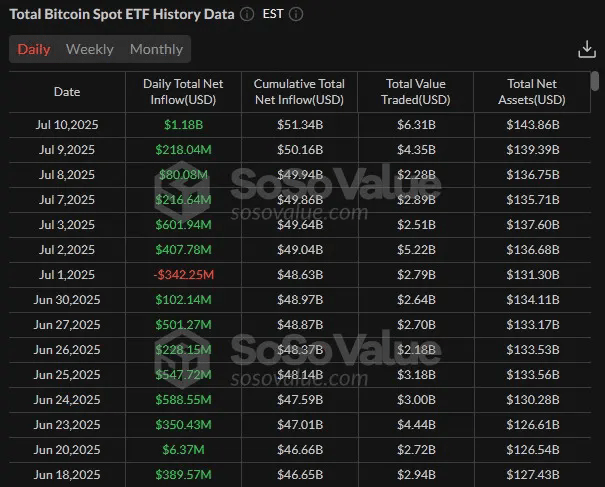

On July 10, Bitcoin ETFs in the US recorded inflows of up to $1.18 billion – the second highest level in history, only after Trump's election victory last year. The event took place at the same time that BTC exceeded $118,000, pushing the Fear and Greed index to "total greed", showing that institutional cash flow is coming back strongly.

BlackRock leads the way with $448 million, followed by Fidelity (324 million), Ark (268 million) and Grayscale (81 million). Meanwhile, GBTC continued to be net withdrawn 40 million USD. IBIT's total trading volume exceeded $5 billion – almost double normal.

Ethereum is also not on the sidelines. ETH ETFs recorded $383 million inflows, with BlackRock's ETHA breaking a record $300.9 million in a single day.

Notably, Trump Media has filed a dossier to set up a "Crypto Blue Chip ETF" consisting of 70% BTC, 15% ETH, 8% SOL, 5% XRP and 2% CRO. From once calling Bitcoin a "scam", Trump has now officially entered the crypto ETF game.

With massive cash flows, ETFs set new records, the crypto market exploded when the capitalization exceeded $3.67 trillion, trading volume increased by 67% to $246 billion. Bitcoin leads the wave!!

Show original

11K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.