Sharding, without the headaches.

PoW, without the energy drain.

Smart contracts, without the exploits.

If Ethereum and Bitcoin had a child, that would be @alephium.

[Product Report] ↓

Alephium isn’t rewriting history. It’s rewriting base-layer assumptions on energy, throughput, and how smart contracts should work on PoW.

→ PoW, but 87% less energy.

→ Sharding, but without cross-chain mess.

→ Smart contracts, but UTXO-secured.

Most chains scale by mimicking Ethereum, but @alephium scales by asking a simpler question:

Can Bitcoin’s UTXO model be made programmable without losing what made it secure to begin with?

And the benefits ripple outward:

→ Devs get modularity without global-state fragility.

→ Users get asset safety without revoke rituals.

→ Builders get parallelism without fragmentation.

→ Miners get scale without heavier nodes.

UTXOs secured the execution layer, but what about the consensus layer?

@alephium didn’t switch to staking; instead, it reduced PoW’s energy cost by 87% without changing the trust model.

They call it Proof-of-Less-Work.

Alephium’s native token ALPH is what miners earn, move, and eventually burn.

It powers the entire system, from block rewards to smart contracts.

And under PoLW, it becomes part of the consensus mechanism itself.

So what is PoW?

→ It’s still PoW, miners compete with hardware and energy.

→ But at scale, they also burn ALPH to earn rewards.

→ The cost stays real, but shifts on-chain.

Burning tokens replaces part of the electricity bill.

This design stayed on paper until Danube. The Danube upgrade made @alephium faster, more usable, and ready for real applications:

→ Blocks every 8 seconds

→ Multiple chains working in sync

→ Tools that make it easier to build

It’s what turned a novel idea into something usable.

What makes this possible under the hood is @alephium 's custom sharding engine: Blockflow.

It splits the network into smaller chains, each handling a slice of transactions but keeps them stitched together so users and devs feel like they’re on one chain.

No bridges, no rollups, no fragmented logic.

But scaling transactions is only half the story. To make smart contracts safer and easier to build, @alephium didn’t adopt the EVM. It built its own virtual machine from scratch: Alphred.

Tighter control. Fewer exploits.

Purpose-built for UTXOs!

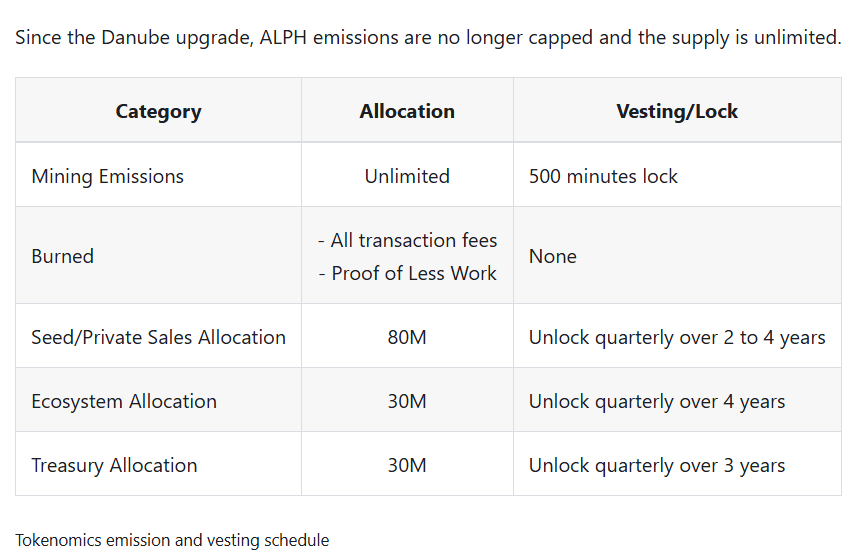

But a new VM also means rethinking how incentives flow. With the Danube upgrade, @alephium 's tokenomics changed:

→ ALPH emissions are no longer capped

→ Supply is now unlimited

→ Transaction fees and PoLW burns offset issuance

Scarcity is no longer fixed but earned.

So where does all this infrastructure Blockflow, Alphred, PoLW start to show up? In the growing @alephium ecosystem.

→ Onramps, bridges, wallets

→ DeFi, NFTs, games, tooling

→ 100+ live and upcoming apps

Not hype. Just projects building on what’s shipped.

And the chain’s been busy!

→ 58M+ transactions processed

→ 50M+ blocks produced

→ 17.2 PH/s of mining power securing the network

→ Blocks every 8.6 seconds

→ 116M ALPH issued, just over half in circulation

Alephium doesn’t start from Ethereum, it doesn’t need to.

Some chains are built to extend what already works; chasing compatibility, liquidity, or attention. @alephium took a harder path: it reimagined the base layer.

It won’t be the loudest chain but if modular L1s have a future this one’s already doing the quiet work of earning it.

9.56K

104

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.