How Zora's flywheel captures value

• Creators earn a direct 1% cut from every trade

• All fees flow through and impact ZORA in one way or another

• The native app builds a powerful moat fixing capital flight issues

Read more here 👇

How does the Zora flywheel work?

The term "flywheel" is overused in crypto, but Zora's tokenomics model is worth a closer look.

Zora is engineered around a simple 3% fee on every trade: 1% to the creator, 1% to Zora, and 1% to the Liquidity Positions (LP).

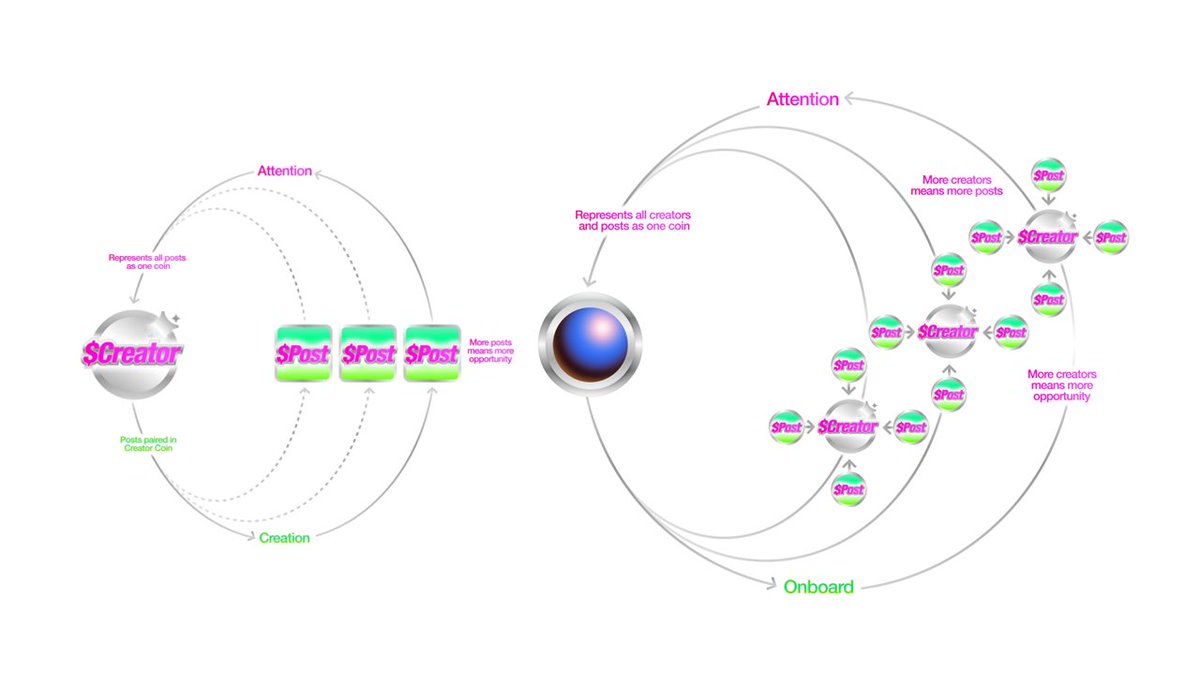

Every asset on the platform is directly or indirectly paired with the $ZORA token. Content coins are paired with creator coins, and creator coins are paired with $ZORA.

This gives ZORA two distinct value accrual forces: fees and sinks.

As the ultimate base pair, half of the fee to LP (0.5% of every trade) is effectively a buyback of $ZORA to be added to the liquidity pool. Since Zora and creator rewards are distributed in ZORA, all fees flow through and impact ZORA in one way or another. 2.5% of each trade results in immediate ZORA buy pressure.

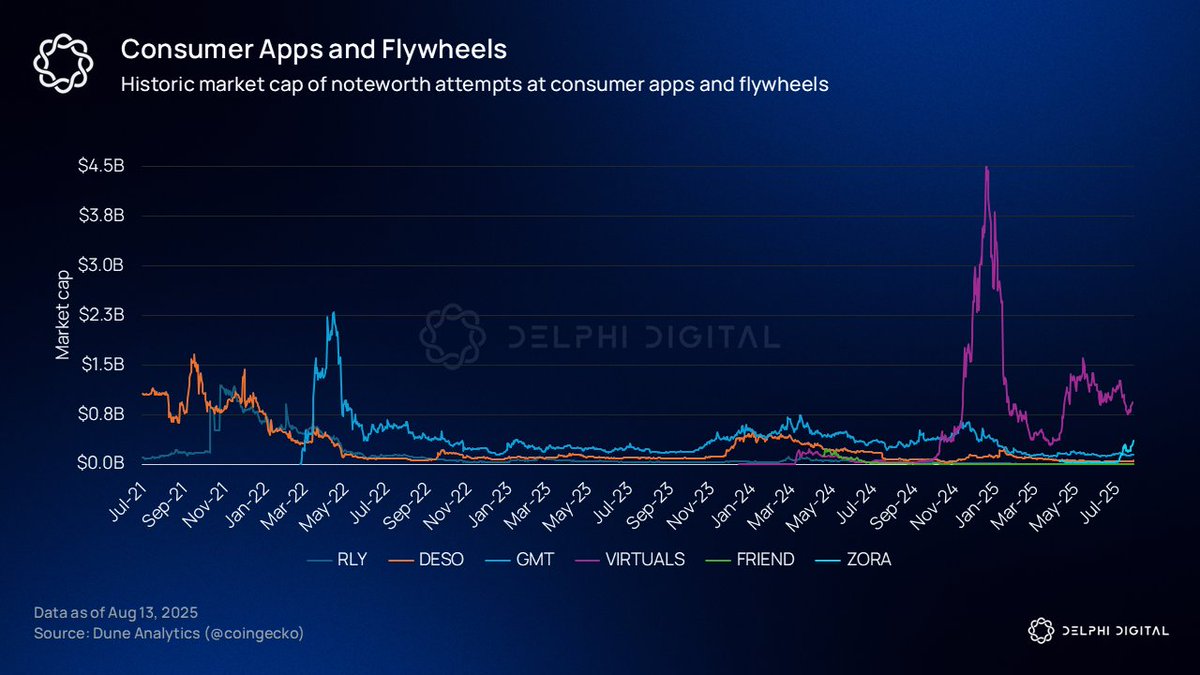

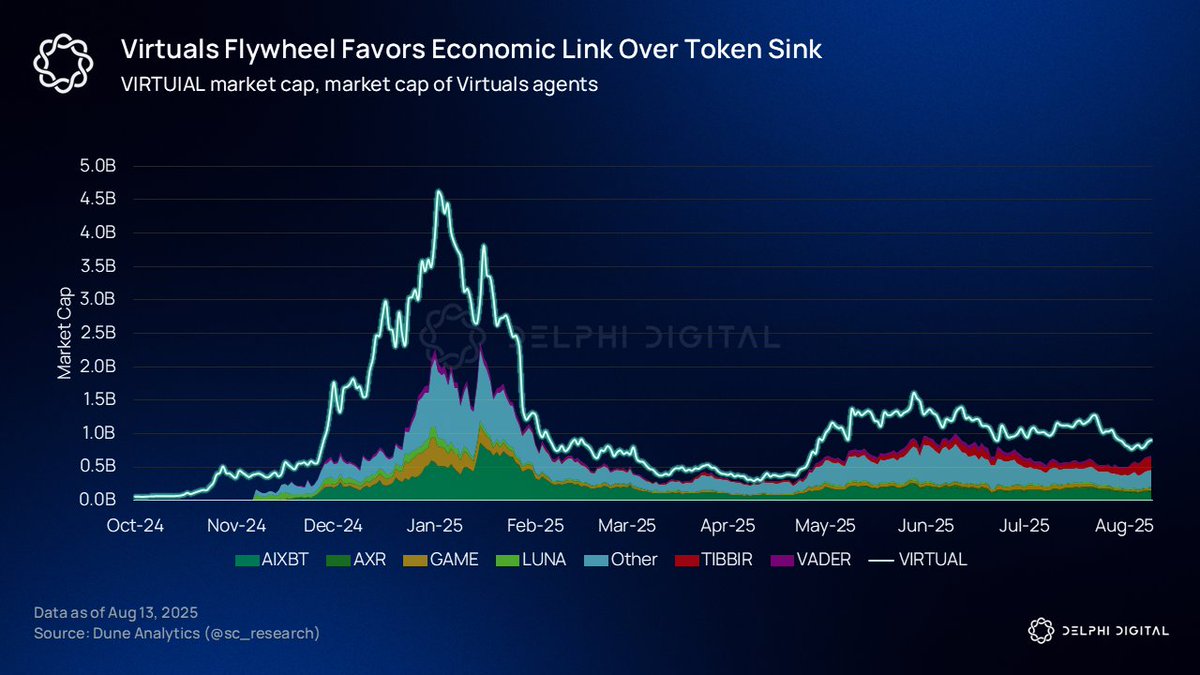

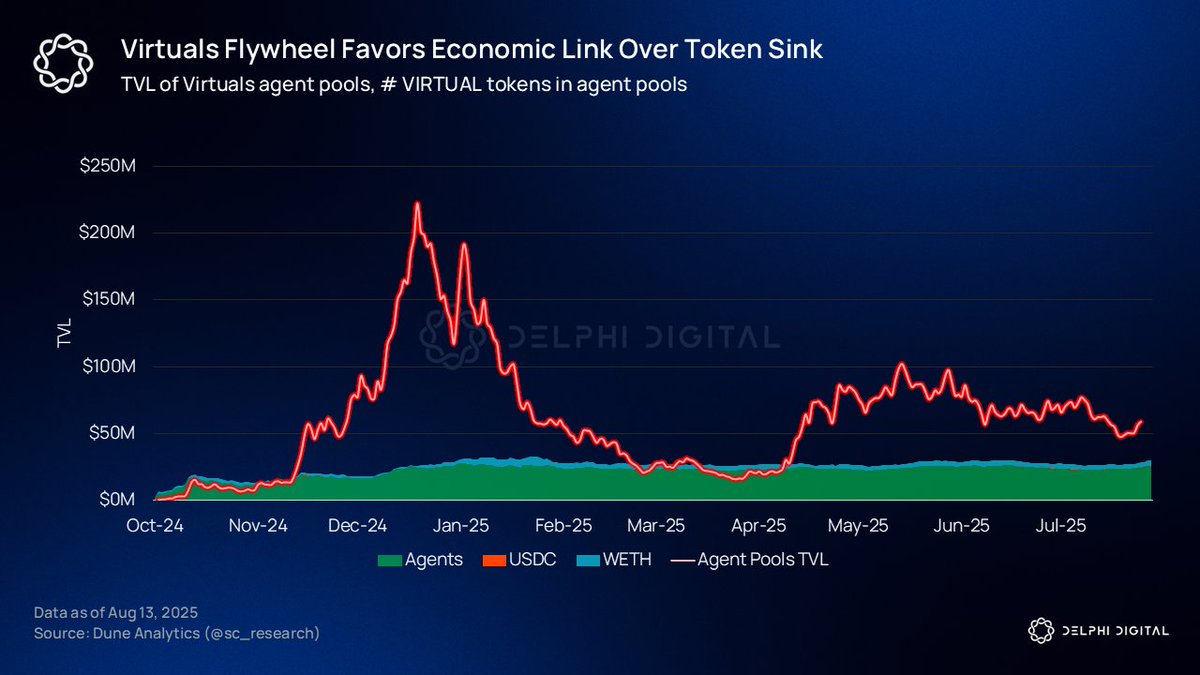

To understand why this design is so robust, we can look at Virtuals which inspired this model. Virtuals also had a powerful flywheel, but it was dependent on the initial launch and "graduation" of new agents from its bonding curve.

Once major agent tokens matured, liquidity became fragmented and moved to more capital-efficient pools on Uniswap v3 or against other assets like USDC. This weakened the token sink aspect of the flywheel.

Zora learns from this by routing trading volume through its official, canonical pools, preventing the liquidity fragmentation that Virtuals experienced. The result is a persistent token sink for $ZORA over the entire lifecycle of a creator's coin, ensuring that ongoing volume fuels the flywheel.

Some may argue that a 3% swap fee is too high to sustain volume. However, there is precedent for this. During its peak, the NFT market thrived with $5B monthly volume despite ~10% fees.

The Solana trenches all-in fees approach 3%:

- Tokens graduate into 1% fee pools

- The refined consumer-app interfaces (Phantom/Photon/Axiom) charge a 1% fee

- Poor liquidity conditions, MEV, and socialized losses from snipers likely amount to 1%+

At its bear case, Zora is just a repackaging of the trenches with better tokenomics, distribution and branding. Zora brings hidden costs to the forefront and retains the value within the ecosystem.

Trading volume of Zora coins will be the key metric to watch as the flywheel gets going.

18.11K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.