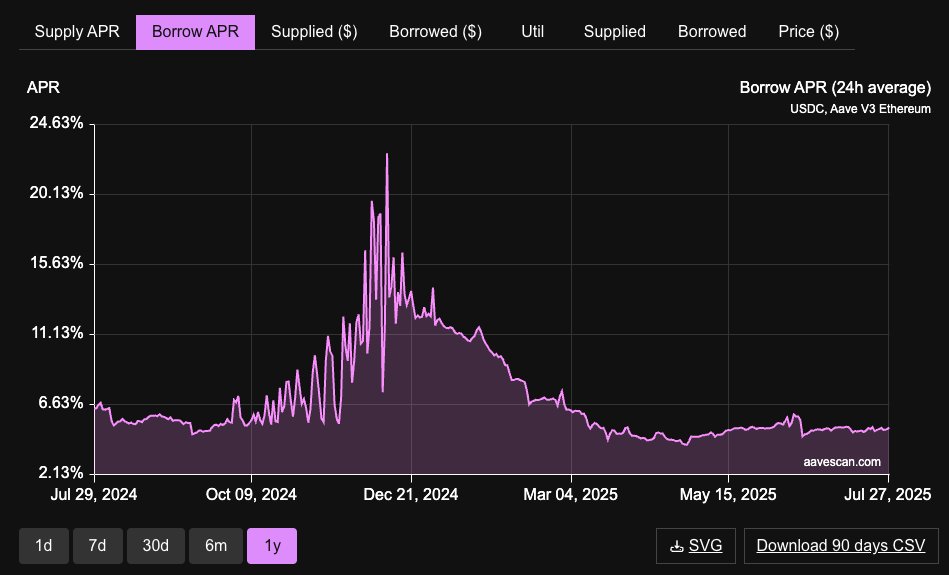

The main concern and only variable we can't control about looping PT is the borrowing rate. I don't think it's a concern this time.

December was very different: funding went nuts, there were less funds/protocols arbing the funding, Aave just launched sUSDe collateral, Euler/Morpho were not at their current TVL.

I may be wrong, but I think PTs >13% are really a steal. This should continue as long as ENA pumps because it's driving YTs implied yield up.

Loop at your own risk.

@brisket131 I wanted to check what % is Usual's USD0++ market but their UI is awful and fucking slow so I couldn't. But it may be right that it feels lacking liquidity because it is very fragmented.

6.08K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.