My Yala mainnet experience: The zero-liquidation artifact for BTC institutional DeFi!

The DeFi spring for Bitcoin whales has arrived! Yala, the BTC native liquidity layer that launched on the mainnet on May 16, allows me to play with $YU using self-custody + zero liquidation, and the returns are fantastic!

From my perspective, let's talk about Yala's institutional-level narrative, participation methods, and the upcoming TGE!

Earning interest on BTC has always been a pain! Restaking and LSD yield only 1% annually, and there's a risk of penalties; centralized platforms like BlockFi require custody, and the fear of bank runs and liquidations is terrifying!

Yala shows me a glimmer of hope: it uses self-custody + CRSM zero liquidation to create a safe DeFi entry for institutions and high-net-worth users.

Narrative logic: Why is Yala so hardcore?

In my view, Yala's logic is strong for three reasons:

Self-custody security: My BTC is stored in a time-locked + multi-signature address, and Yala mints $YU using YBTC, allowing me to maintain full control over my native BTC, as secure as a vault!

CRSM zero liquidation: BTC is volatile? CRSM automatically adjusts positions, using $YU earnings to repay debts when the collateral ratio is low, completely preventing liquidation, which institutions love!

Multi-ecosystem earnings: $YU plays cross-chain with Pendle, Kamino, and Centrifuge, offering 20% APY in DeFi mining and 12% on RWA bonds, with diversified returns, a favorite for large funds!

How do I play Yala? Both whales and retail investors benefit!

Yala's mainnet launched on May 16, and I've tried several strategies, yielding high returns and a sense of security:

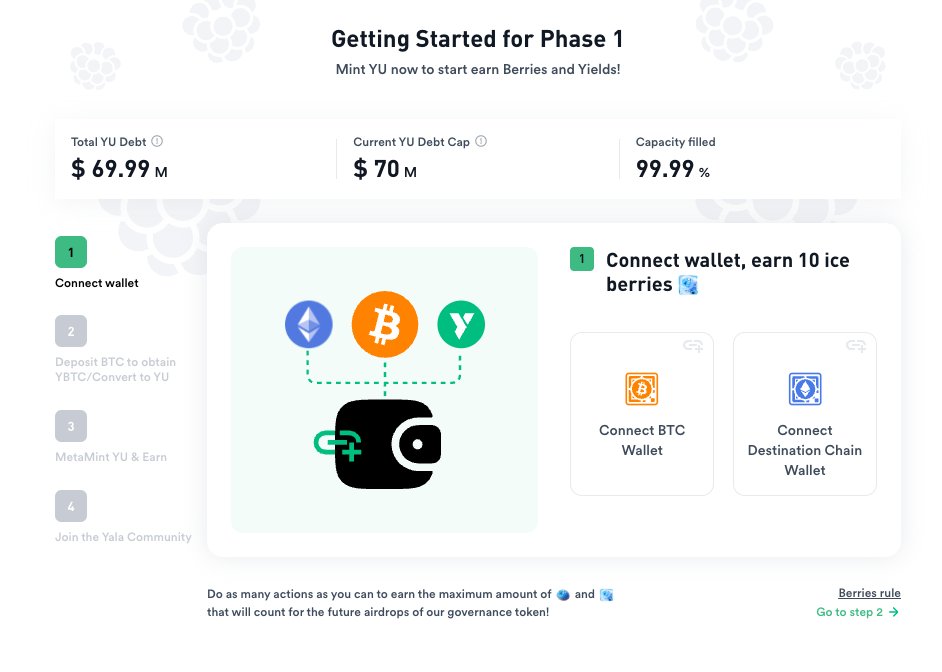

Minting $YU to earn Berries: Mint $YU using BTC on the mainnet, or exchange USDC 1:1 for $YU, and collect Berries for the TGE airdrop!

High DeFi returns: Invest $YU in the DeFi Marketplace on Kamino, with 20% APY and 100% head mining!

Guaranteed RWA returns: Invest in Centrifuge bonds with RealYield, offering 12% annualized returns, compliant and stable!

Triple earnings in the stable pool: Deposit $YU into the stable pool for 10-12% APY + Berries + liquidation earnings!

Lite Mode for easy earnings: Deposit $YU/USDC, AI-optimized for 12% annualized returns + points, worry-free!

Whales use CDP + self-custody with zero risk, while retail investors use PSM with low barriers; the bridging code is open-source, ensuring transparency and security!

Join Yala and unlock BTC earnings!

Participation: Mint $YU, DeFi, RWA, stable pool,

TGE: $YALA airdrop relies on Berries!

Follow @yalaorg

Summary: Yala, the ace of BTCFi

Yala breaks the deadlock of institutional DeFi with self-custody + CRSM, allowing for enjoyable play with $YU on the mainnet, and the TGE airdrop is imminent,

A new era of Solana-BTC earnings has arrived!

---

The above content is based on personal observations, and the project information is compiled from publicly available materials.

The market is ever-changing, and investment carries risks; readers are advised to view rationally, make independent judgments, and protect their personal interests.

DYOR.

Show original

5.23K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.