What Happened Last Week in Crypto (7/13-7/20)

BTC all-time High: Bitcoin delivered a strong performance last week, surging to fresh all-time highs above $123,000, reflecting continued institutional momentum and macro tailwinds.

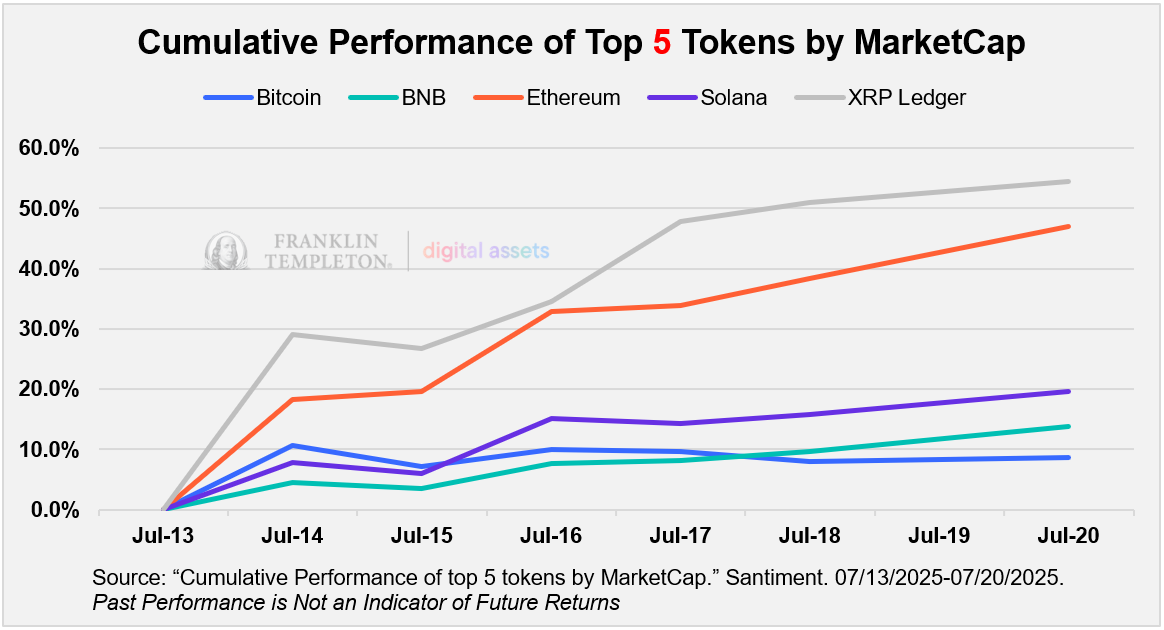

Altcoin Rally: Major altcoins followed suit, with SOL, ETH, and XRP posting notable gains. XRP notably jumped 54.43% in the last week, signaling renewed investor confidence across Layer 1 ecosystems.

GENIUS Act: Passing the House with bipartisan support (308 -122), the GENIUS Act made its way to President Trump’s desk on Friday and was officially signed into law. The GENIUS Act aims to establish a federal framework around stablecoins.

Crypto Week in Washington: Last week marked “Crypto Week” on Capitol Hill. The U.S. House leadership voted on several key crypto-related legislation, including the CLARITY Act and the Anti-CBDC Surveillance State Act. Both acts passed the House and are now on their way to the Senate for review.

Standard Chartered – Trading for Institutions: Last week, Standard Chartered announced they would be making a major step in crypto by launching a spot trading service for Bitcoin and Ethereum for their institutional clients, opening the door to digital assets under a regulated banking institution. (1)

JPM & Citigroup are jumping onboard: Last week, both JPM CEO Jamie Dimon and Citigroup CEO, Jane Fraser, said they were going to be getting involved in stablecoins. This comes during a time where law makers are embracing digital assets and creating new legislation around the crypto industry. (2)

*The above referenced discussions are noteworthy activities that happened during the week in crypto markets. Discussions should not be regarded as any type of trading recommendation, or as a signal about any past, current or future trading activity in any fund or strategy, by Franklin Templeton and its affiliates.

1. Source: “Standard Chartered Launches Spot Bitcoin and Ethereum Trading for Institutions.” Cointribune. July 16, 2025.

2. Source: “JPMorgan’s Dimon and Citigroup’s Fraser consider stablecoins in Wall Street crypto pivot.” AOL. July 15, 2025.

23.13K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.