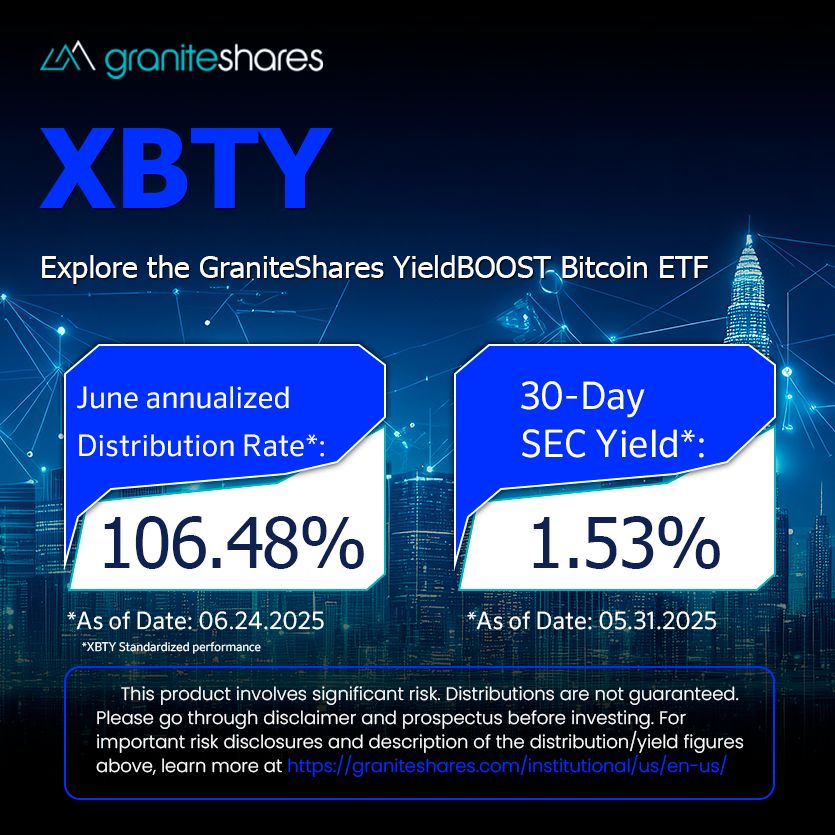

The distribution rate = Latest distribution annualized / current NAV

The 30-day SEC yield is a standardized measure of the income earned by a fund, typically a bond fund or ETF, over a 30-day period, annualized to provide an estimated annual return.

* The Distribution Rate and 30-Day SEC Yield is not indicative of future distributions, if any, on the ETFs. In particular, future distributions on any ETF may differ significantly from its Distribution Rate or 30-Day SEC Yield. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs (if any) are variable and may vary significantly from month to month and may be zero. Accordingly, the Distribution Rate and 30-Day SEC Yield will change over time, and such change may be significant. The distribution may include a combination of ordinary dividends, capital gain, and return of investor capital, which may decrease a fund’s NAV and trading price over time. As a result, an investor may suffer significant losses to their investment. These distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. Stated distribution frequency subject to change. Additional fund risks can be found below.

For standardized performance of GraniteShares YieldBOOST ETFs, please visit:

• $TSYY:

• $TQQY:

• $YSPY:

• $XBTY:

• $NVYY:

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. Returns for the fund would have been lower if the management fee had not been waived. NAV prices are used to calculate market price performance prior to the date when the Fund first traded on the NASDAQ. Market performance is determined using the bid/ask midpoint at 4:00 pm Eastern time, when the NAV is typically calculated. Market performance does not represent the returns you would receive if you traded shares at other times. For the fund’s most recent month end performance, please call 1(844)-476-8747, or visit

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Funds, please read the prospectus before investing.

Funds are newly launched and has risks associated with its limited operating history.

An investment in the Funds involves risk, including the possible loss of principal. The Funds are non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as option contracts and swaps are subject to market risks that may cause their price to include Risk of the Underlying ETF, Derivatives Risk, Affiliated Fund Risk, Put Writing Strategy Risk, Option Market Liquidity Risk, Counterparty Risk, Distribution Risk, & NAV Erosion Risk Due to Distribution. These and other risks can be found in the prospectus.

There is no guarantee that the Fund's investment strategy will be properly implemented, and an investor may lose some or all of its investment.

An Investment in the Funds is not an investment in the Underlying ETF

-The Fund’s strategy will cap its potential gain if the Underlying ETF’s share increases in value

-The Fund’s strategy is subject to all potential losses if the Underlying ETF’s share decline, which may not be offset but the income received by the Fund,

-The Funds do not invest directly in the Underlying ETFs or the underlying stock,

-Fund shareholders are not entitled to any distribution paid by Underlying ETFs.

This information is not an offer to sell or a solicitation of an offer to buy shares of any Funds to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Please consult your tax advisor about the tax consequences of an investment in Fund shares, including the possible application of foreign, state, and local tax laws. You could lose money by investing in the ETFs. There can be no assurance that the investment objective of the Funds will be achieved. None of the Funds should be relied upon as a complete investment program.

The Fund is distributed by ALPS Distributors, Inc, which is not affiliated with GraniteShares or any of its affiliates ©2025 GraniteShares Inc. All rights reserved. GraniteShares, GraniteShares Trusts, and the GraniteShares logo are registered and unregistered trademarks of GraniteShares Inc., in the United States and elsewhere. All other marks are the property of their respective owners.

$BTC

154.55K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.