Look, I know not all crypto treasury companies will make it but at least they aren't hoarding cash:

"Look, it doesn’t make sense to pay 22x forward earnings on a portfolio loaded with T-Bills."

If you have any operating business underneath (onchain or offchain), hoarding BTC or ETH just makes more sense to me and 2x - 4x mNAV starts to not sound as crazy.

But I'm pretty buzzed/half cut right now soooo...

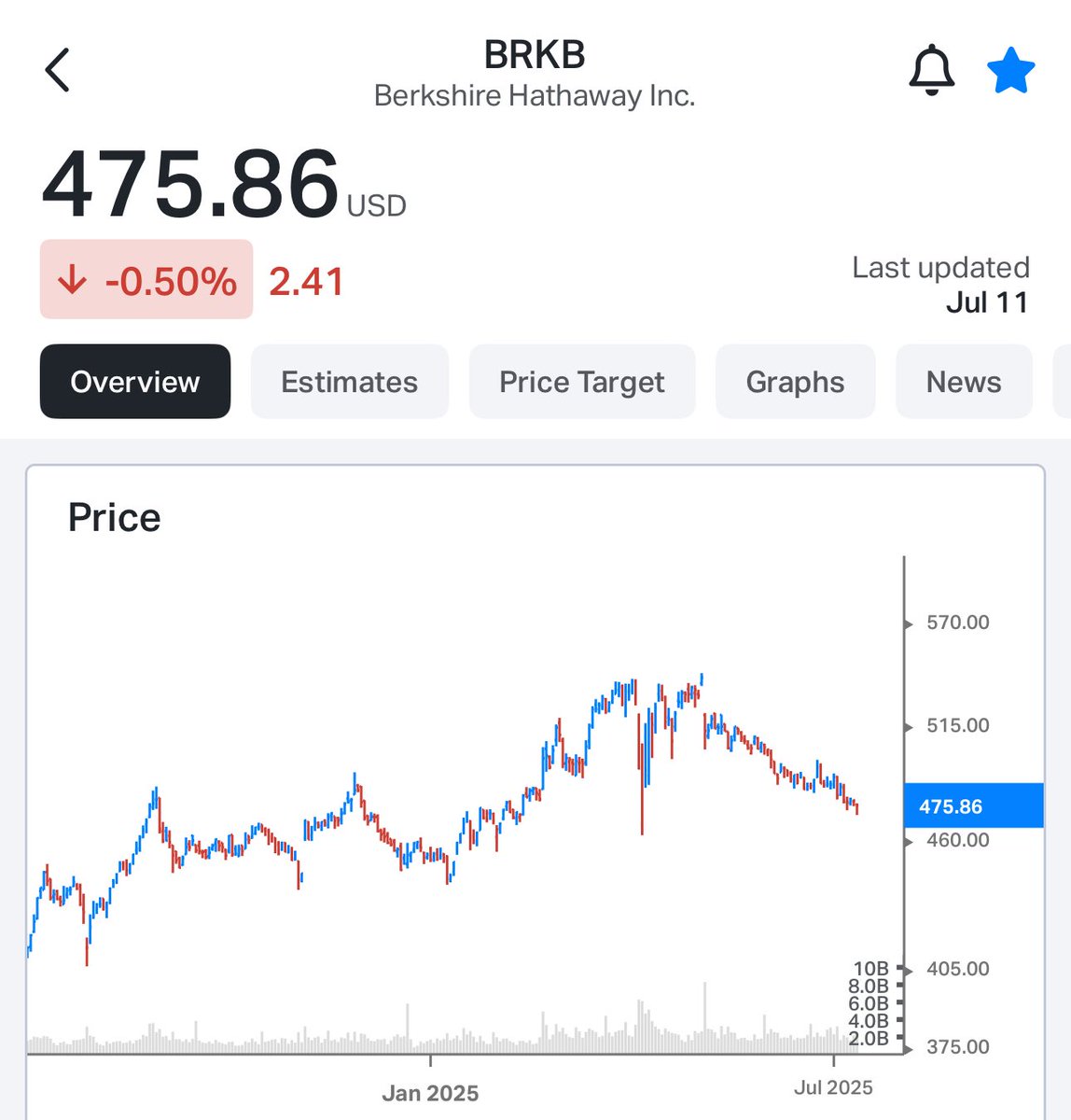

THE BERKSHIRE CORRECTION

Berkshire Hathaway topped out the day Buffett announced his retirement.

It’s dropped non stop since then.

Look, it doesn’t make sense to pay 22x forward earnings on a portfolio loaded with T-Bills.

Here’s the opportunity though.

It’s a nice one, and no one has connected the dots here.

The decline of Berkshire Hathaway’s stock has dragged down the prices of all sorts of insurance companies.

Berkshire is the largest insurance company out there.

The others are dragging down due to correlation effects.

But, other insurance companies are growing earnings.

Their stock price decline has nothing to do with earnings expectations.

They are just getting cheaper because Berkshire is getting cheaper.

I see insurance companies with sub-10X PE and double digit EPS growth.

Plenty of them.

The way to approach this:

Wait for Berkshire to base and stop sliding.

Then load up on the other insurance companies.

$BRKB $BRKA $PGR $ALL $KBWP

3.51K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.