Bloomberg article translated to English:

Metaplanet Joins the ¥1 Trillion Market Cap Club, Surpassing Kioxia and Tokyo Metro

By Yasutake Tamura

June 16, 2025, 16:13 JST

Metaplanet, a company that invests in Bitcoin, has surpassed ¥1 trillion in market capitalization. The company’s accelerating share price is being driven by investor expectations of further Bitcoin purchases and gains in Bitcoin’s value.

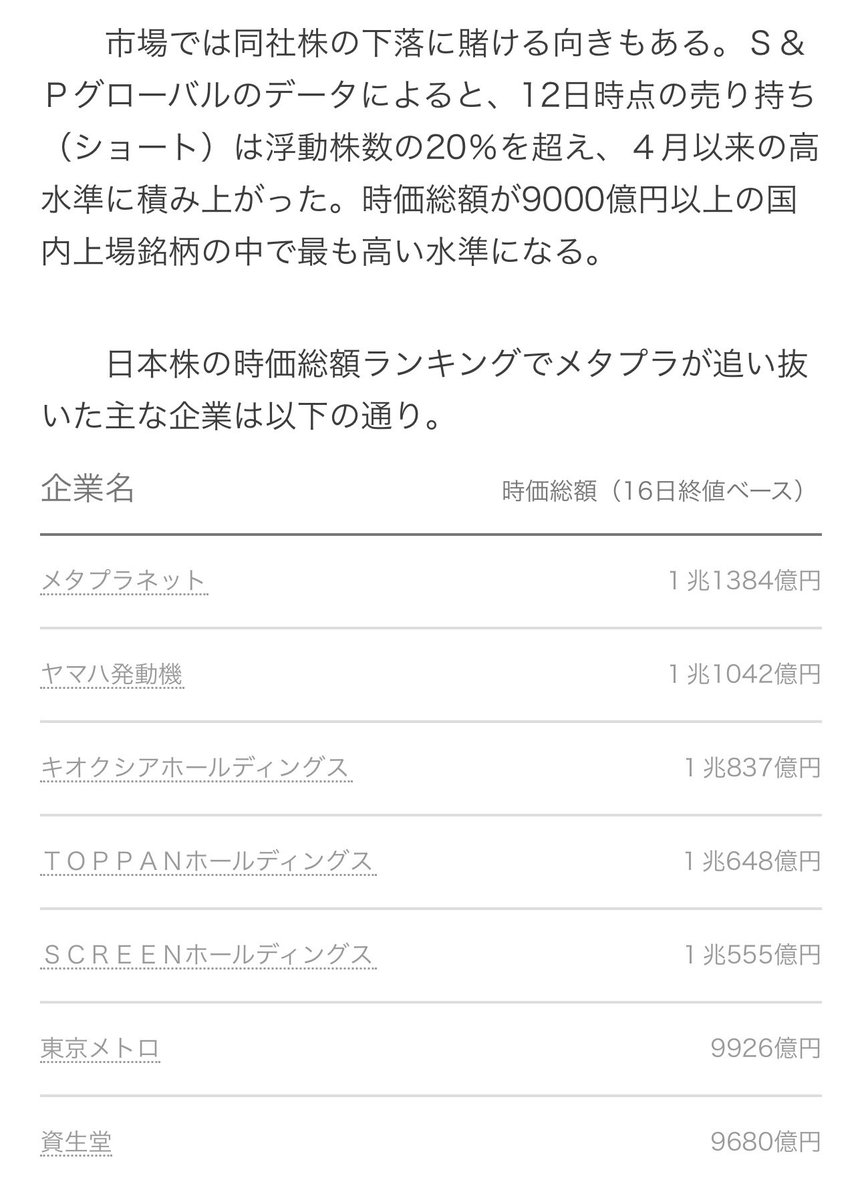

On June 16, shares of Metaplanet surged 26% from the previous Friday to close at ¥1,895 on the Tokyo Stock Exchange, hitting their highest level in roughly 12 years. Its market capitalization expanded from ¥906.5 billion at the end of last week to ¥1.1384 trillion, overtaking major companies such as semiconductor maker Kioxia Holdings and Tokyo Metro (Tokyo Subway).

That same day, Metaplanet announced that it had purchased an additional 1,112 Bitcoin, bringing its total holdings to 10,000 BTC. With Bloomberg’s Bitcoin Index rebounding for the first time in four days, investor expectations rose for improved earnings due to the appreciation of the company’s Bitcoin assets. The relatively lower tax rate on gains through equities, compared to direct Bitcoin purchases, has also fueled buying interest.

Metaplanet has recently made a series of announcements regarding capital raising through instruments such as stock acquisition rights, aimed at funding its Bitcoin investments. Most recently, it unveiled a capital raise plan exceeding ¥700 billion. According to Bloomberg data, Metaplanet is now the largest company by market capitalization among Japanese-listed stocks not currently covered by securities analysts.

Previously engaged in the hotel and restaurant business, Metaplanet fell into negative net worth in FY2021. Starting in 2024, it pivoted to focus on Bitcoin investment and holding. Its strategy closely mirrors that of U.S.-based MicroStrategy (now simply “Strategy”), which also centers its business around crypto asset investment.

There are also investors betting against the stock. According to data from S&P Global, as of June 12, short interest exceeded 20% of the company’s free float — the highest level since April. Among all domestically listed Japanese companies with a market cap over ¥900 billion, Metaplanet has the highest short interest ratio.

The below table displays some of the major companies Metaplanet has overtaken in Japan’s market capitalization rankings.

1.21K

194.64K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.