Why Ethereum Price Is Falling Rapidly? Here’s The Real Reason

The largest altcoin, Ethereum (ETH), has experienced a significant price decline over the past few days.

What preceded this sharp fall was a spike in borrowing rates, major position liquidations, and the breakdown of a popular trading strategy.

These developments have impacted market balance, despite institutional investments remaining strong.

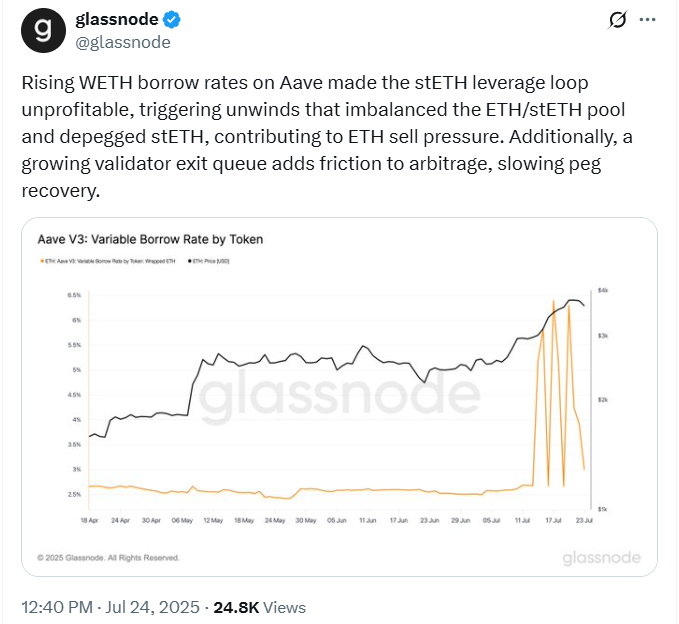

It is worth noting that the price of Ethereum began to decline after borrowing rates on Aave increased.

Data showed that the variable borrow rate for Wrapped Ethereum moved above 6.5% during the past week.

According to the update, this change made borrowing ETH more expensive.

For months, traders had used a strategy that involved borrowing Wrapped ETH using staked ETH as collateral.

The borrowed ETH was then used to buy more staked Ethereum ETH. As rates increased, this trading method stopped being effective. Thereafter, many traders began to unwind their positions.

Meanwhile, the closing of these positions led to more ETH being sold on the market. This placed extra pressure on the price.

The process also affected the balance between ETH and stETH. The peg between the two assets broke temporarily, creating a wider gap.

Additionally, more validators began to exit the Ethereum network. This made it more difficult for traders to act quickly when trying to adjust the price difference.

The slower reaction time allowed the price imbalance to continue longer than expected.

Ethereum ETH Liquidations Reach 177 Million Dollars in One Day

Meanwhile, market data from the past 24 hours revealed that Ethereum experienced the highest number of liquidations among all significant digital assets.

As detailed, more than $177 Million worth of ETH positions were closed. This was more than Bitcoin, which saw around $68 Million, and XRP, which had more than $79 Million.

It is worth noting that the large number of liquidations followed the drop in price and the rise in borrowing costs.

As the value of ETH fell, many positions reached their liquidation points. This resulted in additional sales in the market.

Solana, Dogecoin, and other tokens also saw liquidations, but their numbers were smaller.

In total, long trades were hit harder than short trades. Around $113 Million came from long liquidations, while short liquidations made up just under $64 Million.

The large number of closed positions continued to drag down Ethereum’s price during the trading day.

Institutional Funds Continue to Flow In

It is essential to add that despite the price drop, Ethereum has continued to attract interest from large investors.

Nate Geraci reported that spot Ethereum exchange-traded funds received $330 Million in net inflows on July 23.

According to the update, it was the seventh-highest day since they began trading.

Still, six of the top seven inflow days have been recorded in the past two weeks. Over the last 13 trading days, these funds generated $4.4 Billion.

Meanwhile, according to SoSoValue data, BlackRock ETHA fund now holds $10.09 Billion in net assets.

According to the update, well-known Bloomberg Senior ETF Analyst Eric Balchunas stated that ETHA is now the third-fastest exchange-traded fund to reach that amount.

More importantly, it took just ten days for the fund to double its assets from $5 Billion to $10 Billion.

These large inflows have not been enough to lift the price of Ethereum ETH in the short term as borrowing pressure and liquidations remain strong.

From all indications, Ethereum’s recent drop has been driven by borrowing stress and heavy liquidations.

While institutional interest remains steady, trading conditions have created downward pressure on prices. Market activity in the coming days may determine if the price finds support or continues to fall.

The post Why Ethereum Price Is Falling Rapidly? Here’s The Real Reason appeared first on The Coin Republic.