What are the highlights of Lombard's Sentora DeFi Vault?

It provides a way for BTC to earn income that is both profitable and secure. Many BTC holders are asking if there is a BTC DeFi strategy that doesn't require constant monitoring, offers stable returns, and can be safely left alone in such a competitive market.

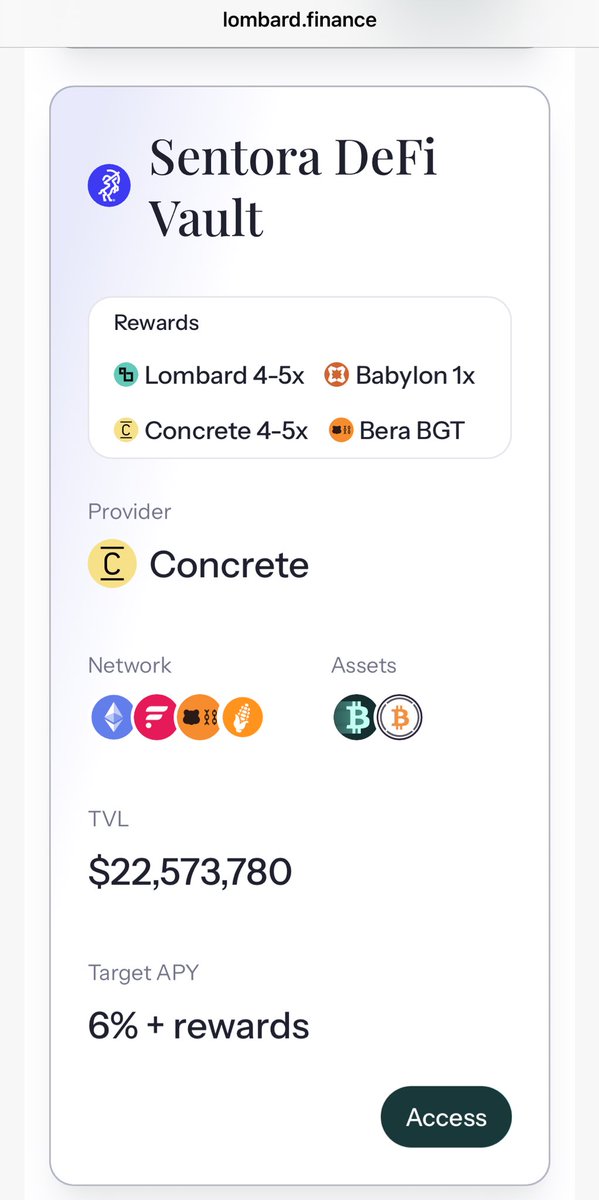

Sentora has created a pretty decent product. This Vault aims for an annualized return of 6%, with a focus on being fully automated, real-time risk control, and supporting LBTC and wBTC!

▰▰▰▰▰

Why is this Vault worth trying?

1/ The source of income is not reliant on incentives, ensuring sustainability!

This includes:

※ Lending on lending platforms

※ Trading BTC yield on Pendle

※ Collateralizing BTC to borrow stablecoins or ETH, earning the interest spread

※ Providing liquidity on DEX (Berachain + ETH mainnet)

The strategy is not complicated but is relatively stable; the core goal is to achieve a long-term 5-6% APY without chasing high volatility, leveraging, or taking unnecessary risks 🥰

2/ Strict risk control

Sentora originated from IntoTheBlock, which specializes in data and risk modeling. Now, it monitors in real-time in the background:

※ Interest rate changes and liquidity risk

※ On-chain liquidity and position changes

※ Counterparty risk for each strategy

This is not just you looking at APR on a webpage; it’s an institutional-level risk perspective, actively monitored and adjusted by the system.

3/ ERC-4626 standard receipts, fully traceable

⚠️ If you deposit LBTC, you will receive ctBeraLBTC

⚠️ If you deposit wBTC, you will receive ctBeraWBTC

These two vault tokens are standard assets, allowing you to track your positions, accumulated earnings, and potentially support trading and collateral uses in the future.

4/ Flexible exit mechanism is Rolling 5-Day (this is very practical)

It’s not one of those silly strategies that lock your assets for 30 days, nor is it unlimited liquidity; rather, it strikes a balance between liquidity and efficiency:

※ Withdrawals can be made daily

※ Maximum delay of 5 days

※ Ensures that sudden withdrawals by users do not crash the pool or affect others' earnings

▰▰▰▰▰

To summarize the advantages:

※ Rigorous risk control, not relying on luck

※ Clear strategy combinations, no black box

※ Stable income targets, neither too high nor too low

※ Traceable, with the ability to exit and not lock liquidity

※ Cross BTC standards: both LBTC and wBTC can be deposited

If you are a BTC holder who doesn't want to adjust your portfolio daily and doesn't want to waste opportunities by doing nothing, Sentora's vault is a viable option!

Show original

23.62K

203

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.