger for this round of decline actually came from $BTC.

Bitcoin briefly fell below $66,000, causing a collapse in overall sentiment for altcoins. But the key point is that altcoins are still too highly correlated with $BTC, especially during times of tight liquidity.

This is the risk point that most people are unaware of:

🔹 You buy $ARB, $DOGE, $LINK,

🔹 But your fate depends on the whims of $BTC and ETFs.

➤ So why is this round not the end of the altcoin season, but rather a high-intensity breather?

We see three very critical phenomena:

1. The ETH/BTC trading pair is still slowly rising.

If the altcoin tide were truly receding, $ETH would have collapsed first; now it is still holding at $3,700, indicating that funds haven't completely fled.

2. Capital rotation remains active.

For example, $LINK, $TON, and $LDO actually saw capital inflow before the decline, indicating that the retreat is not a one-size-fits-all but rather a rotation of hotspots.

3. Open Interest has not shown a cliff.

According to CoinGlass data, the overall open contracts have not significantly decreased; the market is still observing, not in a panic exit.

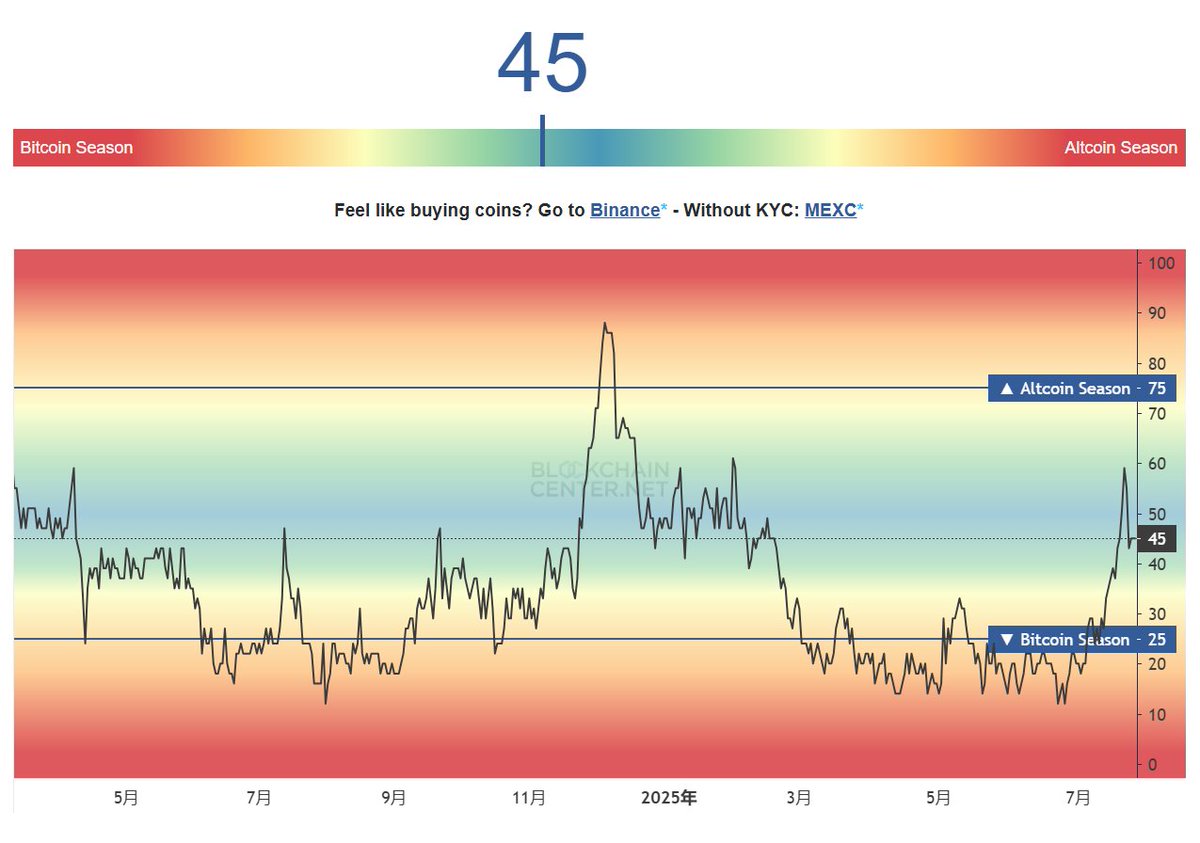

The Altcoin Season Index is currently still around 45, not yet entering a full altcoin season, but there have been multiple rounds of localized explosions within the sector, which feels more like a preheating phase for the altcoin season, and it is a good time to position early and select the main players.

➤ Key point: What you see is a price drop, but you might overlook the ecological switch.

If you are an old player, you should be thinking:

✅ Which coins are oversold?

✅ Which coins are just liquidated after rising too much?

Conversely, you can also think: Are there any coins that originally had no value, just being hyped up? For example, certain meme coins and unproven AI concept coins.

The altcoin season is not about a universal surge but rather a rotation with selection logic.

➤ A bit of advice from me:

1. If you are holding altcoins that are already in profit: consider adjusting your positions moderately, swapping high volatility for high certainty.

2. If you are hesitating whether to enter: you can wait a bit longer to see if $BTC can stabilize above $66k and if $ETH continues to attract capital.

Most importantly, do not treat the pullback as the end.

➤ Conclusion: The fluctuations of $DOGE, $XRP, and $SOL are not the endpoint; rather, they may be the beginning of a new selection cycle.

The altcoin season has not ended; it is just redefining the main players.

Show original

10.53K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.