Why crypto will replace the stock market.

Spoiler: it won't.

The real story is how blockchain tech will fundamentally re-architect global finance, merging the best of both worlds.

The global stock market is ~$133T. The entire crypto market? ~$3.8T.

Stocks represent ownership in a business with intrinsic value. Most crypto value is driven by speculation.

A direct replacement is a conceptual mismatch, right?

Up to 46% of Millennials and 55% of Gen Z investors own crypto. Why?

They're digital natives with a higher risk tolerance, FOMO, and distrust of traditional systems.

But huge hurdles remain.

"Huh?"

The #1 barrier is the "Regulatory Gauntlet."

Lack of clear rules handcuffs institutional adoption. Until there's a clear legal framework, crypto will remain on the institutional periphery.

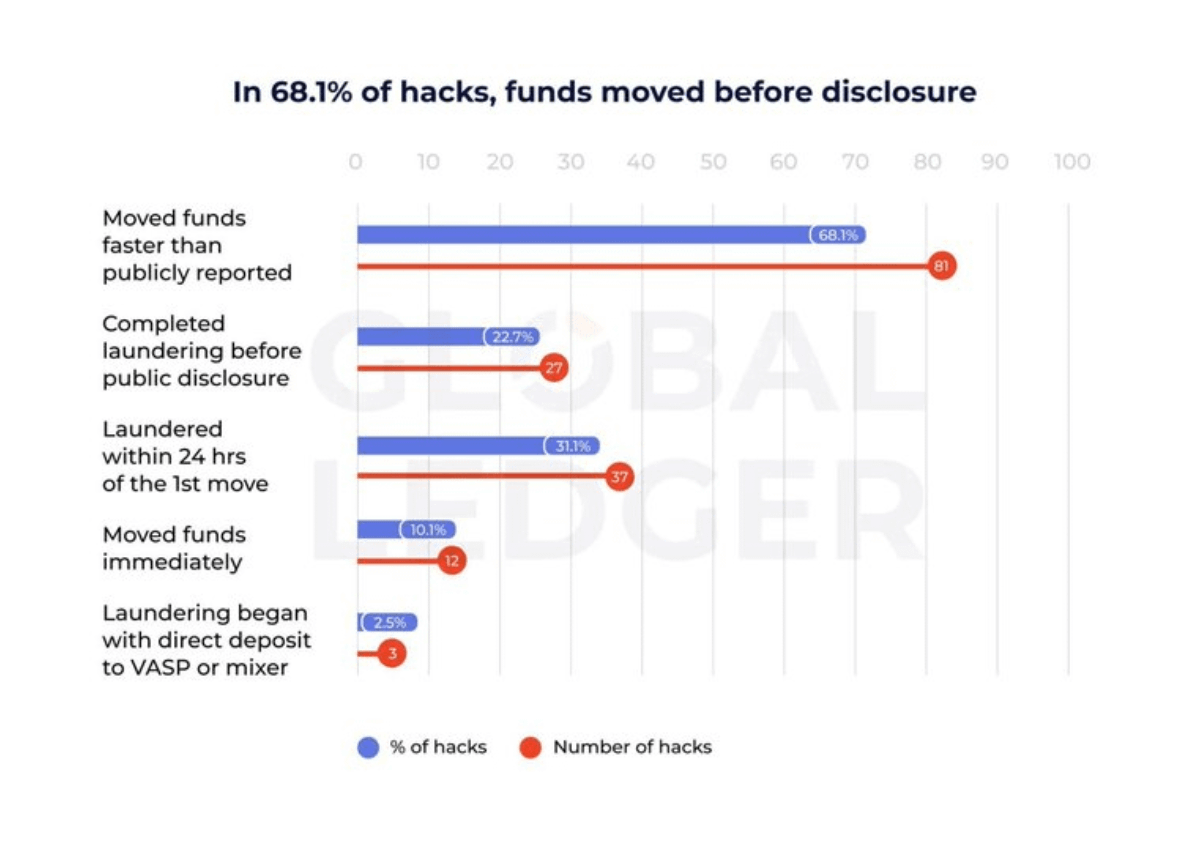

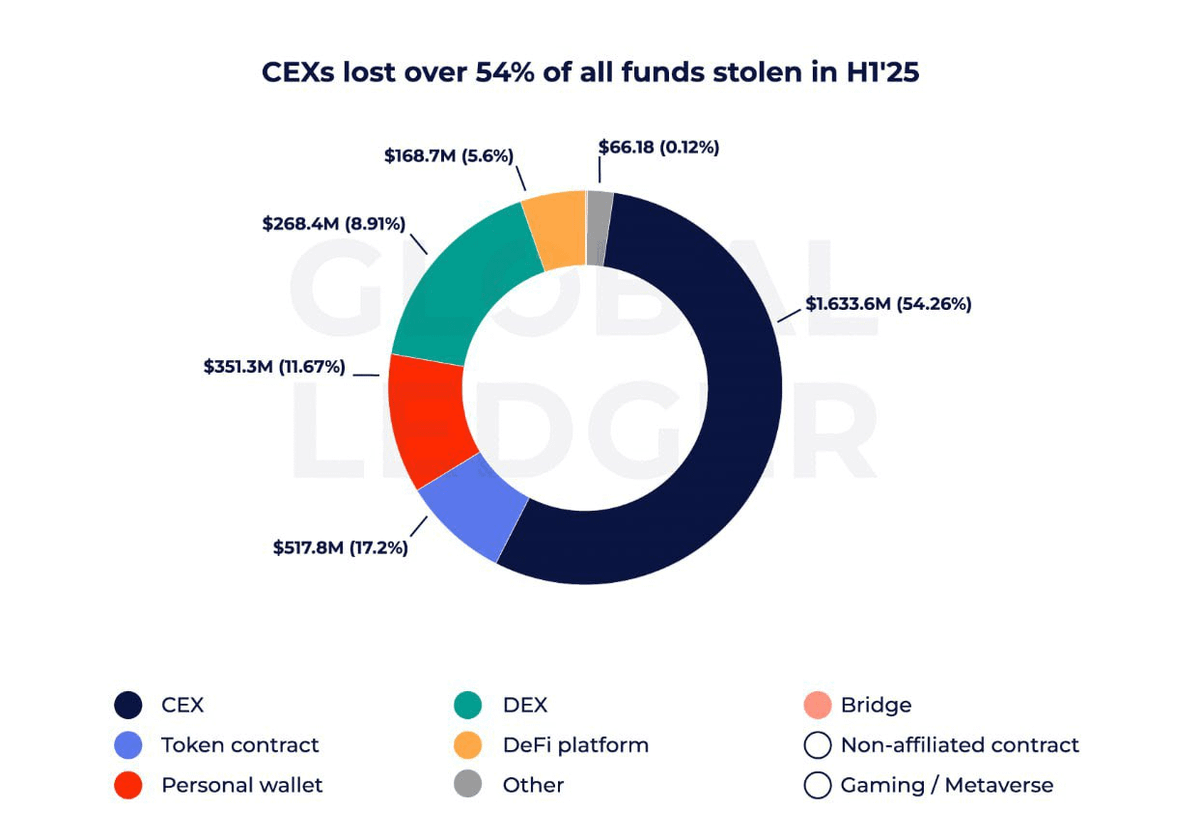

In crypto, there is no FDIC-like insurance for your assets. Hacks are common, and transactions are irreversible. If your funds are stolen, they're likely gone forever.

Isn't this a massive risk for mainstream adoption?"So what's the real revolution?

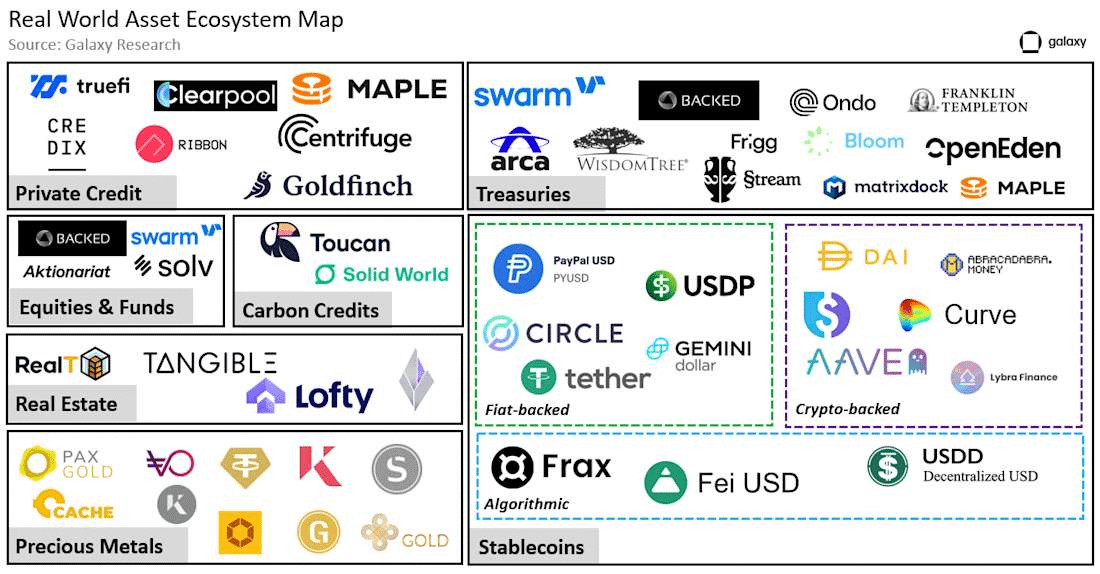

Not new assets, but a new tech "wrapper" for existing ones: tokenization. E.g. @maplefinance, @SolvProtocol, @pendle_fi (i.e. Boros), @ClearpoolFin, etc.

I view this tweet as an alternative perspective on tokenization and believe that betting in protocols within this sector will pay off.

9.34K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.