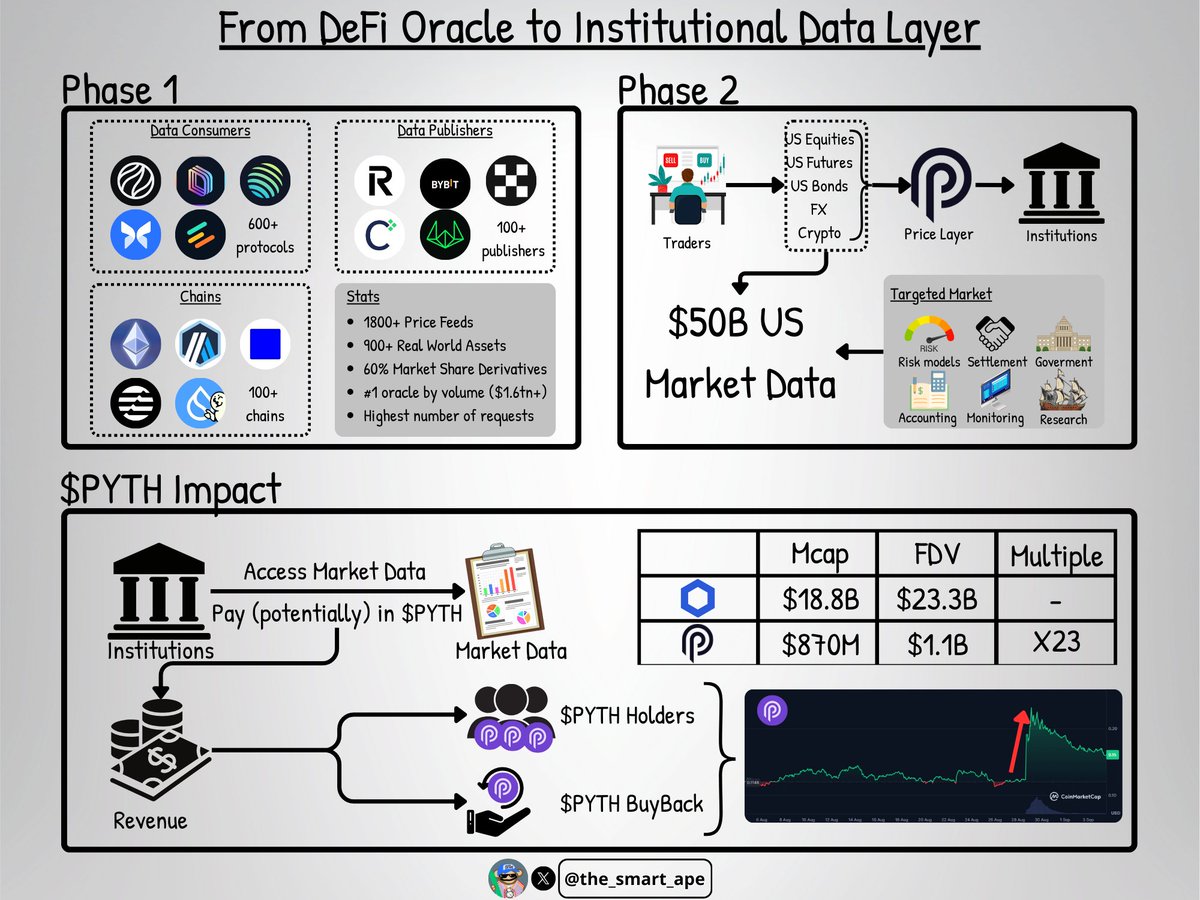

Institutional money is the backbone of this bull run. Retail investors still haven’t entered the market, yet we already see $BTC at $112K and $ETH close to its ATH, all driven by institutional flows. But institutions aren’t just powering BTC and ETH; they’re also fueling altcoins like $PYTH, which has made major moves in the institutional ecosystem. New services, new value propositions, and new utilities are positioning PYTH for the next stage of growth. @PythNetwork is already one of the top price layers, delivering 1,800+ price feeds across 900+ real-world assets. It operates through two marketplaces: → Data Consumers: protocols using price feeds (DeFi derivatives, lending, borrowing, stablecoins, DeFAI, etc.) → Data Publishers: providers of these feeds (banks, exchanges, market makers, etc.) Today, Pyth is integrated with 600+ protocols across 100+ blockchains, making it the #1 oracle by cumulative transaction volume ($1.6T+) and capturing 60% of the DeFi derivatives market. In...

28.41K

71

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.