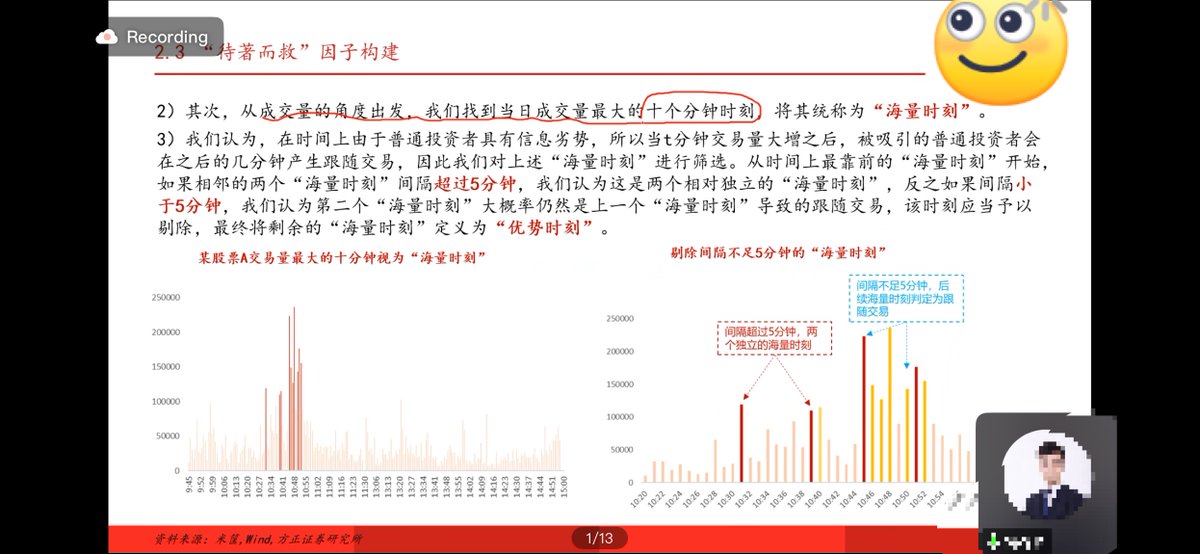

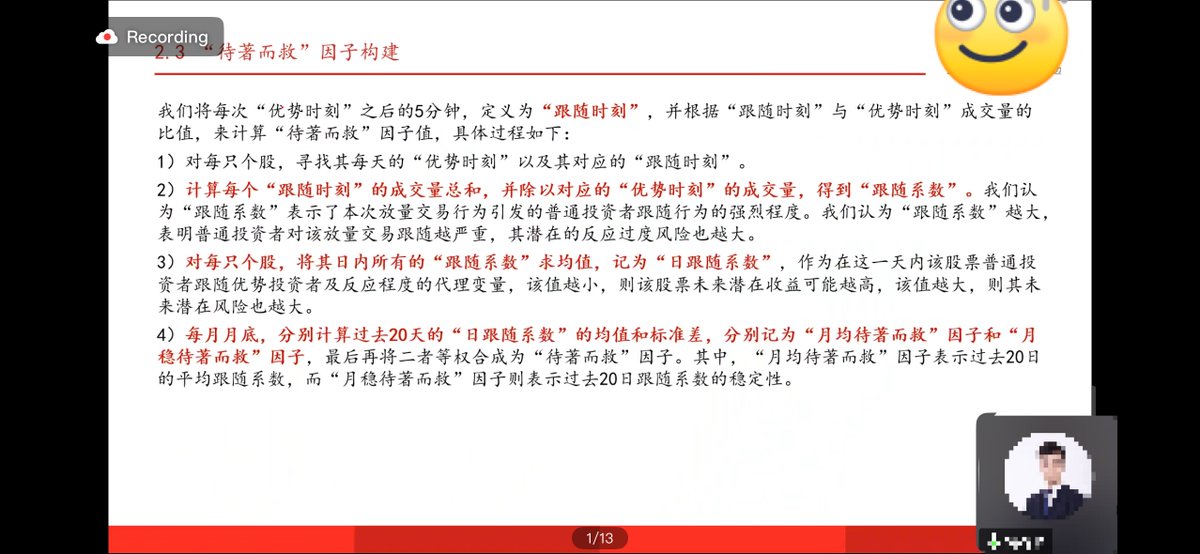

The core idea of "waiting and saving the cause" is: assuming that there are superior traders in the market who can react to market benefits more intelligently and quickly, while following traders, such as retail investors, may delay their entry.

When superior traders enter the market, they assess the trading volume in the subsequent 5 minutes to determine the degree of market follow-through. If it's high, it may indicate that the market is overreacting. If it's low, then they enter the market.

This is what traditional quantitative trading does, based on an understanding of market structure, modeling the market, looking for mismatches, and executing the first buy.

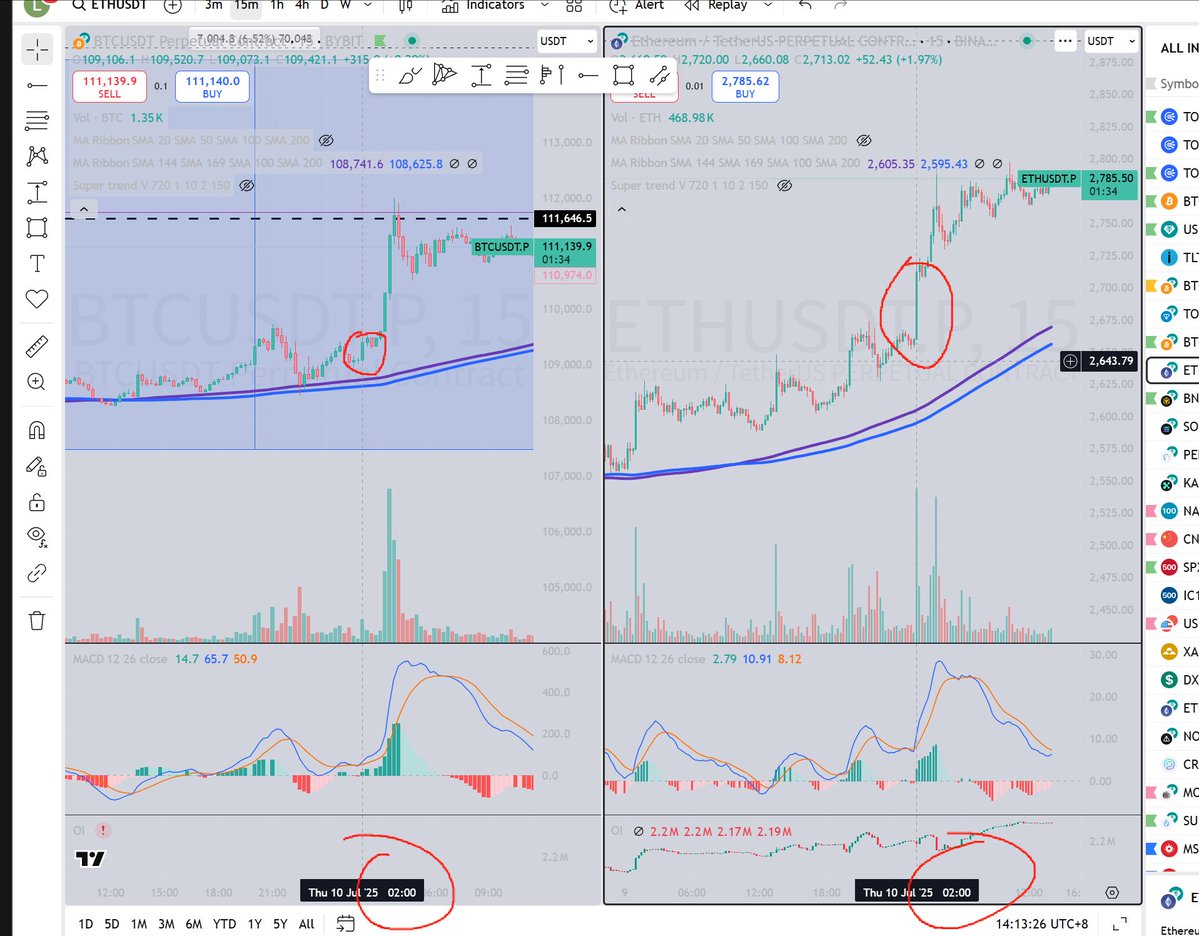

On Wednesday night, a group member reported that ETH had a spike on Hype, which instantly caught my attention. I had never seen such a nearly point-to-pool matching method on HYPE; that was all about HLP doing the counterparty, with $345 million locked. Further reports from group members indicated that a large trader actively closed a short position of $500 million, rather than liquidating.

I immediately thought of "waiting and saving" that I heard in the sharing session during the day. I already had the idea of increasing my position, so I directly added to my positions in B and S.

Looking back, the funds in B indeed quickly showed follow-through. The large trader who closed the short position in ETH is one of the superior traders.

Show original

7.5K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.