$ETH: Becomes Settlement Layer; Driven by ETFs, Credit, Treasuries, and ZK Infra

- $ETH up +17% in 7D and +84% in 90D, outperforming majors.

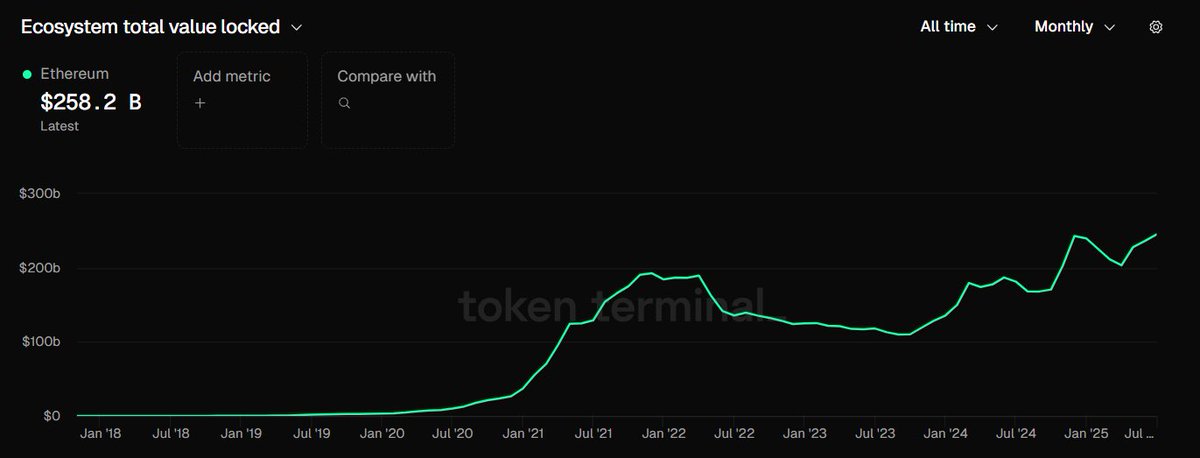

- DeFi TVL +18.2% MoM to $72.7b; ETH commands >54% share of stablecoins and RWAs.

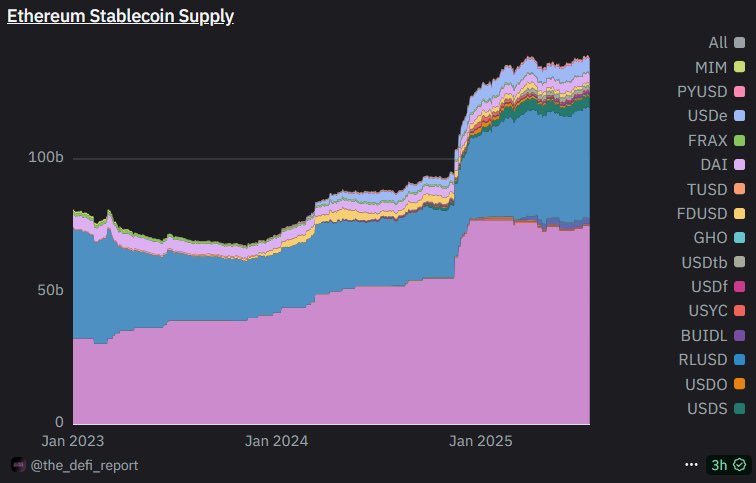

- Stablecoin cap on ETH +14.4% YTD to $127.6b; RWA on L1 surged 48% QoQ to $7.5b (58.2% share).

- Onchain credit at ATHs as active loans on ETH + L2s hit $24b (+43% QoQ); @maplefinance +291%, @eulerfinance +174%, @aave +46%.

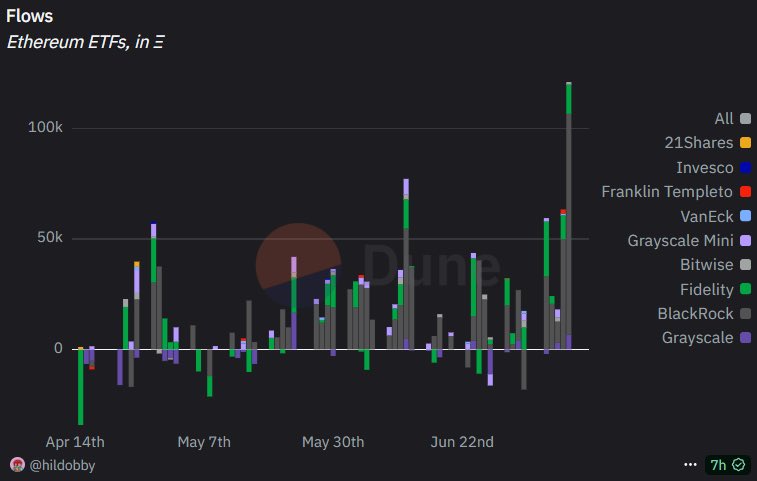

- ETF demand climbs as 4.5m ETH held (+20% QoQ), ~3.7% of supply; treasuries up 5,829% QoQ amid $908m weekly inflows.

- Circulating supply nearly flat (+0.18% in Q2); 43% of ETH locked in smart contracts. CEX balances drop to 8-year low (16.4m).

- SuccinctLabs successfully proved full L1 blocks using <10GB RAM; work continues on zkEVM mainnet integration, with zk-proof standardization and real-time proving roadmap.

- Infra upgrades ahead: EIP-7983 (gas cap), ePBS + FOCIL (Pectra, Q1 2026), stateless architecture under BloatNet stress-test.

- Restaking flywheel as ETH hosts ~30% of all staked ETH; hybrid yields via Aave/Pendle gaining traction.

- BTCFi cross-chain growth: $20b+ BTC on ETH (+150% YoY); ETH captured 42% of restaked BTC, powering next-gen DeFi yield.

- With ETFs, treasury flows, credit markets, and zero-knowledge infrastructure scaling on-chain, $ETH stands to benefit as the default financial layer.

11.06K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.