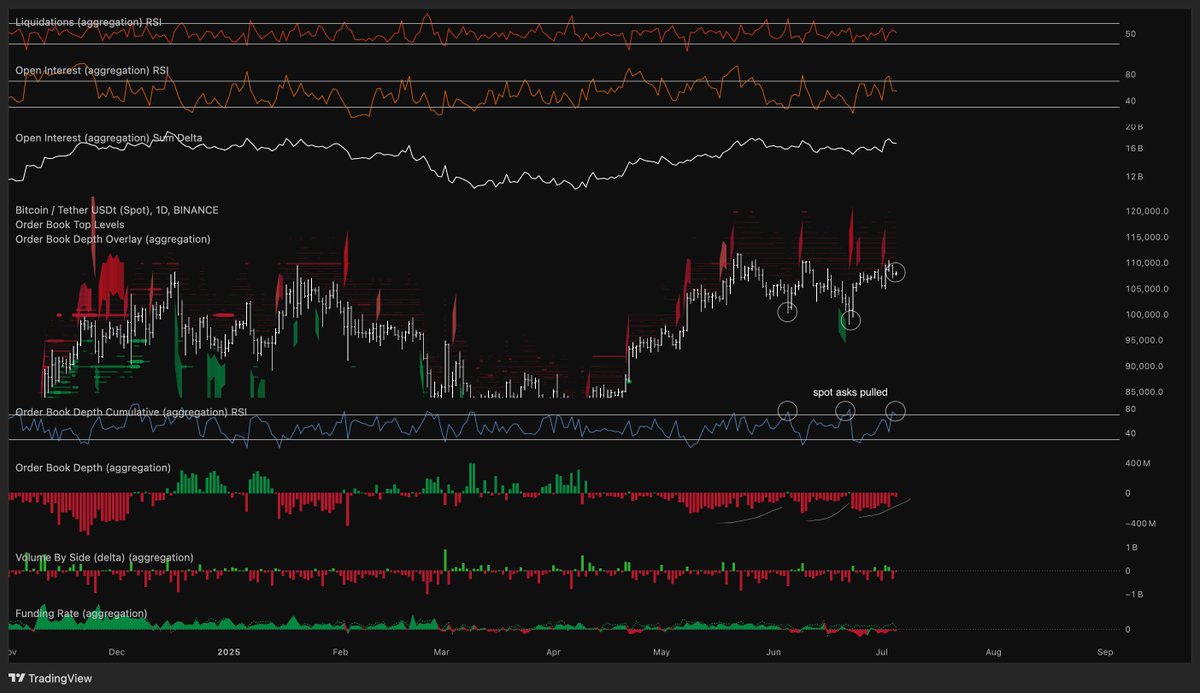

Orderbook depth is a very useful tool. After those asks got taken out we are now seeing bids emerge below walking up price defending heavily.

Bids much more heavily stacked than asks at this moment in time. Meanwhile equities at an all time high, the big beautiful bill has passed, spot ETF flows incredibly strong and there's an emerging bubble in number of DAT vehicles launching with intent to purchase Bitcoin.

Think there are plenty of marginal buyers here and we are not out of buying power just yet. One important thing to note is ETFs launched in Jan 2024 when BTC was trading around $40k and many new entrants were absorbing supply in 2024 summer at $60k so profit taking above $100k is inevitable.

Moves above $140k I become very nervous that Bitcoin will put in a cycle top approaching peak euphoria and numerous of these DAT vehicles will implode providing legitimate sell side pressure forcing others to capitulate their positions.

When this happens remains to be seen but believe the music hasn't stopped for now. Macro backdrop is favourable to capital going further out on the risk curve.

$BTC

In my humble opinion, one of the reasons why Bitcoin struggled to make new highs in the last month and a half was due to heavy spot asks absorbing any buy attempts.

At the beginning and end of June, we could see these offers being pulled mainly because the price moved quite far from them, giving the market room to mean-revert.

Towards the end of last week, we had an impulse move up through the offers, and they were not restacked yet.

This lets me think that if we are about to make new all-time highs there are not many reasons to fuck around much and do if from around here.

From a technical (imaginary lines) point of view, this also makes sense as price is testing a trendline support and a 50-day SMA while trading above +1 standard deviation of the yearly vwap (fair value).

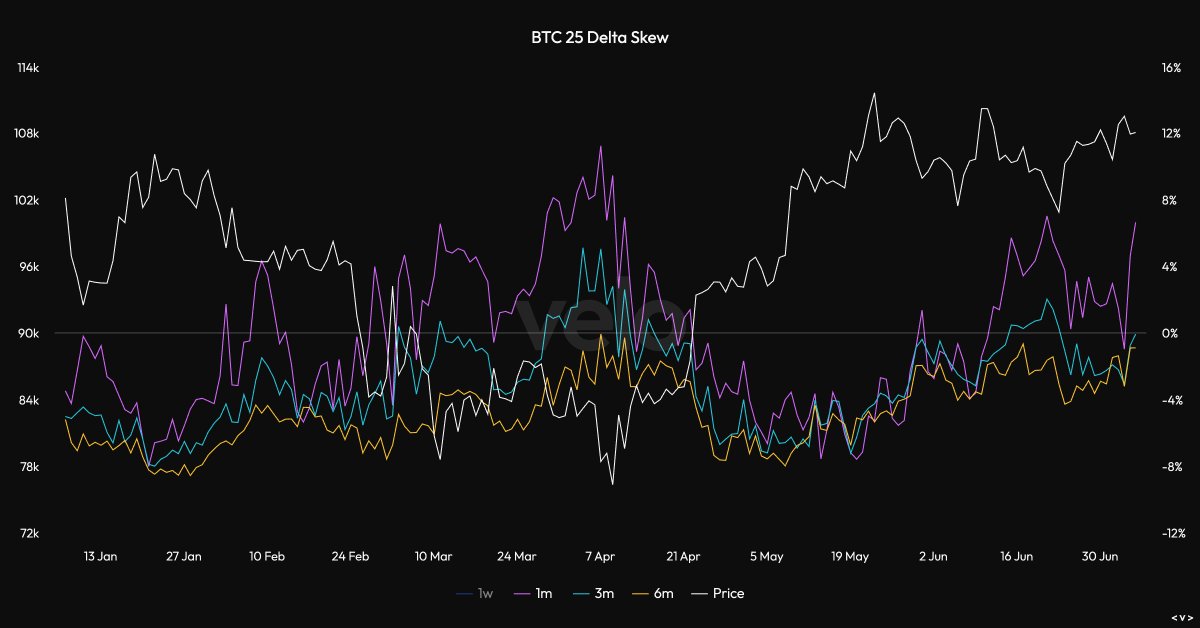

Options data are also pretty interesting, as the demand for puts is relatively high considering we are just shy of the all-time highs.

Anyway, just my two cents; I'm long, I'll delete if I'm wrong (probably somewhere under $105k).

15.75K

65

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.