Earn BTC and ETH with XT staking and lending: three low-threshold arbitrage skills to master at once

Key takeaways:

-

XT staking and lending provides ultra-low interest rate financial support for arbitrage, and the operation is all completed in the platform, without the need to transfer coins, and the risk is lower and more secure.

-

Instead of traditional leveraged trading, the interest cost can be directly reduced by more than 90% by replacing high-interest margin financing with fixed-rate pledge loans.

-

With perpetual contract funding rate arbitrage, you only need to borrow BTC or ETH to short, and you can get a stable daily passive income.

-

The three strategies are all based on the internal functions of the XT platform, which is simple and safe, and there is no need to jump platforms or switch wallets, which is especially suitable for novices to try.

-

By reasonably setting the borrowing cycle, paying attention to the funding rate, and repaying in advance, the arbitrage income and risk control efficiency can be further improved.

If you can increase your crypto earnings without trading too often and risking too much, would you like to give it a try?

This is the charm of arbitrage - it is not a game of skyrocketing and plummeting, but a way to make money steadily through the difference in funding rate or market mechanism.

Many people mistakenly think that the threshold for arbitrage is very high, requiring multiple exchanges, cross-platform brick moving, and real-time monitoring, but in fact, XT's pledge lending service has simplified the arbitrage operation to "can be completed within one platform". You can borrow BTC or ETH at a low interest rate, and then complete arbitrage operations within XT's spot, leverage, perpetual contracts, and other markets.

Currently, the fixed APR for XT staking and lending is very competitive: only 1.23% for BTC and 1.50% for ETH. In the past, most of these arbitrage opportunities were in the hands of institutions, but now they can be easily used by ordinary users.

This article will introduce you to three arbitrage games with low risk, clear operation, and suitable for novice and advanced users. What's more: your funds stay in XT the whole time, so you don't have to move around, which is more efficient and secure.

Whether you're new to crypto arbitrage or a trader looking to expand your game, all three strategies can be applied right away and start your path to passive income on BTC and ETH.

directory

What is XT Staking Lending? Borrow BTC and ETH at ultra-low interest rates

Strategy 1: Replace leveraged financing with XT staking lending, save 90% of the cost

Strategy 2: Earn daily income through BTC perpetual contract arbitrage

Strategy 3: Use XT staking and lending to capture the arbitrage opportunity of ETH perpetual contract funding

Advanced Advice: How to Maximize Your Arbitrage Returns

What is XT Staking Lending? Borrow BTC and ETH at ultra-low interest rates

XT Staking & Lending is a convenient financial service launched by XT.com that allows users to borrow popular currencies such as Bitcoin (BTC), Ethereum (ETH), and USDT directly on the platform. You don't need to sell the coins in your hand, you can temporarily release the value of your funds, which not only retains long-term positions, but also obtains instant liquidity, which is very suitable for arbitrage, rebalancing or short-term operations.

How to use XT staking lending? Get started in 4 easy steps:

-

1. Pledge pledged assets

Choose BTC, ETH, or other mainstream tokens supported by other platforms as collateral to lock in your borrowing limit.

-

2. Select the borrowing currency and term

Borrow BTC, ETH, or USDT as needed, and set a term (flexible borrowing, 7 days, 30 days).

-

3. Funds arrive in seconds

The borrowed coins will be credited directly to your spot account, no waiting, no transfers, and you can borrow and use.

-

4. There is no charge for repayment at any time

You can repay the loan in advance at any time during the term without any additional handling fees, and release the mortgaged assets immediately after repayment.

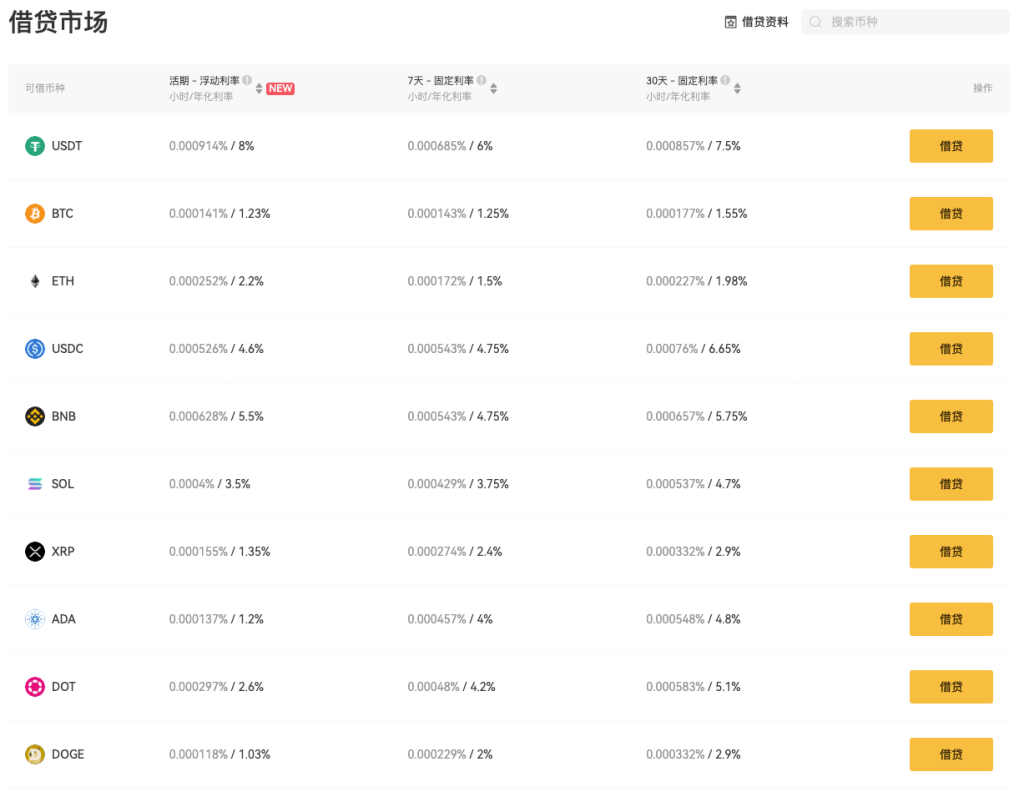

XT Latest Lending Rate (Updated on 16 July 2025)

Four advantages of XT staking lending

-

– Ultra-low interest rates and extremely competitive costs

The interest rate is much lower than that of traditional leveraged trading or DeFi lending, giving more room for arbitrage and short-term operations.

-

Transparent interest rates are calculated on an hourly basis

All of them are fixed interest rates, and you can borrow for as long as you want, with no hidden fees, and the interest costs are clear at a glance.

-

Repayment is flexible and there are no penalty clauses

There is no additional handling fee for early repayment, which is especially suitable for short-term arbitrage and low-risk strategies.

-

The entire process of assets is within the XT platform, which is safe and convenient

There is no need to transfer coins around, and the collateralized and loaned coins are in XT's internal account, which is safer and better managed.

In XT lending, the pledge rate can be up to 80%. Once the warning line is triggered, the system will automatically remind you of a margin call; If the position is not covered in time, the pledge rate continues to rise, and when it reaches the liquidation line, the order will be forced to close (that is, what we often call liquidation). This mechanism is actually to protect the safety of your assets, and at the same time, it also allows strategies like arbitrage to be executed in a low-risk, low-cost environment with peace of mind.

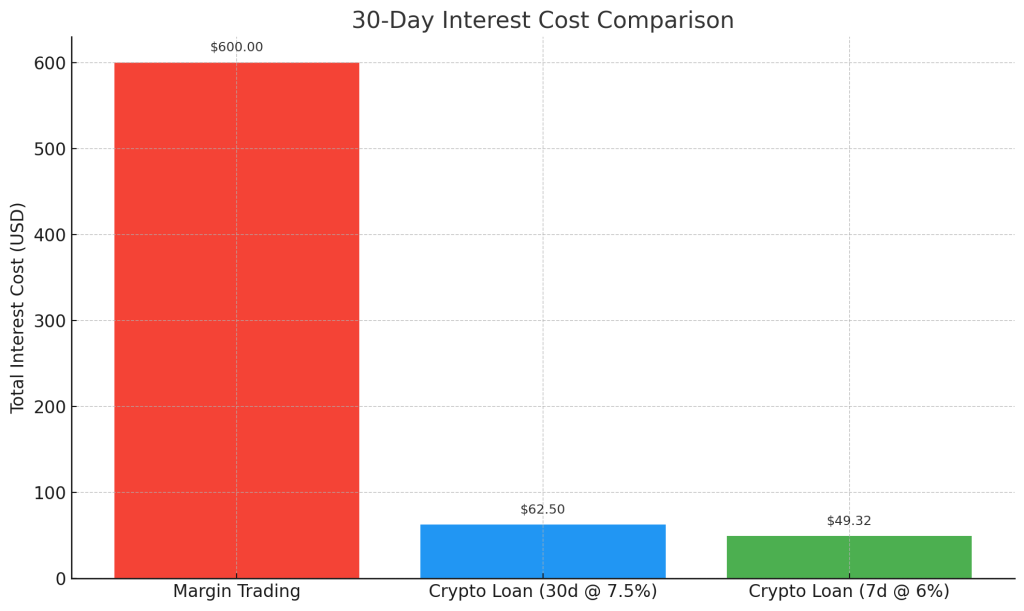

Strategy 1: Replace leveraged financing with XT staking lending, save 90% of the cost

Trading with leverage on XT allows you to quickly open long or short positions, and is a common tool for many short-term traders. However, there is also an "invisible killer" behind this convenience - high interest costs. The daily interest rate of leveraged lending is usually around 0.2%, and the annualized interest rate is close to 73%.

Why use XT staking lending instead of traditional leverage?

XT staking lending is a very practical alternative. XT lending's fixed APR is much lower than traditional leveraged lending (currently 6% annualized for 7-day USDT lending and 7.5% annualized for 30-day USDT borrowing), allowing you to obtain the same leveraged exposure at a lower cost, greatly increasing the overall yield while reducing the potential risk associated with compounded interest.

How to do it at a glance: Teach you how to do it step by step

-

1. Lend USDT through XT staking lending

Choose a fixed borrowing term (6% p.a. for 7 days or 7.5% p.a. for 30 days) and choose flexibly according to your trading plan.

-

2. Buy BTC or ETH in the XT spot market

Buying BTC or ETH with borrowed USDT is equivalent to opening a long position similar to traditional leveraged trading.

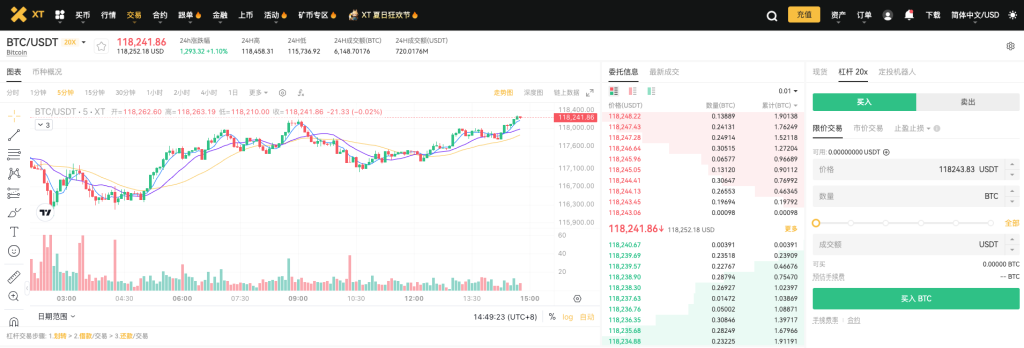

XT.com BTC/USDT leveraged trading pair

-

3. Hold + Close + Repay

Once you've reached your profit goal, sell BTC or ETH back to USDT, return the XT loan principal and interest, and the rest is your net profit – and the interest cost is much lower than traditional leverage!

Actual cost comparison ($ 10, 000 for 30 days)

Why choose XT Staking Lending?

-

Lower Cost:

Interest expenses have plummeted by ninety%, and there is more room for arbitrage and position adjustment, and profits are naturally more considerable.

-

Interest Transparency

Fixed annualized + hourly interest with no hidden fees and no worries about interest "rolling over and over".

-

Clear and transparent risk control:

The maximum pledge rate can reach 80%, and the trigger warning line will automatically remind you to add margin; If the liquidation line is reached, the system will execute forced liquidation to ensure the safety of the borrower and the platform.

-

Suitable for a variety of strategies:

Whether it's swing arbitrage, low-frequency trading, or short-to-medium term positions (more than 2-3 days), you can find a more secure and low-cost execution method in XT Lending.

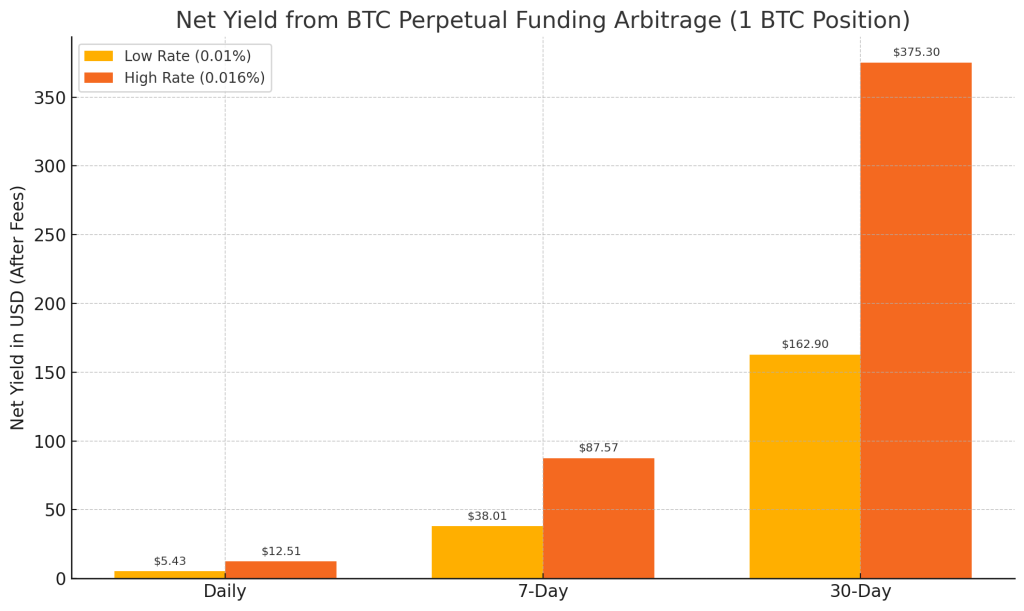

Strategy 2: Earn daily income through BTC perpetual contract arbitrage

For users who don't want to sell their altcoins and want to get a stable passive income, BTC perpetual contract funding rate arbitrage is a very good choice. With XT staking and lending, you can borrow BTC at a low interest rate and earn a stable daily return in XT's BTC coin-margined perpetual contract market.

How does BTC perpetual contract arbitrage make money?

When the market is on the long side, users who are long usually have to pay the funding rate to the users who are short on a regular basis. All you need to do is borrow BTC via XT and open a short position to receive these funding fees on a regular basis. In the whole process, you don't look at the ups and downs of the market, as long as the funding rate is positive, you can continue to make money.

Follow these steps to get started:

-

1. Stake your altcoin or stablecoin:

Stake mainstream altcoins such as ETH, SOL, XRP, or stablecoins such as USDT and USDC on XT.com to obtain BTC borrowing and lending.

-

2. Borrow BTC through XT Staking Lending:

Choose the right borrowing cycle, the current 30-day fixed interest rate for BTC is 1.55% per annum.

-

3. Open a short position:

Immediately sell the borrowed BTC in XT's BTC coin-margined perpetual contract market to open a short position.

XT.com BTC/USD coin-margined swap trading pair

-

4. Charge Funding Fee:

As long as the funding rate is positive, you will receive passive earnings every 8 hours.

-

5. Close Position + Repay + Take Profit:

When you're ready to end your strategy, close your BTC position, return the loan, and all that's left is the net proceeds from the funding you earned minus interest and fees.

Examples of real-world benefits:

Calculation Description: Daily Net Income = (F × P × Q) − (I × P × Q); Total net income = [(F − I) × P × Q × T] − Commission

-

F = Daily Funding Rate (e.g. 0.01% = 0.0001)

-

P = BTC current price (e.g. $ 118, 000)

-

Q = Number of positions (e.g. 1 BTC)

-

I = Daily borrowing rate (APR ÷ 365, e.g. 1.55% ÷ 365 ≈ 0.0000425)

-

T = number of days borrowed

-

Fee = round-trip fee (e.g. ~$ 118)

The core advantages of BTC perpetual arbitrage:

-

Market-neutral strategy:

The market is not afraid of ups and downs, as long as the funding rate is positive, you can continue to earn.

-

Passive Sources of Income:

As long as you keep an empty position every day, you can receive coins stably without frequent trading.

-

Extremely low cost:

XT's BTC borrowing rate is much lower than that of external platforms, making the strategy more cost-effective.

-

Ideal for altcoin holders:

You don't have to sell your coins to earn arbitrage income by staking BTC.

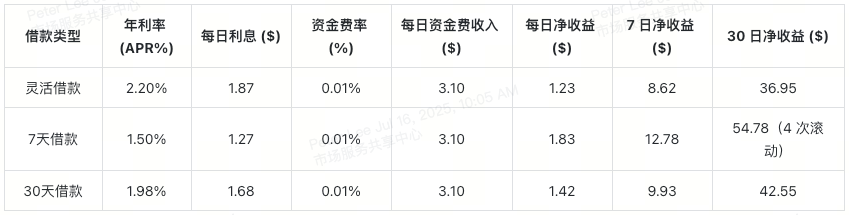

Strategy 3: Use XT staking and lending to capture the arbitrage opportunity of ETH perpetual contract funding

This strategy is similar to the BTC arbitrage method mentioned earlier, but the ETH coin-margined perpetual contract market is usually more volatile, so timing and funding rate monitoring are particularly important. With XT's low-interest ETH lending service, you can continue to earn daily returns in a market with a high market and a positive funding rate.

How does ETH arbitrage work?

Like BTC perpetual contracts, when the ETH/USD coin-margined contract market is bullish, long-term users will regularly pay funding fees to short-sellers. You only need to borrow ETH through XT and open a short order, and you can receive this part of the income every day.

The steps are very simple, just follow along:

-

1. Use altcoins or stablecoins as collateral:

Stake mainstream altcoins like SOL, XRP, BTC, or stablecoins like USDT, USDC, and get borrowing on XT.com.

-

2. Borrow ETH via XT Staking Lending:

Choose a suitable borrowing term, XT currently offers ETH lending services with a minimum APR of 1.5% (7 days / 30 days optional).

-

3. Open a short position:

Sell the borrowed ETH directly in XT's ETH coin-margined perpetual contract market to open a short position.

XT.com ETH/USD coin-margined swap trading pair

-

4. Charge Funding Fee:

As long as the market remains on the high side, you can earn funding fees from long users every day.

-

5. Closing positions, repaying loans, and taking profits:

When you decide to end arbitrage, close your ETH position and then repay it, and after deducting transaction fees and interest, what remains is your net profit.

Example of daily earnings:

Illustration 1: Assumptions

-

Position size: 10 ETH

-

ETH current price: $3, 100

-

Daily Funding Rate: 0.01% (i.e. 0.0001)

-

Transaction fees are not included

-

A 7-day borrowing is when it is returned and re-borrowed after 7 days, rolling 4 times to simulate a 30-day cycle

Note 2: Calculation formula

-

Net income per day = (F × P × Q) − (I × P × Q)

-

Total net income = [(F − I) × P × Q × T] − Commission

Thereinto:

-

F = Daily Funding Rate (e.g. 0.01% = 0.0001)

-

P = ETH current price (e.g. $ 3, 100)

-

Q = Number of positions (e.g. 10 ETH)

-

I = Daily Borrowing Rate (APR ÷ 365, e.g. 1.5% ÷ 365 ≈ 0.0000411)

-

T = number of days borrowed (e.g. 7 or 30)

-

Fee = total fee (e.g. about $ 120 for 10 ETH per side)

Advantages of ETH Perpetual Arbitrage Strategy:

-

Daily income can be reused:

As long as the market is on the high side, you can get profits every day.

-

Low operating costs:

ETH borrowing rates are extremely low, making there more room for arbitrage.

-

Suitable for intermediate users:

It is suitable for advanced traders who are sensitive to market fluctuations and can regularly monitor their funding fees.

Advanced Advice: How to Maximize Your Arbitrage Returns

Want to make the aforementioned arbitrage strategy really work? These are some tips you must master! It can help you reduce costs, increase revenue, and control risks at the same time.

Loan term selection

-

– If you plan to complete the arbitrage in a short period of time, prioritize using 7-day borrowing with minimal interest expense.

-

– If you expect to hold a carry position for a long time, it is more appropriate to choose a 30-day borrowing to lock in a lower fixed interest rate.

Advice on collateral assets

-

Choosing a currency with a high collateral ratio, such as ETH and SOL, can increase the borrowing limit.

-

Diversify your collateral portfolio and reduce the risk of single currency fluctuations.

Funding monitoring

-

The funding fee is updated every 8 hours, and it is recommended to check back regularly to take advantage of positive returns.

-

Set up funding fee reminders to respond to market fluctuations in a timely manner.

Key points of risk control

-

Control the collateral ratio, try to keep it within a safe range, and avoid approaching the liquidation line.

-

Set a stop loss on your contract position to prevent significant losses from sudden market conditions.

Repayment strategy

-

It is recommended to repay the loan as soon as possible after the arbitrage is over, which can effectively reduce interest costs and increase net income.

What's next?

XT's staking and lending feature makes it easy for traders of all experience levels to unlock stable and secure passive income. Whether you are a newbie or an experienced user, these beginner-friendly, low-risk arbitrage strategies can maximize the efficiency of your capital without transferring assets or operating multiple platforms.

With the current APR as low as 1.23% for BTC and only 1.5% for ETH, XT.com offers some of the most competitive financing options in the industry. Combined with the tips introduced in this article, you can now take advantage of the price and funding spreads within the platform to start your path to arbitrage gains.

Go to the XT staking and lending page now, select the coin and term you want to borrow, and put these strategies to real use and make your assets move!

FAQs: About XT Staking Lending and Arbitrage

Q: Can novices also use XT staking and lending for arbitrage?

A: Absolutely. XT's pledge lending feature is simple to operate, low interest rate, and flexible repayment, making it ideal for beginners to try low-risk arbitrage. It is advisable to start small, familiarize yourself with the process and then gradually scale up your operation.

Q: What are the potential risks of using cryptocurrency lending for arbitrage?

A: There are two main risks: one is that the price fluctuation of the collateral currency may cause the position to be close to the liquidation line, and the other is that the funding rate of the perpetual contract may change adversely. It is recommended to maintain a healthy collateral ratio, keep an eye on market fluctuations, and adjust positions in a timely manner to control risks.

Q: Can I repay XT's pledge loan in advance?

A: Yes, but it depends on the type of borrowing. Current loans can be borrowed and repaid at any time, with no penalty interest; Early repayment of fixed loans (e.g. 7 days, 30 days) may be subject to penalty interest, so it is recommended to choose a suitable term according to your needs.

Q: Do you need a lot of trading skills to do these arbitrage strategies?

A: No, you don't. The arbitrage methods described in the article are very clear and easy to understand, just follow the steps. At the same time, the XT platform itself is friendly and suitable for newbies. However, it is recommended that you continue to pay attention to the market dynamics, and the income will be more stable after you have certain basic knowledge.