Tokenomics Design - The Hidden Architecture of Protocol Success 🧵

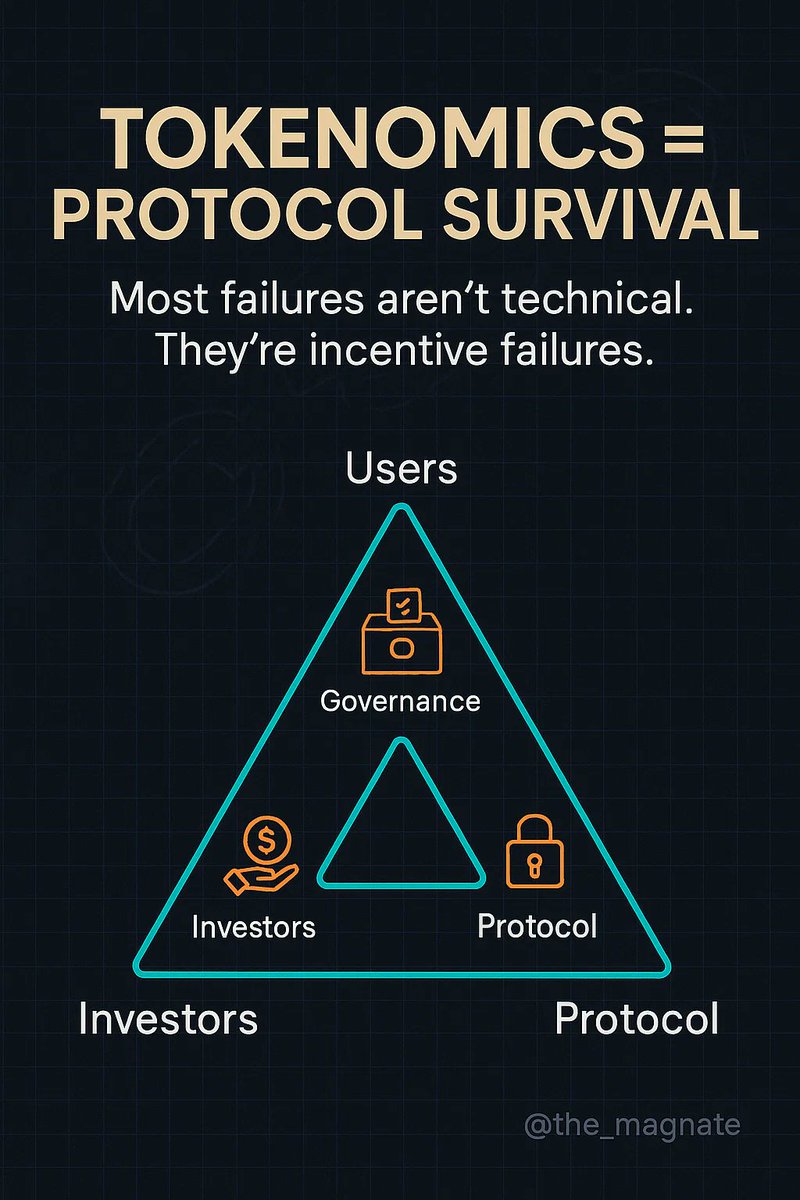

Most failures in crypto aren't technical.

They're incentive failures.

Here’s how elite builders design tokenomics that actually work 👇

❶ Your token is not your product.

It’s the incentive layer a bridge between:

• Users

• Investors

• The protocol

If one group dominates, your ecosystem collapses.

Balance is the name of the game.

❷ 3 Core Stakeholders You Must Balance:

• Users - Want utility & upside

• Investors - Want ROI & liquidity

• Protocol - Needs sustainability & growth

Misalign these & your flywheel breaks.

❸ Common Tokenomics Failures:

• High inflation without real demand

• Mercenary liquidity chasing short-term rewards

• Unlock cliffs triggering supply shocks

• Utility promises without actual usage

Good tokenomics is risk engineering.

❹ Framework: The Tokenomics Triangle

Design around 3 axes:

🧲 Incentive Alignment - Are stakeholders pulling in the same direction?

💰 Emission Discipline - Are you buying growth or bleeding out?

📈 Utility Feedback Loop - Does usage increase token demand?

If you can't answer these, you're gambling.

❺ Vesting ≠ Alignment

• Long locks don’t guarantee loyalty

• Short locks attract farm & dumpers

• Cliffs create unlock shocks

Instead:

→ Use dynamic vesting

→ Tie unlocks to usage, performance & milestones

→ Build around earned liquidity, not free rides

❻ Real Yield > Emissions

Protocols that print tokens to attract users? Unsustainable.

Protocols that generate revenue & share value? Long-term durable.

Move from “token as subsidy” to “token as value engine.”

❼ Design Questions Every Builder Should Ask:

• What behaviour are we incentivising & is it sticky?

• What happens if the price crashes 80%? Do users stay?

• Can the protocol survive without token rewards?

Tokens should amplify product-market fit, not replace it.

❽ Case Study: What Works

• $GMX - Revenue share + no emissions

• $RBN - Token unlocks tied to DAO votes

• $JTO - Staking aligned with protocol growth

• $AAVE - Safety Module + governance = real utility

There’s no perfect model but there is discipline.

❾ In summary:

→ Treat your token like a second product

→ Align incentives, don’t just distribute supply

→ Design for behavior, not price

→ Build a system that works even if the price doesn’t moon

Sustainability > speculation.

Building something real?

• Follow @THE_MAGNATE for more high-IQ trading frameworks.

• Bookmark 🔖 this for your trading journal.

• DM ✉️ open for collabs, insights, or 1-1 Masterclass.

#PriceAction #SmartMoney #TradingTips #BTC #ETH #Altcoins

5.14K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.