💡 “What is #Bitcoin, really?”

To understand it, you need to know where it came from.

This is the story of how one anonymous message board post changed the world forever. 🧵

The world’s first decentralized digital currency didn’t come out of nowhere.

#Bitcoin was born out of decades of failed experiments, cryptography breakthroughs, and growing distrust in centralized systems.

⛓️ The Cypherpunks

In the 90s, a group of privacy-obsessed cryptographers and hackers known as the Cypherpunks began working on tools to free individuals from surveillance and censorship.

They believed in using code as a shield against centralized power.

🧪 Early digital money attempts:

• eCash (1990s) by @chaumdotcom

• b-money by @_weidai

• Hashcash by @adam3us (proof-of-work system to prevent spam)

• Bit Gold by @NickSzabo4

All contributed critical ideas but none solved everything.

Then came 2008.

💥 The global financial system collapses. Banks are bailed out. Trust in institutions hits a low.

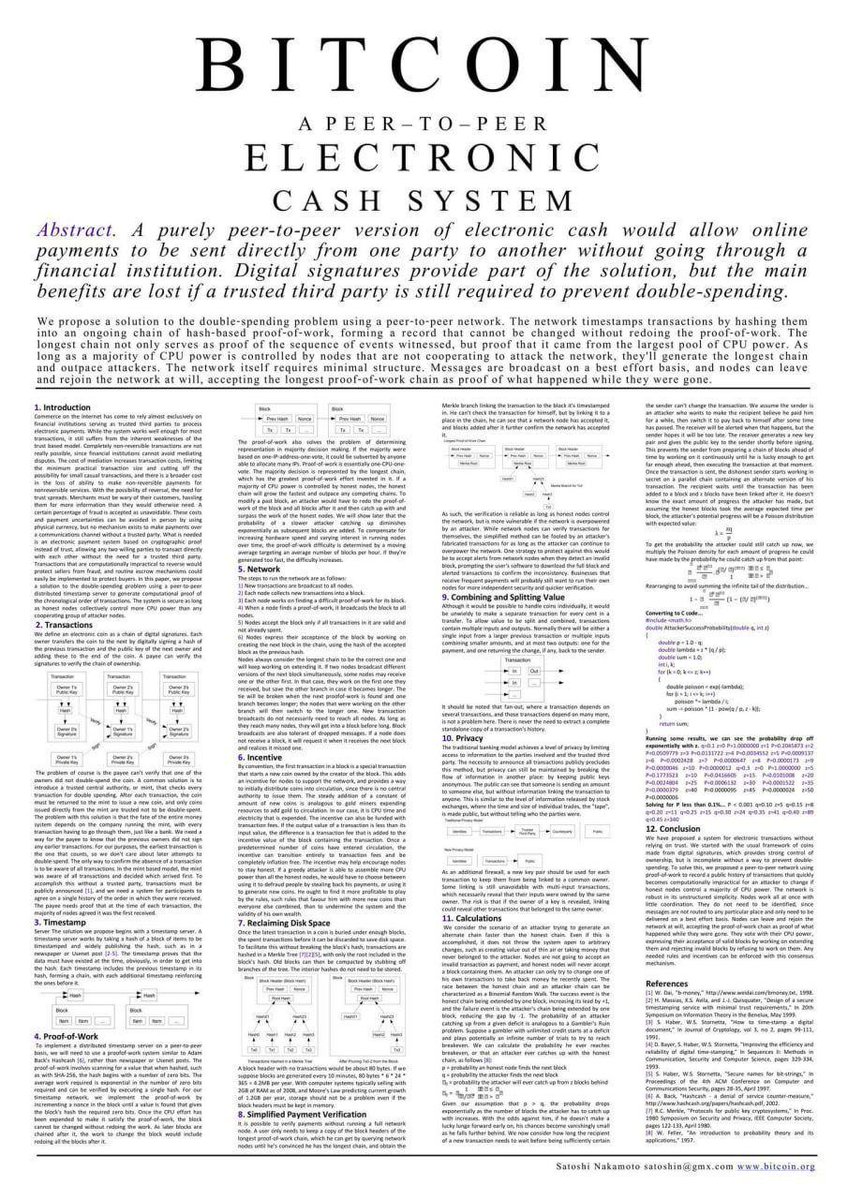

Just weeks later, an anonymous figure named Satoshi Nakamoto publishes a whitepaper:

“Bitcoin: A Peer-to-Peer Electronic Cash System”

📜 The #Bitcoin whitepaper (Oct 31, 2008) proposed:

• A purely peer-to-peer version of electronic cash

• No intermediaries

• Digital scarcity via a capped supply

• Trustless consensus through Proof-of-Work

On January 3, 2009, #Bitcoin goes live. Satoshi mines the Genesis Block.

Embedded in its code is a message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

A timestamp. A protest. A mission statement.

Early adopters included cryptographers, libertarians, coders, and digital misfits.

#Bitcoin had no price. No exchange. No app. Just raw code and conviction.

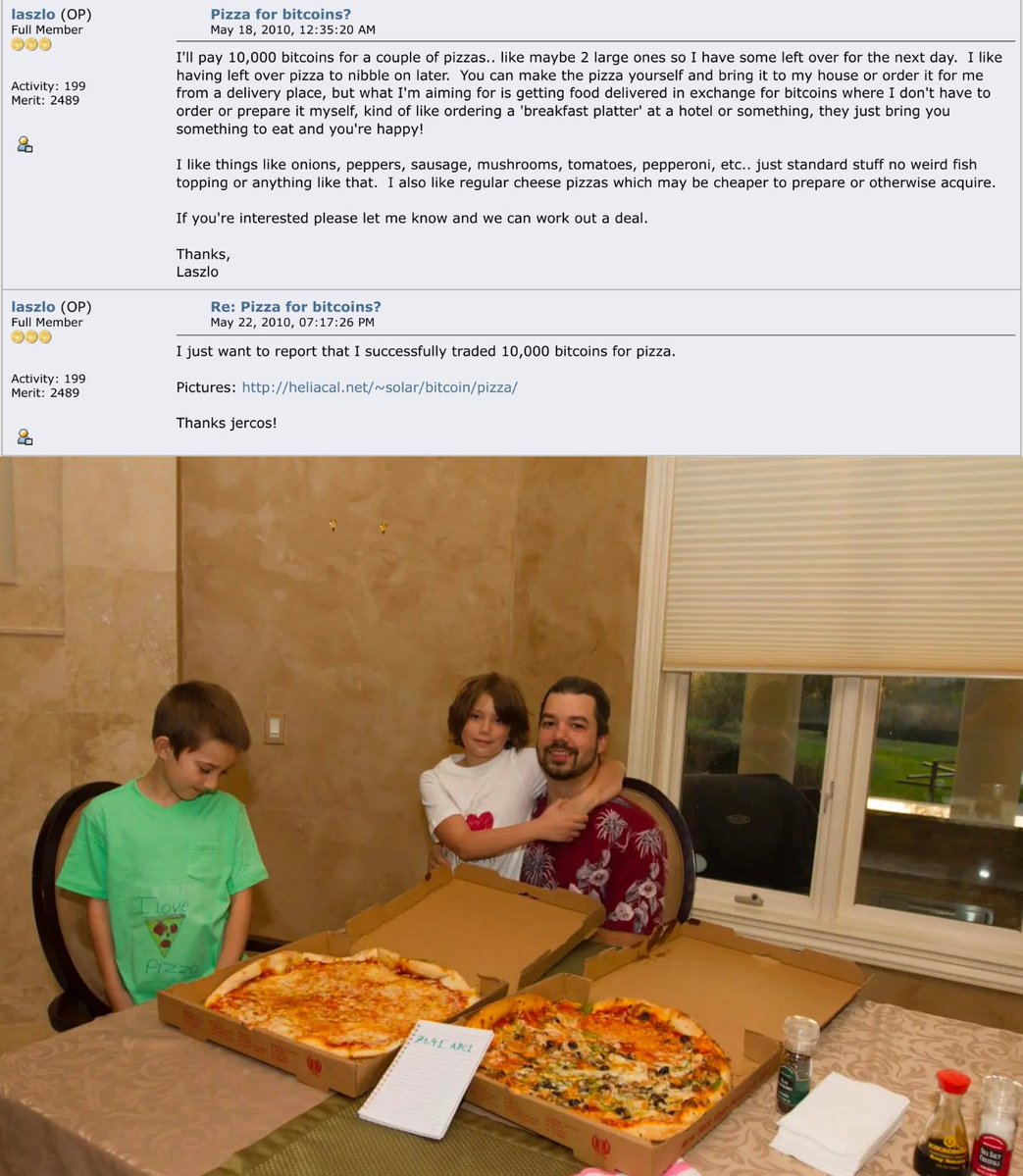

One early transaction? 10,000 BTC for two pizzas. 🍕

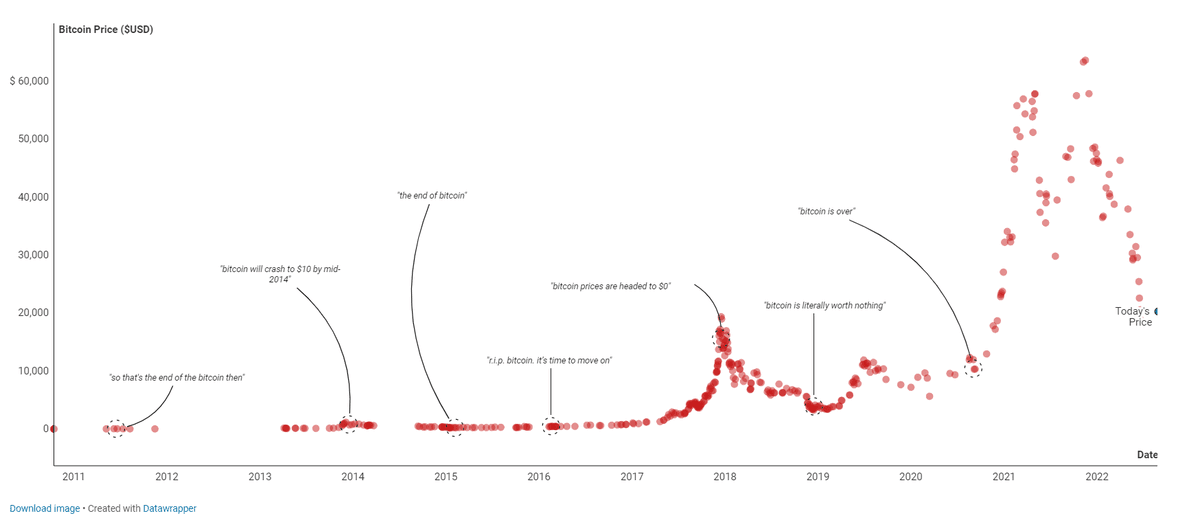

#Bitcoin slowly gained traction:

• 2010: First real exchange opens (Mt. Gox)

• 2011–13: Wikileaks and Silk Road boost usage

• 2013: Reaches $1,000 then crashes

• 2017: Hits $20,000 and crashes again

• 2021: Reaches $69,000

Volatile? Yes. Dead? Never.

What makes #Bitcoin revolutionary?

• It’s decentralized

• It’s censorship-resistant

• It has digital scarcity (21M BTC cap)

• It runs on open-source code

• It doesn’t need permission to use

#Bitcoin is more than price action. It’s a monetary protocol.

• A protest against centralized control.

• A lifeline for the unbanked.

• A tool for self-sovereignty in a digital age.

From cypherpunk mailing lists to institutional portfolios…

From a 9-page PDF to a multi-trillion-dollar asset class… #Bitcoin isn’t just money.

It’s an idea whose time has come.

📚 Want to go deeper?

Read the Bitcoin Whitepaper

“The Bitcoin Standard” by @saifedean

"Shelling Out” by @NickSzabo4

“Digital Gold” by @nathanielpopper

Special mention to @bitcoinanatomy for this animation. 👏

151.9K

955

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.