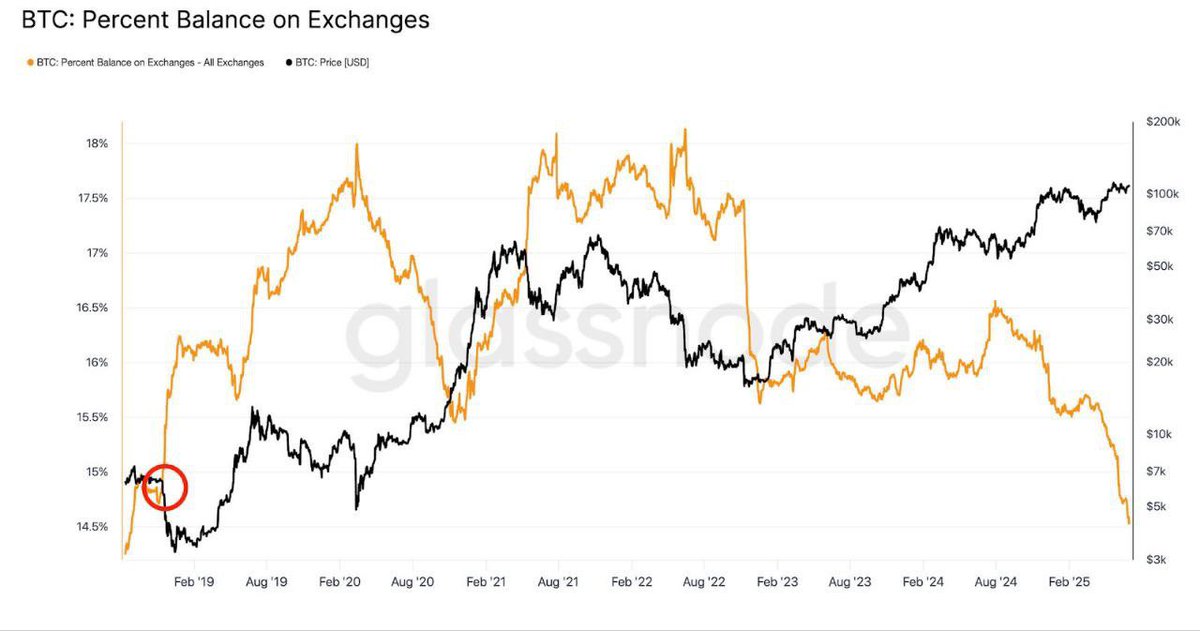

We’re seeing a shift in ownership structure.

Only 15% of Bitcoin’s free float is left on exchanges, and OTC balances are at decade lows. That’s not just a “supply shock” - that’s institutions.

Everyone’s shouting about the supply crunch, but this isn’t just about price.

It’s about a deeper shift: institutional accumulation + mature custody infrastructure.

New game.

And yes, supply shock is real. When BlackRock, Bitwise, Bernstein, and Standard Chartered forecast $200K and more this year - they’re not guessing. They’re watching the order books.

This is what structural transition looks like:

→ Distribution through intermediaries

→ Institutional custody maturity

→ Direct long-term ownership

→ Real scarcity

➦ New price discovery regime

19.28K

132

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.