🚀 Yields Of The Week is out!

There's some new hidden gems to discover in the full article:

✅ More HyperEVM

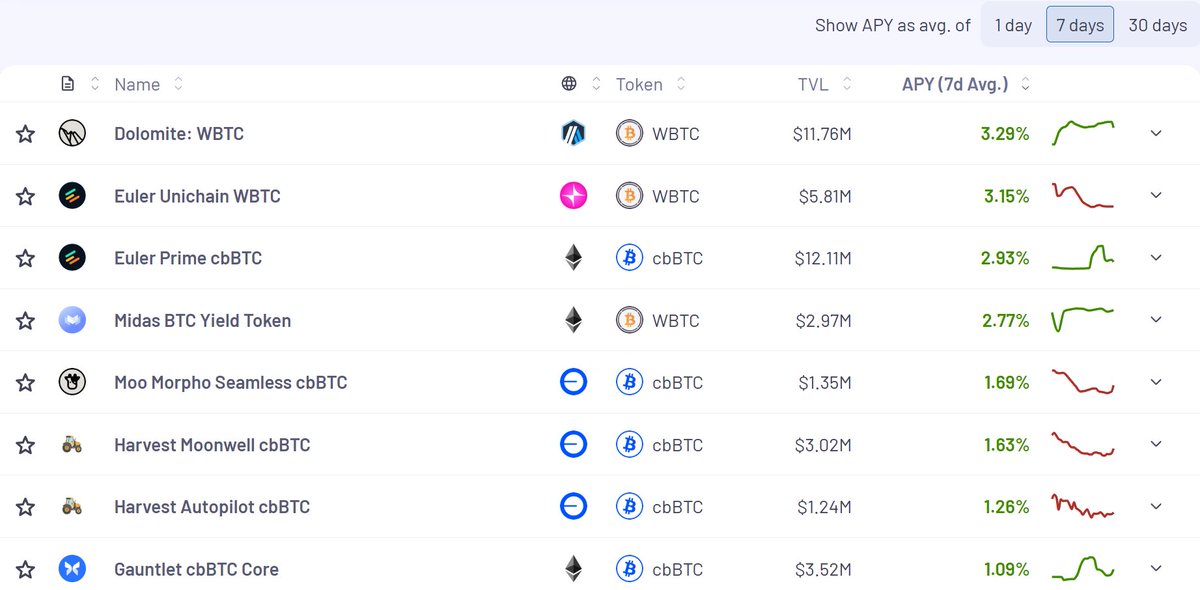

✅Bitcoin yield (would you like to earn 117% on $BTC?)

✅Yield magic with @RumpelLabs

Full thread (bookmark for later) 🧵

Thanks to our amazing partners who make all this possible:

@redstone_defi

@MagicNewton

@Mantle_Official

@maplefinance

@GearboxProtocol

@puffer_finance

@sparkdotfi

@RumpelLabs

OK I promise, on to the yields!

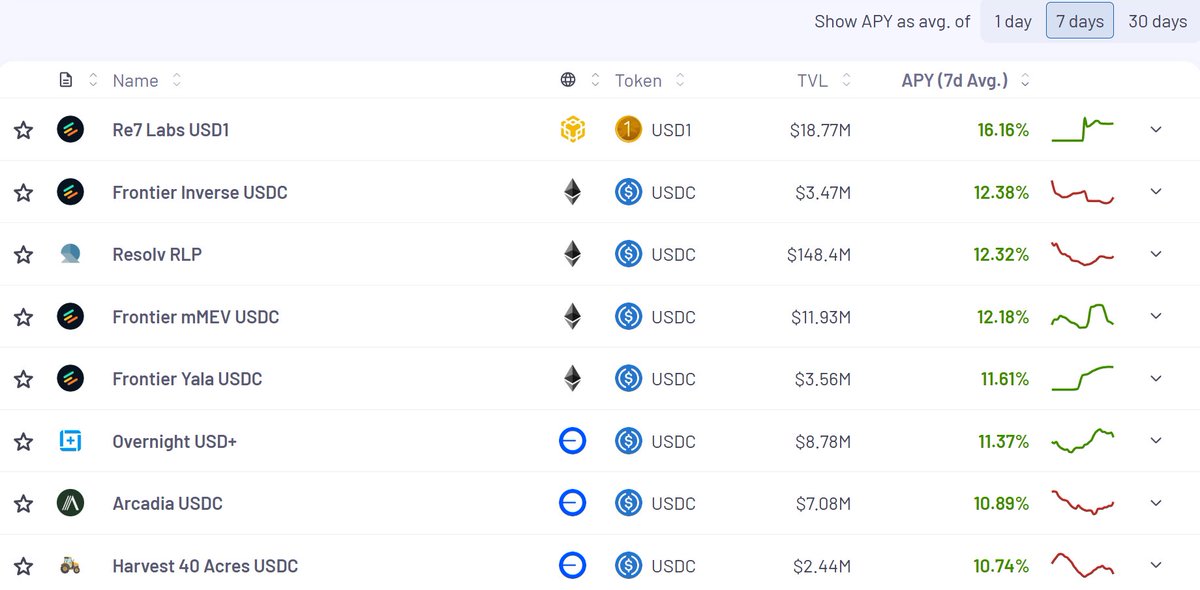

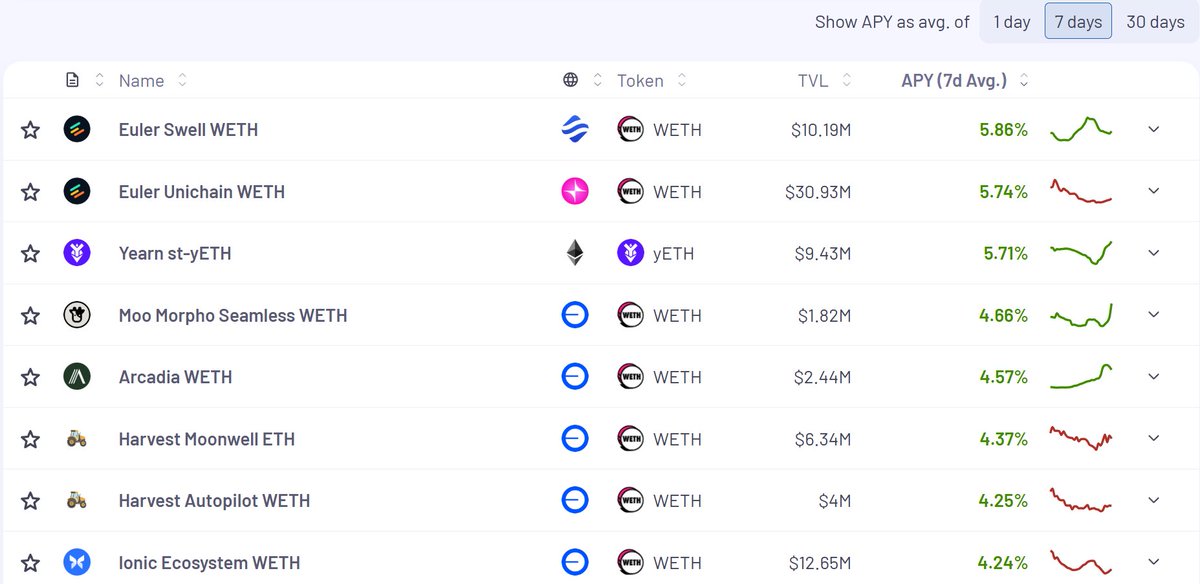

We looked at boosted (incentives) yields with over $1M in TVL over a 7 day avg this week.

Here's the top stablecoin, $ETH and $BTC yields courtesy of @vaultsfyi:

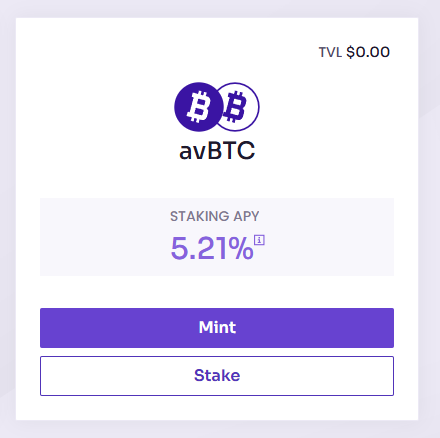

We highlight @avantprotocol and their impressive new $BTC yield with their $avBTC product that's currently yielding 5.21% APY:

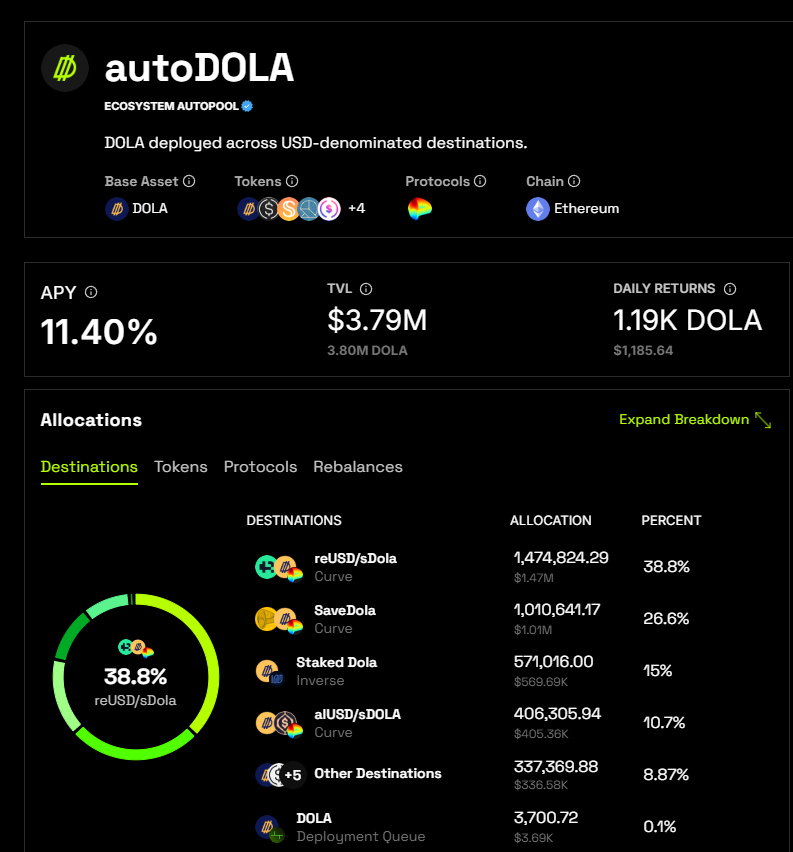

We showcase @TokemakXYZ's autoDOLA autopool that is yielding 11.40% APY and constantly auto rebalancing.

This is pure real-yield, no incentives:

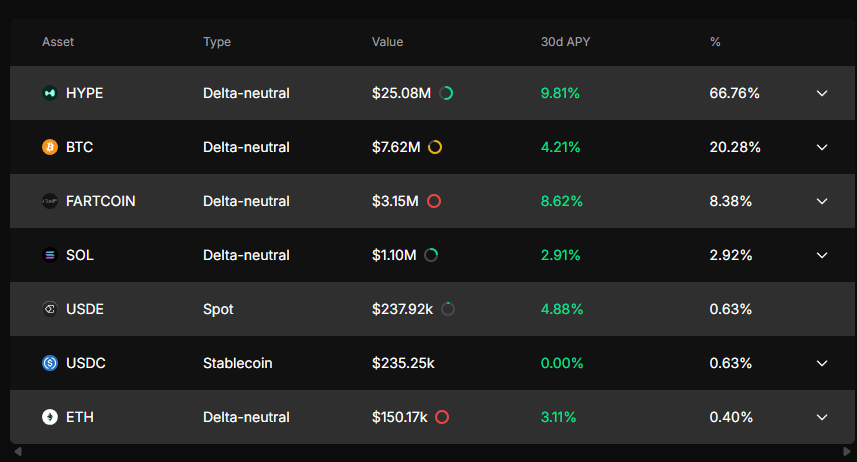

We go back to @liminalmoney again in this one because...I just like it.

And what's not to like?

Delta neutral real-yield on a number of blue chip assets (like Fartcoin 🤣):

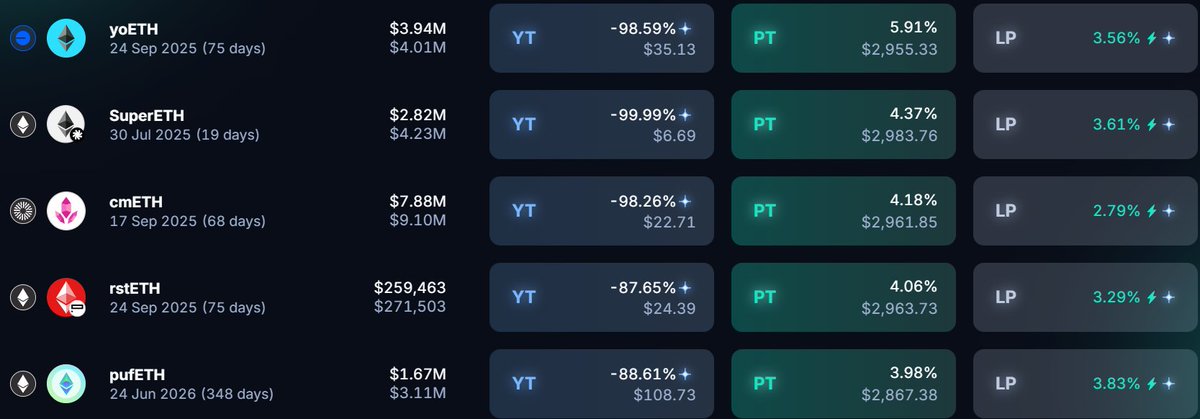

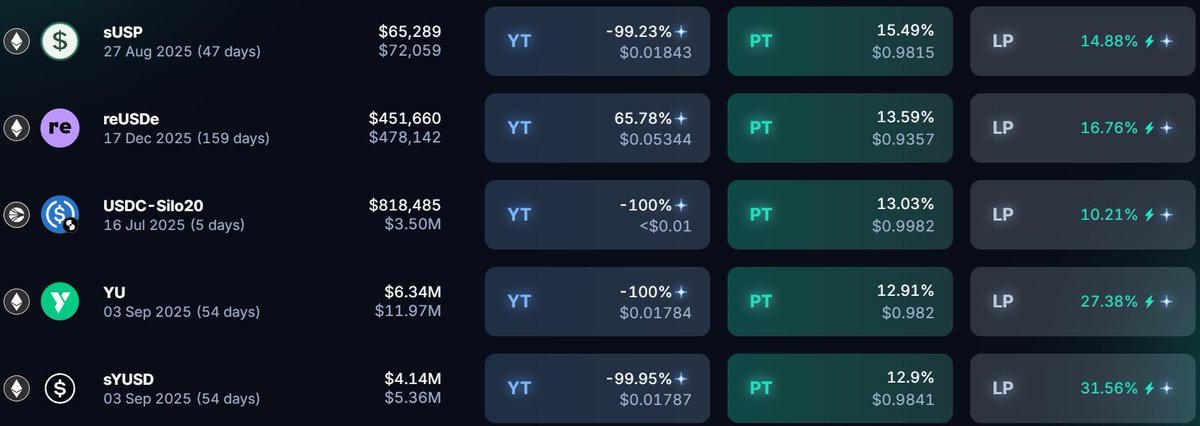

As always we look at the top markets on @pendle_fi:

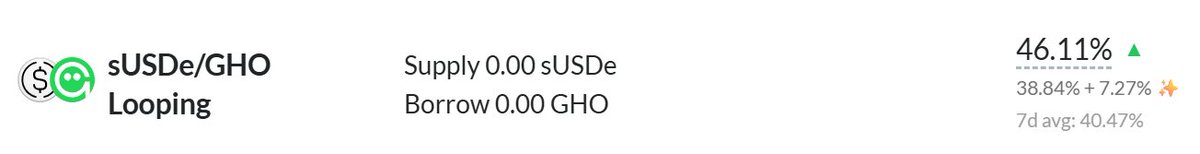

We go pretty deep on @RumpelLabs in our looping section.

If you're a serious points/yield farmer you really need to take a minute and look at what's going on here.

We breakdown what Rumpel is, how it works and how this looping strategy can yield you ~46% APY:

Lastly, we include an overlooked gem from the @GearboxProtocol chads who just want you to keep more of your yield:

Borrowers can lose up to a month's worth of yield due to slippage and DEX fees while leveraging assets. And yet, Gearbox users have built over $75M of leveraged positions on @mellowprotocol without incurring any slippage or fee.

Gearbox Permissionless can help borrowers to retain 100% of their yield, reduce the need to bootstrap DEX-liquidity for projects and maximise returns for curators. How? Read on!

➿ Leverage on Lending Protocols

Traditionally, creating a leveraged position or "looping" on lending platforms involves:

• Borrowing against your collateral

• Swapping the debt back into your collateral via a DEX

• Repeating the process or using flash loans

This reliance on DEX liquidity incurs price impact and trading fees. Over multiple loops, these costs can add up to a full month’s yield. Gearbox eliminates the need for DEXes and goes straight to the source...

👨🌾 The Best a Borrower Can Get

Gearbox takes a fundamentally different approach to leverage by enabling users to borrow multiples of their collateral. The borrowed funds and the collateral are held in an isolated smart contract, called Credit Account, that can:

• Mint tokens on demand, with leverage, by calling Mellow’s native mint function

• Skip DEX routes, eliminating price impact and swap fees

• Deliver full APY, since every basis point stays in your account

The result? Leveraged positions on @mellowprotocol with zero slippage and zero external fees, you keep all your yields.

🥇 Unmatched Efficiency for Liquid Yield-Token Projects

Users hold LSTs/LRTs to earn yields on assets and not to trade. Thus, generating lower trading fee which in turn makes it harder and more expensive to bootstrap DEX liquidity for yield bearing assets.

By utilising native minting, Gearbox reduces the need for DEX liquidity and can help projects save millions in liquidity related costs and incentives.

🔓 Withdrawals go live with Permissionless

As Gearbox transitions to a permissionless model, native withdrawals from @mellowprotocol contracts will be made available as well. This enables

• Borrowers to keep more of their yields

• Projects to save liquidity costs

• And Curators to earn a higher fee via savings

These factors have been instrumental to establish the rstETH market on Gearbox as the largest curated market for ETH assets in DeFi. If you are looking to create lending markets as a curator or a project, Gearbox Permissionless offers the most comprehensive institutional-grade lending stack across 27 EVMs. ⚙️🧰

14.09K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.