"Disenchantment Theory 4: VC is not superior"

VC, the full name is Venture Capital, also known as venture capital in Chinese. That is, investing on the basis of taking a certain degree of risk

There are two main types of VCs in the market: those that do well are called top investment institutions, and those that do not do well are called large retail investors

At the same time, the main work content of VC is divided into four aspects: fundraising, investment, management and withdrawal, of which fundraising and investment are pre-investment work, and management and withdrawal are post-investment work

The former is mainly to raise funds required by the institution, and spread all the funds into different projects (with KPIs) within a certain period of time; The latter is mainly to provide a series of services for the projects invested by the institution, and provide appropriate help and guidance, so that the follow-up projects can earn income when they exit after TGE

So what exactly is the situation and yield of the VC market?

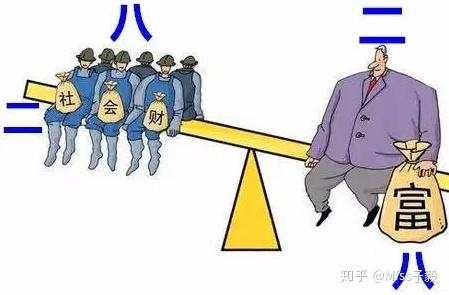

It's still the classic rule of 28, with 20% of the top institutions earning 80% of the gains in the primary market

The reason for this is that the top organizations are extremely competitive in all four areas mentioned above, while most VCs are usually only capable in one or two areas

Although VCs that only raise funds can obtain sufficient investment funds for investment, they have huge shortcomings in follow-up project tracking and various problem handling. This often results in institutions being very rich, but it is difficult to recover what they have invested in

It is generally difficult to see VCs who will only manage and retreat, and in most cases their funds are small, so even if they do a good job of retreating, their income is also capped

In addition, this round of the cycle does not have too much technological innovation in a substantive sense, but mainly revolves around asset issuance and distribution channels. This makes it difficult for the primary market to maintain a relatively normal investment environment in the past, prompting a large number of VCs to frantically huddle together and put themselves in the inner circle

In the end, the VCs in the core inner circle make money, and at worst, they don't make money or lose money; VCs who are not in the inner circle disappear into the continuous update and iteration of the market

Is this very similar to the current on-chain market?

Therefore, when researching a project, don't trust VC endorsements too much, unless you can distinguish which VCs are really powerful and which VCs are really large retail investors

Otherwise, it will be used as a low-priority reference, and it will depend more on whether the project itself has PMF, the prospect of the ecological track it is in, the background of team resources, and so on

Trust that you're doing better than most VCs for what you've put in your research, and the market will reward people for their insights

Let's disenchant VC together

『祛魅理论三:警惕第一次创业的创始人』

为什么资本会更青睐投资连续创业者而不是首次创业者?

答案很简单,选首次创业者踩坑的概率要大得多

我们先讲讲连续创业者的一些优势:

一是有过项目全流程的经验,知道什么时候该做什么事

二是知道如何与投资人们打交道

三是若有成功的项目经历,个人信用和背书会很好

所以比特币质押龙头 Babylon 在早期融资时非常的轻松,靠的就是项目 Founder 们的个人经历和魅力

反观首次创业者,最忌讳遇到以下这种人:

➣ 不懂装懂

➣ 不把前人们的经验教训当回事

前者在一些传统行业转行创业的人身上尤为明显,他们总是依赖于自身的过往经验,从来不会想着灵活应对以符合市场趋势

以至于每当他们想要大干一场时,最后都会被大干一场

后者则跟初次接触交易的小白类似,投资人们由于接触过大量的项目且参与了很多项目流程,因此对于项目发展过程中一些问题的解决方案是比较受用的

但首次创业者心中会有一种执念,他会默认自己的处理方式才是最优解。以至于花费了大量时间和精力进行尝试,最后还是投资人提供的方案最简单高效

很多初次创业的项目就是倒在了尝试的过程中,因为钱烧完了,没有足够的现金流可以维持项目发展

基于此,当我们在调研一个初次创业的项目时,需要着重观察以下两点:

➣ 创始团队是否有足够的认知和对市场的理解。如果还有一些不可替代的过往项目经历那是再好不过,如 Huma

➣ Founder 们是否“听话”。一是听投资人的建议,二是听社区成员的反馈

如果两个都不占的话,我只能说“祝它好运!”

100.64K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.