ETH's New Era: Institutionalization and Mainstream Ascension

ETH Strategic Reserve Skyrockets

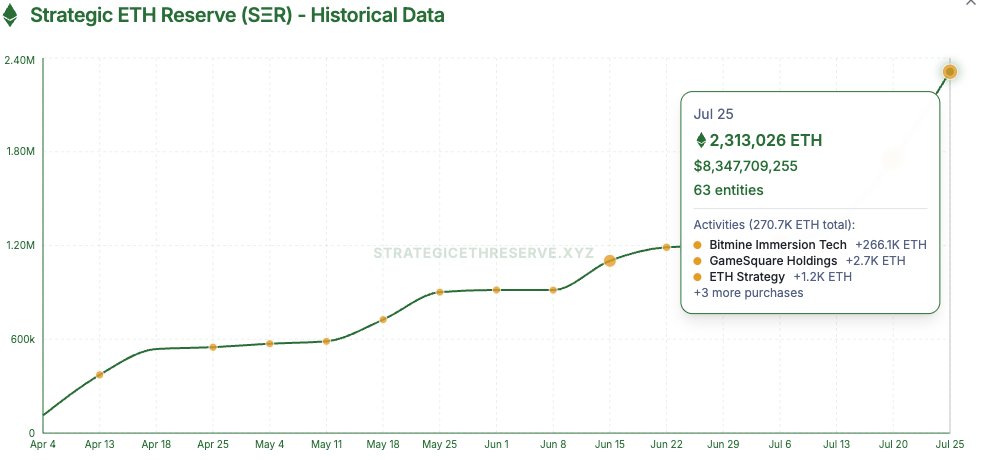

ETH's treasury has become the secondary rocket for institutional funds following ETH ETFs, achieving significant momentum since April this year.

As of now, the ETH strategic reserve totals 2.31 million ETH, valued at $8.35 billion, held by 63 institutions, accounting for 1.92% of ETH's total supply.

This milestone was reached in just three months; in April, only five institutions held 112,960 ETH.

Compared to ETH ETFs, which hold 5.68 million ETH valued at $20.49 billion, the strategic reserve has reached nearly 40% of ETF holdings in four months.

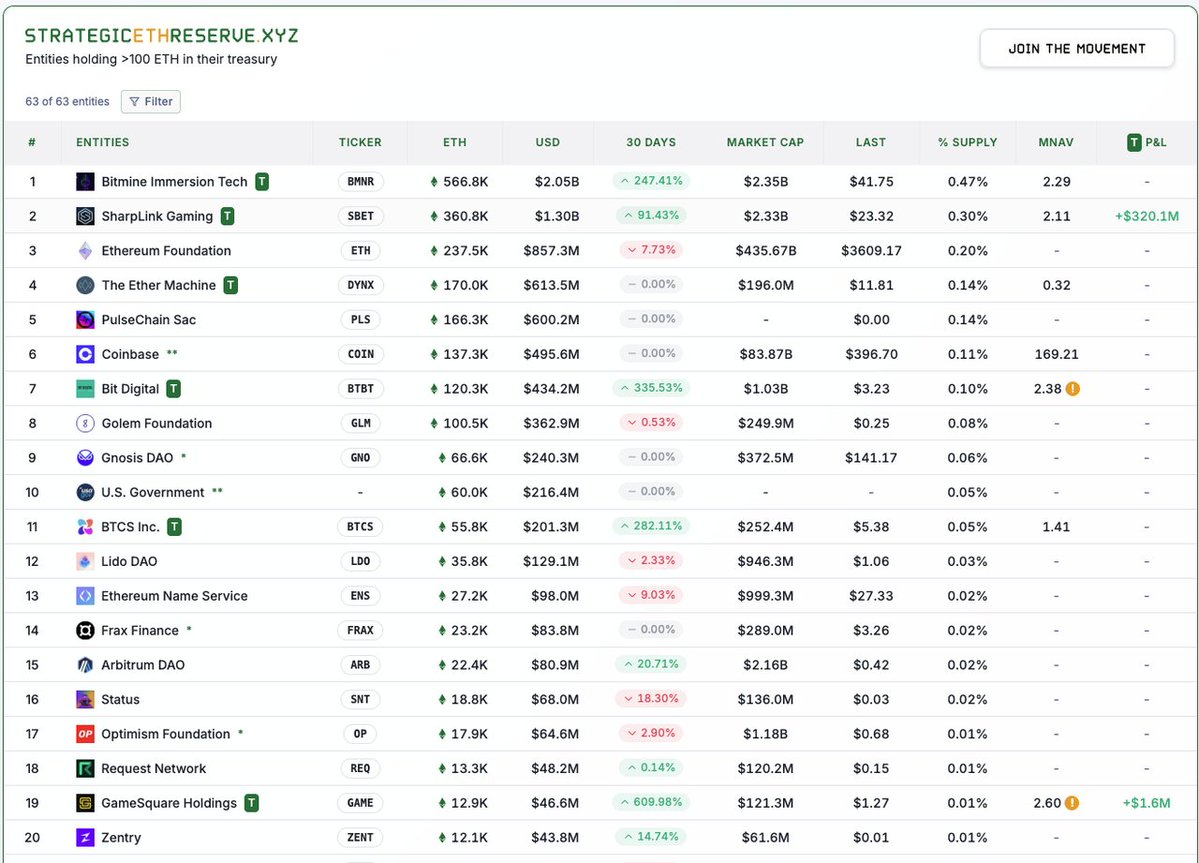

Leading companies like SharpLink Gaming, BitMine, Bit Digital and BTCS continue to aggressively increase their holdings, with 30-day growth rates of 91.43%, 247.41%, 335.53%, and 282.11% respectively.

ETH Institutional Holders Show Diversity

As the preferred institutional asset following BTC, ETH's institutional holders are highly diversified.

ETF issuers include major asset managers like iShare, Grayscale, Fidelity, Franklin Templeton, VanEck and Invesco. The U.S. market currently has 9 ETH spot ETFs, close to BTC's 12.

U.S. listed companies are also major ETH holders. SharpLink Gaming holds 360,800 ETH, surpassing the Ethereum Foundation, while BitMine holds 566,800 ETH, overtaking SharpLink. Bit Digital holds 120,300 ETH, BTCS holds 55,800 ETH, and GameSquare holds 12,900 ETH. Other companies like Intchains Group, KR1 plc, Exodus, and Thumzup also hold thousands of ETH.

Crypto projects are rapidly accumulating ETH. Besides the Ethereum Foundation, PulseChain holds 166,300 ETH, Golem Foundation holds 100,500 ETH, Gnosis DAO holds 66,600 ETH, Lido DAO holds 35,800 ETH, and ENS holds 27,200 ETH. Other notable projects like Frax Finance, Arbitrum DAO, Optimism, Zentry, and Status also hold ETH.

Other institutions are also adopting ETH. Trump family's WLFI held up to 70,000 ETH since its inception in December 2024 and continues to buy. Joseph Lubin mentioned in June that he is exploring infrastructure development with a sovereign wealth fund and a bank. With diverse institutional holders, ETH's consensus is becoming more comprehensive and widespread.

ETH Core Circle Rebuilds with New Leaders

Internally, the Ethereum Foundation completed its most significant management update in seven years: former Executive Director Aya Miyagotchi transitioned to Foundation Chair, while Hsiao-Wei Wang and Tomasz Stańczak were appointed as Co-Executive Directors. Researcher Danny Ryan joined the new organization Etherealize.

Aya Miyagotchi led Ethereum through many milestones in the past 7 years. As Chair, she will focus on strategic partnerships and relationship management, reducing direct involvement in day-to-day operations.

Hsiao-Wei Wang and Tomasz Stańczak form a dual Executive Director leadership structure, dispersing decision-making and reducing single-point failure risks. Their complementary technical and managerial backgrounds have been well-received by the community and industry.

Externally, as ETH becomes more institutionalized, key players have emerged. ETH co-founder and Consensys CEO Joseph Lubin became Chairman of SharpLink Gaming in May, leading a $463 million funding round with participation from ConsenSys, ParaFi, Pantera, and Galaxy Digital.

Wall Street analyst Tom Lee, founder of Fundstrat, was appointed Chairman of Bitmine in June, proposing a $250 million funding plan to position Bitmine as "MicroStrategy for Ethereum." Founders Fund, Pantera, FalconX, and Kraken participated.

Samir Tabar, leading Bit Digital's ETH strategy, previously served as Head of Capital Markets at Merrill Lynch and as a Bitfinex strategic advisor. In June, he raised $172 million for ETH reserves. Cathie Wood's Ark Investment Management invested $182 million in Bitmine.

The Ethereum ecosystem's internal and external core circles are being rebuilt, with new crypto-native leaders and TradFi veterans becoming the spokespersons for ETH's new cycle.

The resurgence of ETFs, strategic treasury management, diverse institutions, and team upgrades mark ETH's entry into a new phase. This is not only a significant milestone in the integration of crypto and traditional finance, but also a way to better convey the value of Ethereum's on-chain economy to institutional markets. ETH's value is being re-established, with a promising future ahead.

8.19K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.