Economic incentives matter.

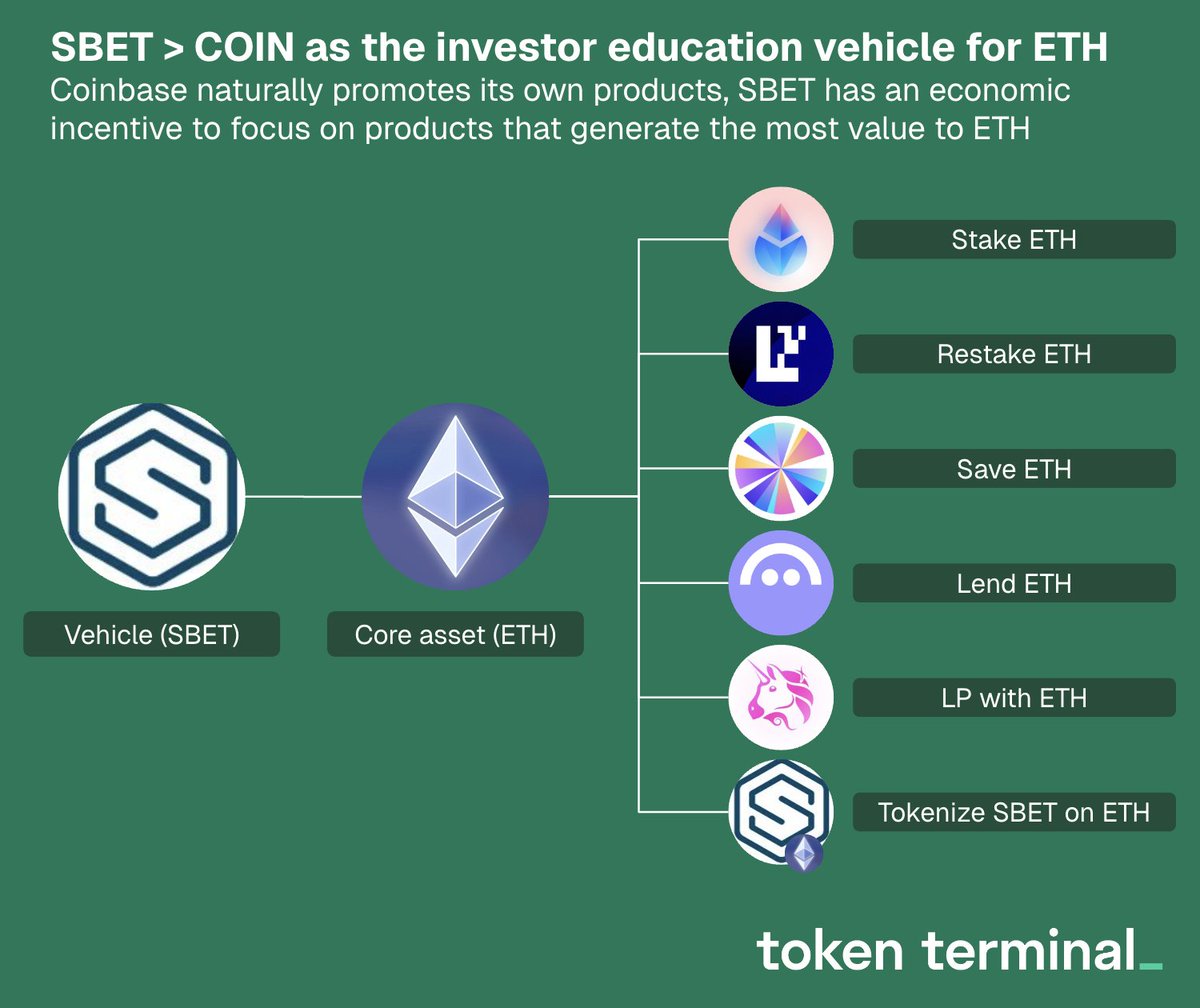

SBET could turn out to be a better investor education vehicle for ETH vs. COIN/Coinbase.

Why?

Coinbase naturally promotes its own products, SBET has an economic incentive to focus on products that generate the most value to ETH.

LIVE NOW - Is Joe Lubin the Michael Saylor of Ethereum? | The $SBET Opportunity

@ethereumJoseph returns to Bankless to break down his latest bold move—launching @SharpLinkGaming, a publicly traded vehicle designed to accumulate and deploy Ether as a strategic treasury asset.

We unpack whether Lubin is stepping into the @saylor role for @ethereum, how SBET might outperform Bitcoin-backed models, and why ETH is poised for a monetary renaissance.

--------------

TIMESTAMPS

0:00 Intro

0:38 Getting Sued by The SEC

7:55 $SBET

16:32 The Michael Saylor of ETH

23:25 $SBET (ETH) vs $MSTR (BTC)

27:16 Valuing ETH

28:30 Wall Street Narratives

30:52 ETH’s Performance

36:53 ETH as Collateral

40:07 Onboarding Others

46:52 ETH as SoV

49:18 What ETH Needs

50:52 Joining Forces

53:08 ETH’s Sentiment Shift

56:53 Genius Act

58:44 Closing & Disclaimers

17

21.59K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.