Can Lombard still hold up a piece of BTCFi @Lombard_Finance

Dune Dashboard:

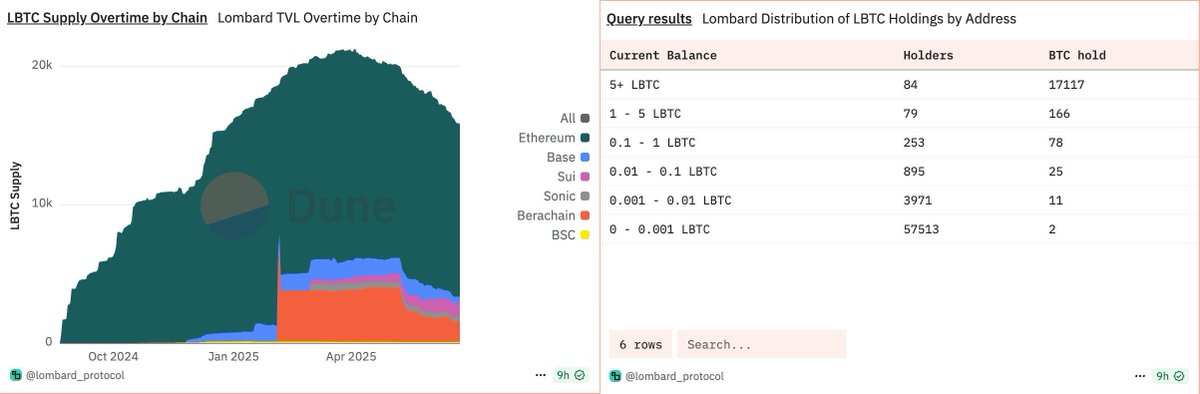

The amount of LBTC provided has decreased from the highest point of 21219 to 15,865, a decrease of 5000+ BTC, and looking at the distribution of LBTC holders, there are 163 people who hold more than 1 LBTC, and most users hold less than 0.001 LBTC.

According to this trend, the amount of BTC in TVL will continue to decline.

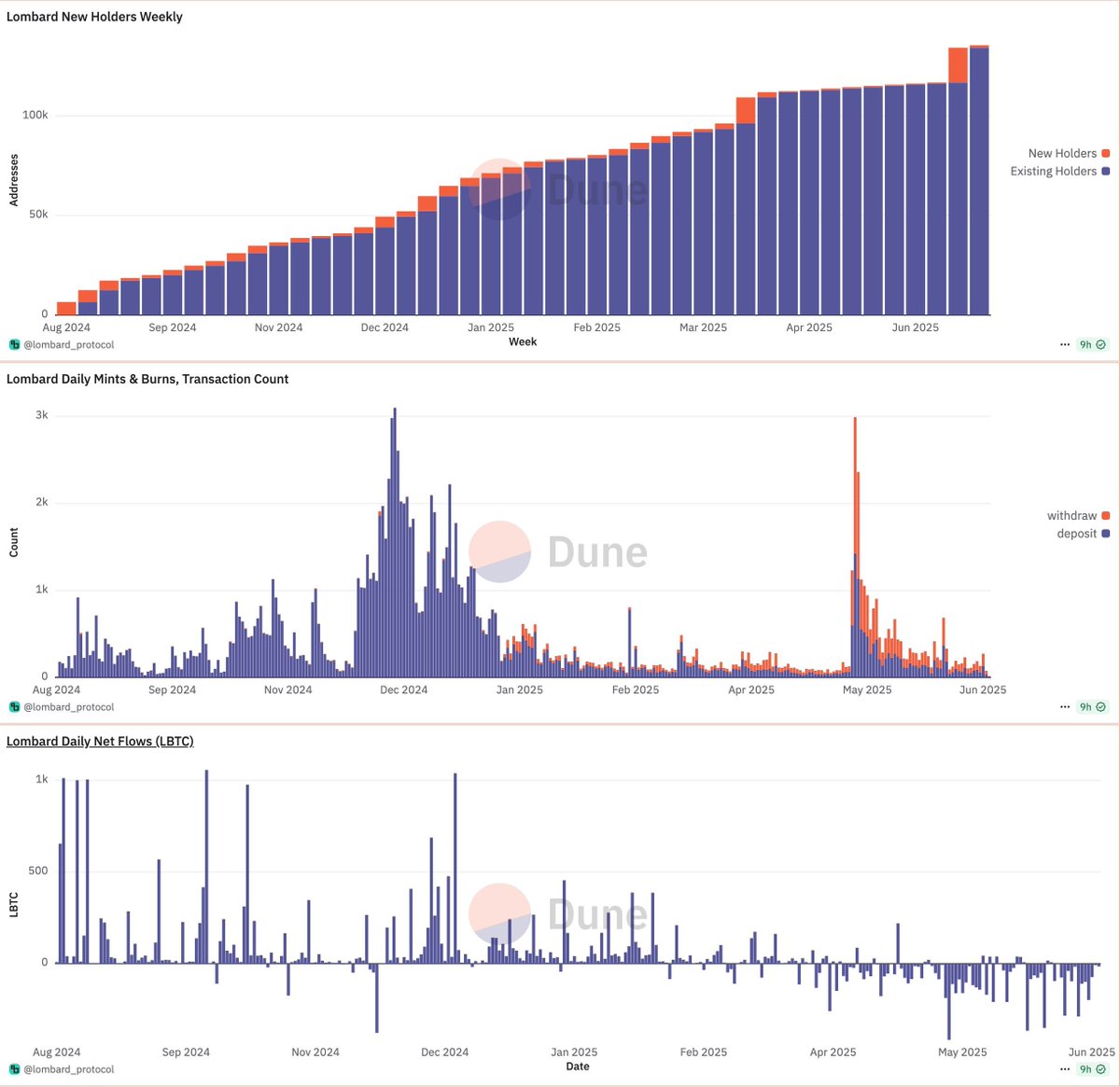

The number of new LBTC holders on 4.17 and 6.16 were 13,000 and 17,000 respectively, and in the middle of the two times, the number of new holders per week was no more than 1,000.

Through the transaction data of Mints & Burns, we can see the peak of withdrawing BTC for everyone in May, and the number of deposit transactions is also decreasing.

Since the beginning of May, the BTC of the entire protocol has been decreasing, with net outflows almost every day

Through the above data, it can be obtained that Lombard's TVL is mainly supported by giant whales, and retail investors are constantly withdrawing, the approximate reason should be that there is no TGE, and Lombard can be said to have almost no income, everyone can only see points, in this market, the most worthless thing is points, or even 1 point is not worth it.

At present, Lombard's strength is still there, and it can attract so many whale deposits, which means that the resources can, and I think this is the right way, these whales are either large investors or institutions, they will not easily sell their BTC, this kind of depositor is what Lombard needs the most, and it is the first choice.

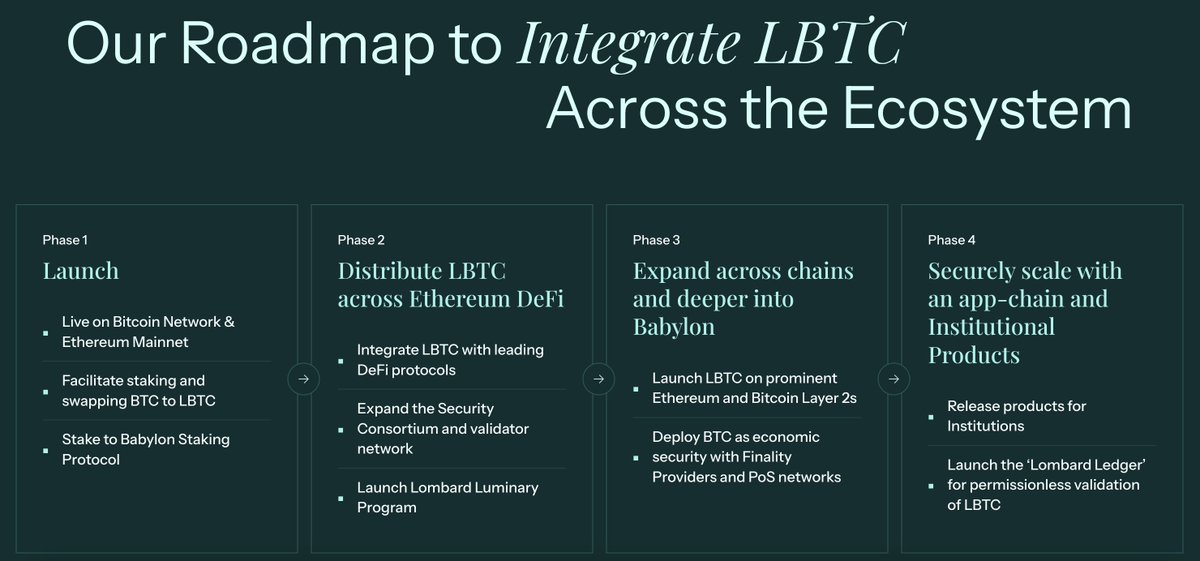

Let's take a final look at the roadmap, it is said that the Lombard chain has also been launched internally, and phase 4 is coming soon, and after phase 4, there is a high probability that it will be the TGE that everyone has in mind.

Either way, I wish you all a fruitful harvest.

Show original

9.44K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.