SOL on-chain data updates

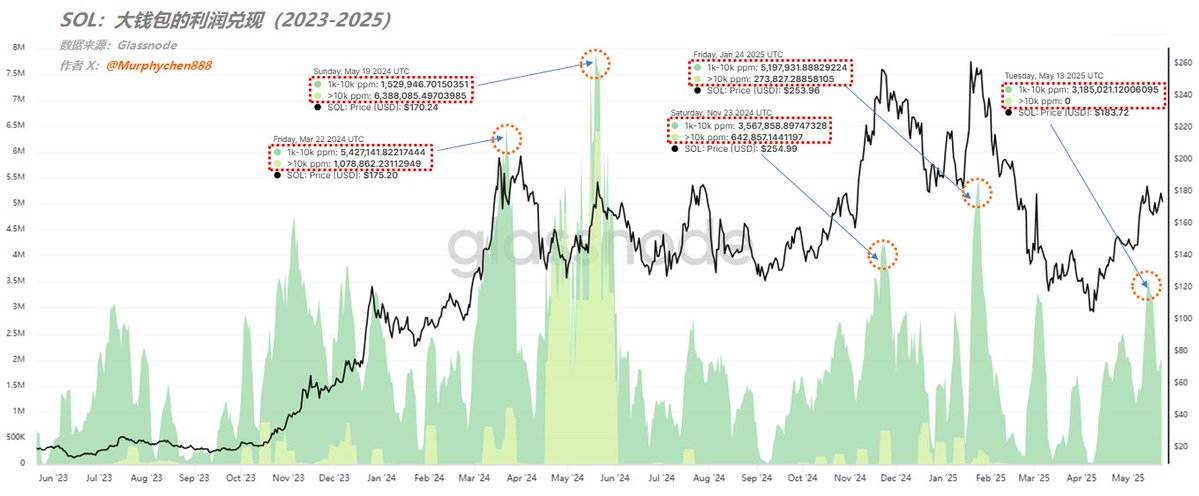

By looking at it, we can see that the price movement of SOL is closely related to the realization of "big wallet" profits. It seems that every time there is a huge amount of cash out in a large wallet of 1k-10k ppm, the price of SOL has to go through a period of recuperation.

The most obvious are the 4 days of 3/22, 5/19, 1/24, and 11/23. This is when the price is at a "high", the big investors take profits and leave the market, and it is their huge selling pressure that consumes a lot of short-term demand in the market. If you hurt your "vitality", you naturally have to take a break.

(Figure 1)

At present, I see that 355w SOL has been cashed out in the big wallet of 5/13 1k-10k ppm, which is not particularly large, but it is closer to 11/23, and it is also a big profit escape. It didn't happen again in the 5/22 rally. Therefore, we can understand that the current SOL needs to take a break from the previous profit realization.

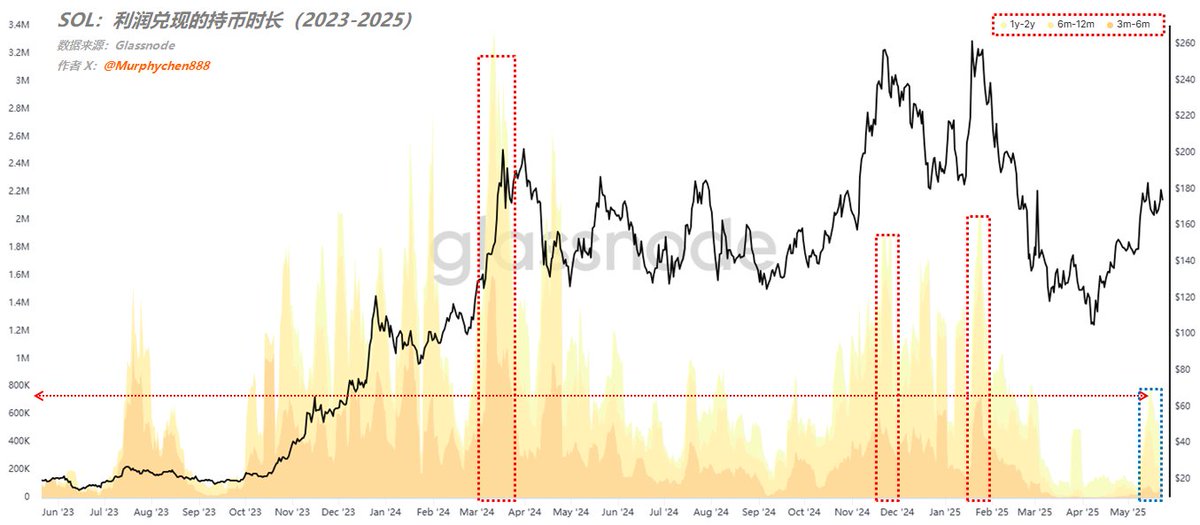

(Fig. 2)

From the perspective of SOL's "old wallet", the scale of the "old wallet" sold at the price high of 5/13 was much smaller than the previous market rush period. Shows that long-term holders are not particularly interested in the current price and seem to be waiting for a better position.

This is also a consideration that I don't think SOL will retrace significantly for the time being, but will only need to adjust for a while. Of course, the premise is that BTC does not experience significant drawdowns during this period.

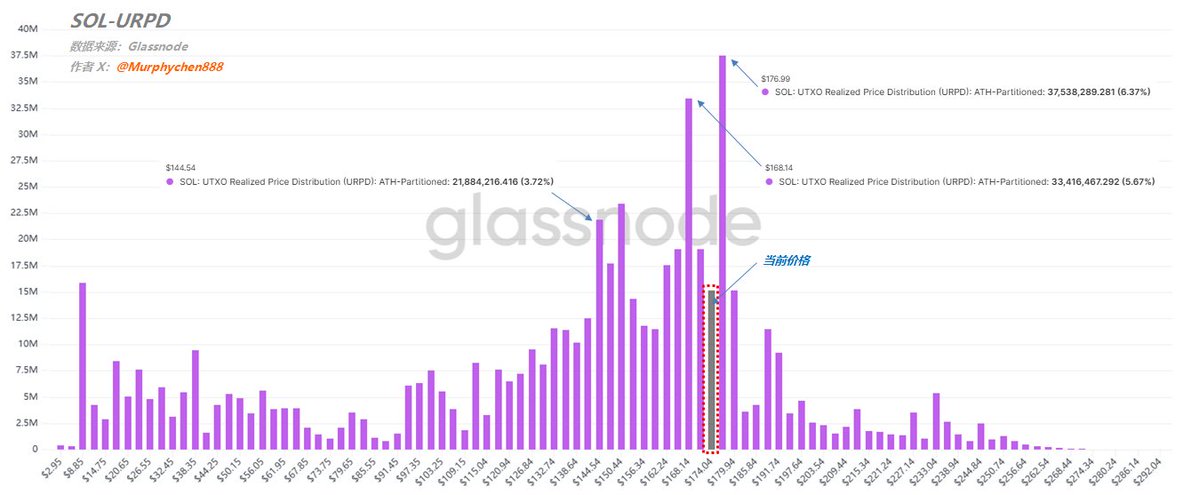

(Fig. 3)

From SOL's URPD data, it can be clearly seen that the two places of $168-$176 have the most chips in the entire price distribution, of which $168 currently has 33.4 million SOL (5.6% of the total circulation), while $176 has 37.53 million SOL (5.6% of the total circulation); The current SOL is located exactly in the middle of the 2 massive bars of $168-$176.

The generation of a huge number of columns shows that the long and short game here is extremely fierce, and some people sell and some buy; Funds are willing to take over here, indicating that this is a demand range (support zone). The next support range is around $144. As long as BTC can maintain a high level of consolidation, the price of SOL should be roughly in this range during this break.

My !️ sharing is only for learning and communication, not as investment advice! !️

-------------------------------------------------

This article was sponsored by #Bitget |@Bitget_zh

The realm of cliffs, broken boats? SOL On-Chain Data Explained (Long Tweet)

🚩 Can SOL, which retraced 57% from its high, bottom out?

🚩 What is the sentiment and holding mindset of SOL investors?

🚩 What important information does the SOL chip structure provide?

In response to these key issues, I use 2 chapters and 6 sets of core data to comprehensively analyze and describe, hoping to provide valuable reference for friends. Read it patiently, I believe you will gain something!

53.38K

98

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.