Here's Tom Lee's argument for ETH, and BTCM

1. Wall Street loves Stablecoins. The Circle IPO is "God Level", trades at 100x Ebitda. They love them because they have the explicit backing of Treasury.

2. Stablecoins run mainly on ETH. They represent 30% of ETH gas fees. Bessent says they will go from 200MM to 2 Trillion in 5 years which is an "exponential increase"

3. Bitcoin Treasure companies make sense because they can issue convertible debt to monetize volatilty and achieve a low / zero cost of capital and increase Bitcoin per Share. ETH volatility is even higher.

4. The next 5-10 years will be about "programable money" as opposed to just "hard money" and ETH has the leadership position in market cap. Robin Hood is expirementing with tokenized stocks and Blackrock has expressed major long term plans.

5. There is a "Sovereign Put" on BTC and ETH Treasury companies as this will be the only way to acquire these extremely large blocks by acquisition. For proof of Stake networks, this comes with power.

and now, click for my comments

First, I agree that codification of Stablecoins by Wall Street is a big deal. This gives Amazon and Apple for example permission to easily accept Stables. Shopify announced integration in anticipation of this bill passing.

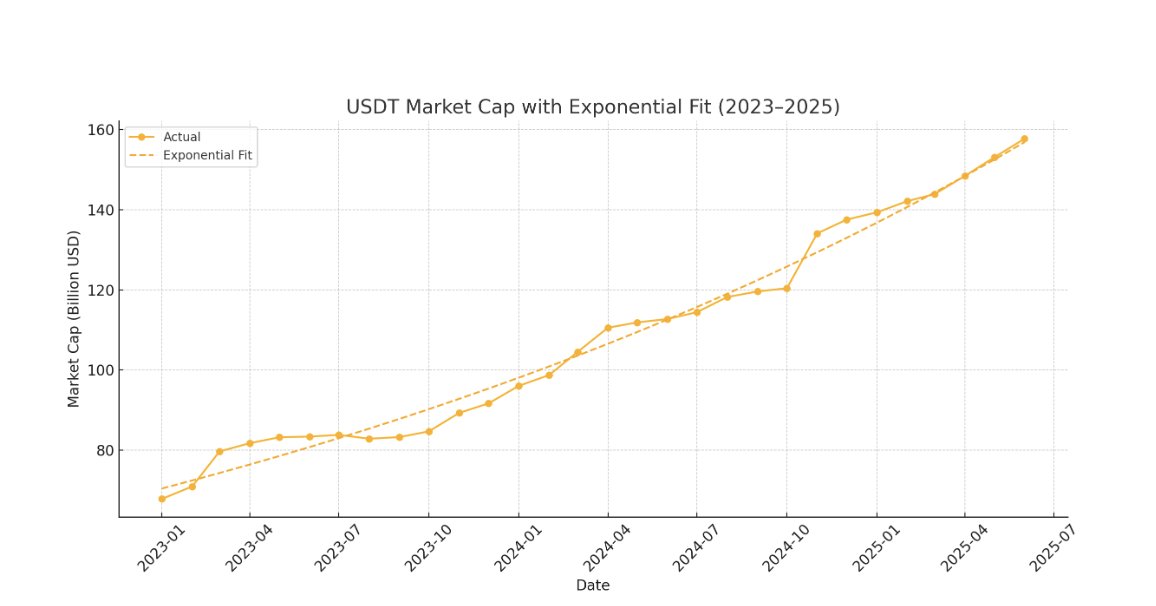

Even without the blessing of the Genius Act, stables are growing very well outside the US (see Graph of Tether). Ironically, USDC has not done as well as USDT and is back to 2021 levels, although has doubled MC in 18 months.

On the other side, Europe is very ANTI stablecoins, and this anti-american sentiment is likely to be replicated elsewhere. Fiat empires don't love invasion by other fiat

2. "Stablecoins run mainly on ETH". Here I see vulnerabilities. Wall Street may love ETH, but consumers don't.

User activity: Solana significantly outpaces Ethereum in daily active addresses, by 5–10× on some measures.

Transaction volume: Solana is vastly ahead, processing tens of millions of daily transactions versus Ethereum’s ~1 million.

True, if you add in all the layer2s on ETH you get close to Solana, but my gut feel says at least that the "programable money will run on ETH" argument has holes in it.

Tom Lee conveniently does not mention Solana.

3. I can't find too much fault with Tom Lee's endorsement of the general structure of MSTR, except to mention that MSTR has largely given up on issuing convertible bonds.

ETH may have higher volatility, but are convertible bonds deep enough for all these treasury companies?

4. The Programable money point is very valid I think. Stablecoins in particular needs rails. And so does Bitcoin.

I just think there is a reasonable chance this happens on Solana, not ETH.

Consumers make this decision, not governments. Right now USDT runs on TRON mainly. This should open eyes.

5. The Sovereign Put idea is clever, but again, rests on the idea that these "rails" can be co-opted by sovereigns. Over the long term (20 years) sats will be the main unit of account, not USDC or other dollars and the rails will be less valuble.

The fact that these rails can be co-opted by Sovereigns is a problem in and of itself.

I much more think Bitcoin, not ETH will be the store of value, and that the rails will be commoditized and less valuable.

But. I will give Tom Lee credit. And I think in the short to medium term he is probably right. ETH and SOL will probably outperform.

71.41K

437

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.