Franklin Templeton Warns of Crypto Treasury Risks 🔎

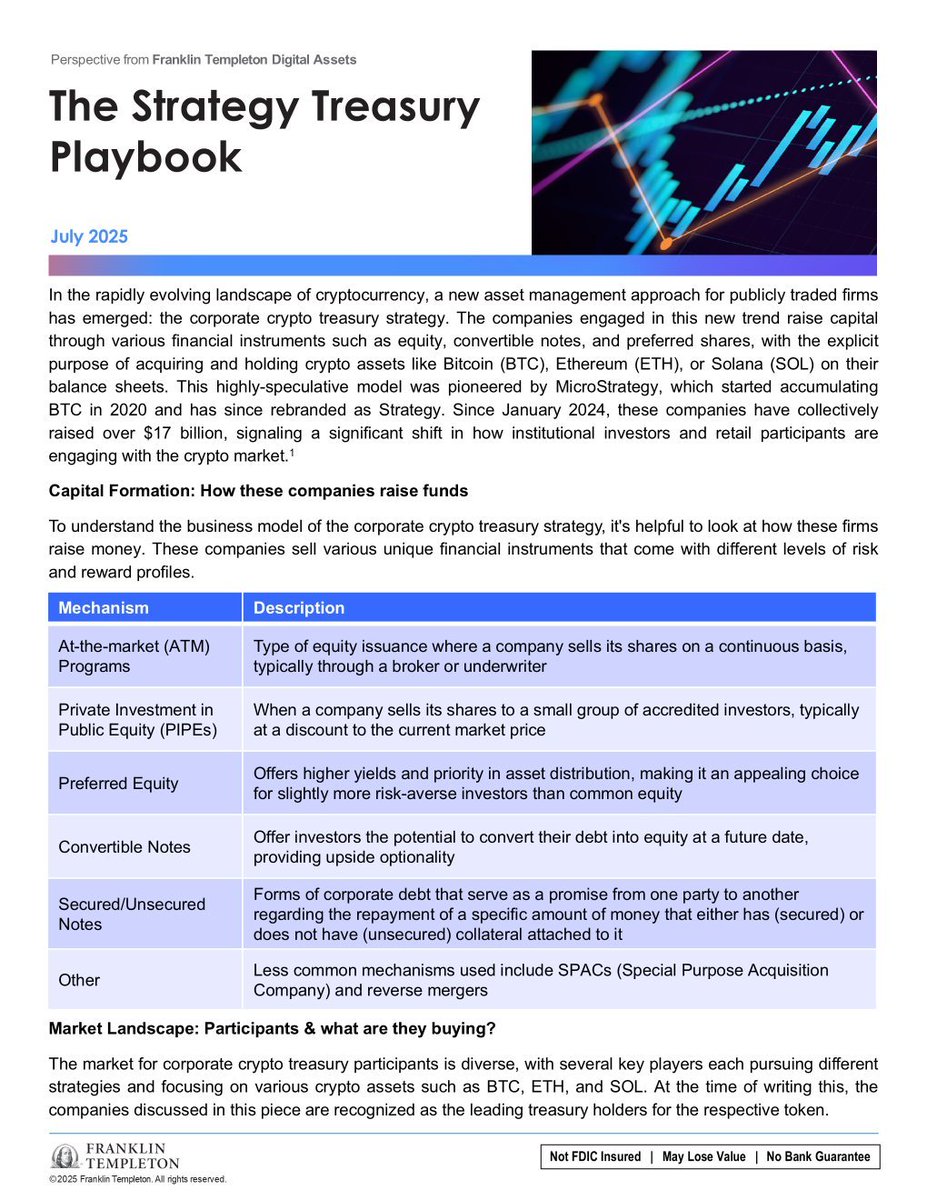

Franklin Templeton analysts cautioned that corporate crypto treasury strategies, where firms raise capital to hold assets like Bitcoin, Ethereum, and Solana, face an uncertain future.

> While these models can boost valuations, generate staking income, and create positive feedback loops when crypto prices rise, they also carry serious risks.

> A drop in market-to-NAV ratios can make new equity issuance dilutive, and falling crypto prices may trigger a “dangerous” negative feedback loop.

> Analysts stressed that maintaining a premium to NAV and managing volatility are essential for long-term success.

Read More Here:

4.04K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.