Why Sushi Could Become One of the Largest DEXs Again

Over the past month, Sushi’s trading volume on the Katana network hit $357 million—about $12 million per day on average. But this is just the beginning. Sushi’s integration with Katana has the potential to create a longterm growth engine for the protocol.

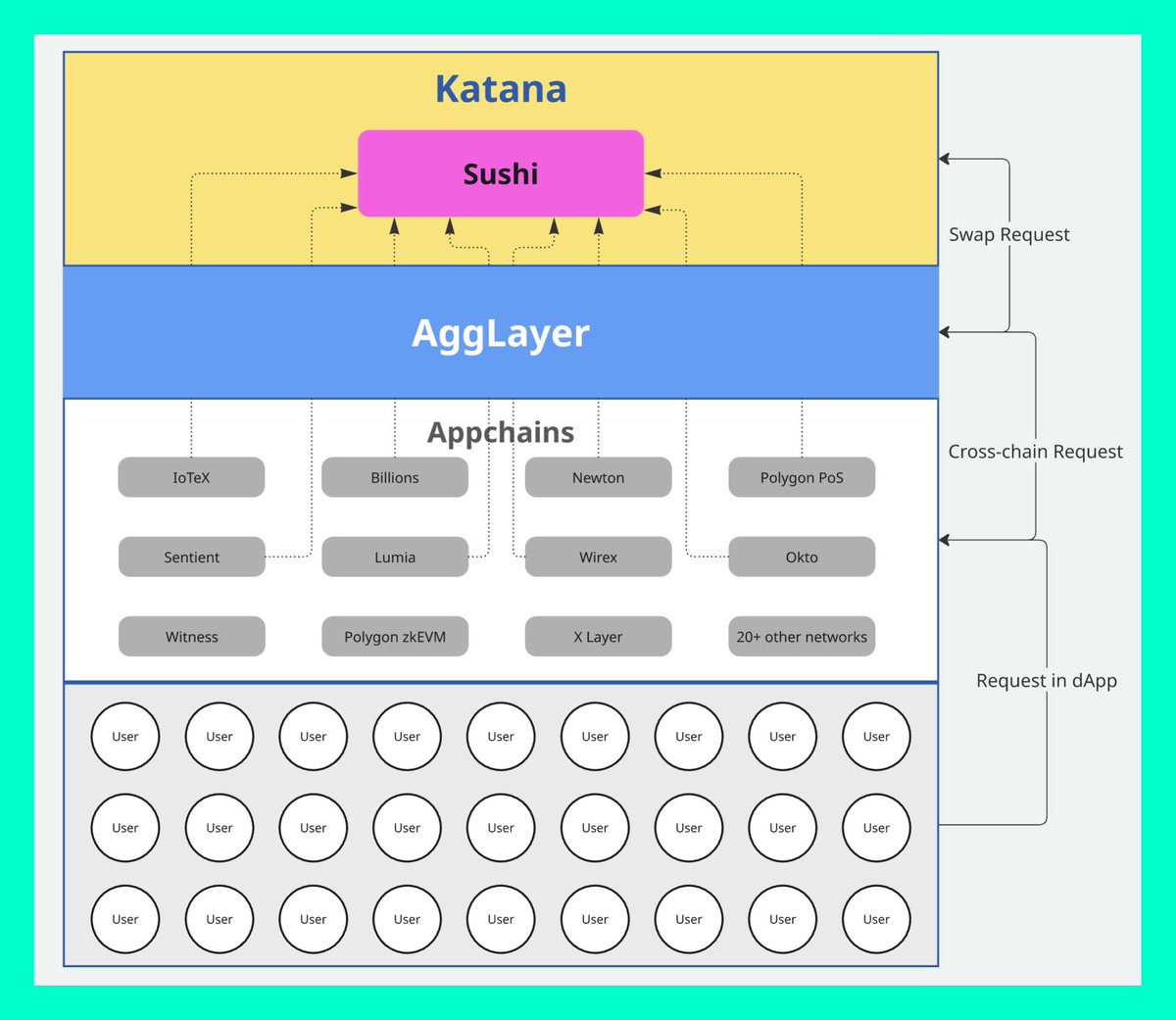

The Bigger Picture: Agglayer’s Architecture

To understand the opportunity, you need to look at Agglayer’s vision. Their goal is to build an appchain ecosystem, where 1 dApp = 1 appchain.

This leads to a network of specialized chains, each laser-focused on its own business:

- Wirex – payments

- IoTeX – DePin

- Sentient – AI

- Billions – identity

- and many more.

These appchains don’t want to manage infrastructure outside their core focus. Instead, they’re willing to pay for modular, SaaS-style components - especially decentralized SaaS - so they can focus on their main product.

Katana’s Role: Financial dSaaS

@katana provides appchains with a decentralized financial module - and at the heart of that is a DEX. All financial flows on these networks will ultimately pass through it.

This is where Sushi comes in.

Because Sushi is one of Katana’s core dApps, every time an appchain needs to swap assets, @SushiSwap is the one doing the heavy lifting. Over time, this central role could drive massive growth in both Sushi’s volumes and revenues.

A Simple Example: Payments

- A user pays for a product in BTC on the Wirex appchain

- Wirex, as a business, prefers to accept stablecoins

- Wirex sends a request to Katana to swap BTC for USDC

- Katana routes the trade to Sushi, which performs the swap

- Katana sends the USDC back to Wirex

This setup allows Wirex to accept any cryptocurrency from users, while always holding stablecoins for its operations. And every such transaction channels value through Sushi.

The Network Effect

That’s just one example—there could be thousands. The more appchains launch on the Polygon ecosystem, the more trading volume flows to Sushi.

Given @0xPolygon's growing focus on payments, this could directly and significantly boost Sushi’s activity.

Longterm, Katana could be for Sushi what Coinbase was for Aerodrome - a distribution powerhouse.

As Web3 becomes increasingly business-oriented, distribution will be one of the most valuable advantages for protocols.

Sushi is positioned right at the center of that shift.

================================

Follow on strong visioners and analysts:

@0xBreadguy

@alpha_pls

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@arndxt_xo

@0xCheeezzyyyy

@Moomsxxx

11.48K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.