"AAVE Honestly Don't Lie to Me V4 is Coming"

On the main stage of ETHCC, Stani announced that Aave V4 will be available soon

TL'DR

⏹︎ Liquidity lending "chain" abstraction, A chain deposit, B chain borrowing, liquidity pluggable

⏹︎ Soft Liquidation Mechanism (L-LAMM) = Self-selection of liquidation targets

⏹︎ Interest rate model adjustments are all embracing marketization

This is what DeFi infrastructure should look like. While other protocols are still struggling with how to survive, Aave is already thinking about how to reshape the entire lending market

Let's dive in

🧵

▶︎▶︎▶︎▶︎▶︎

Aave V4 is really a bit of an upgrade

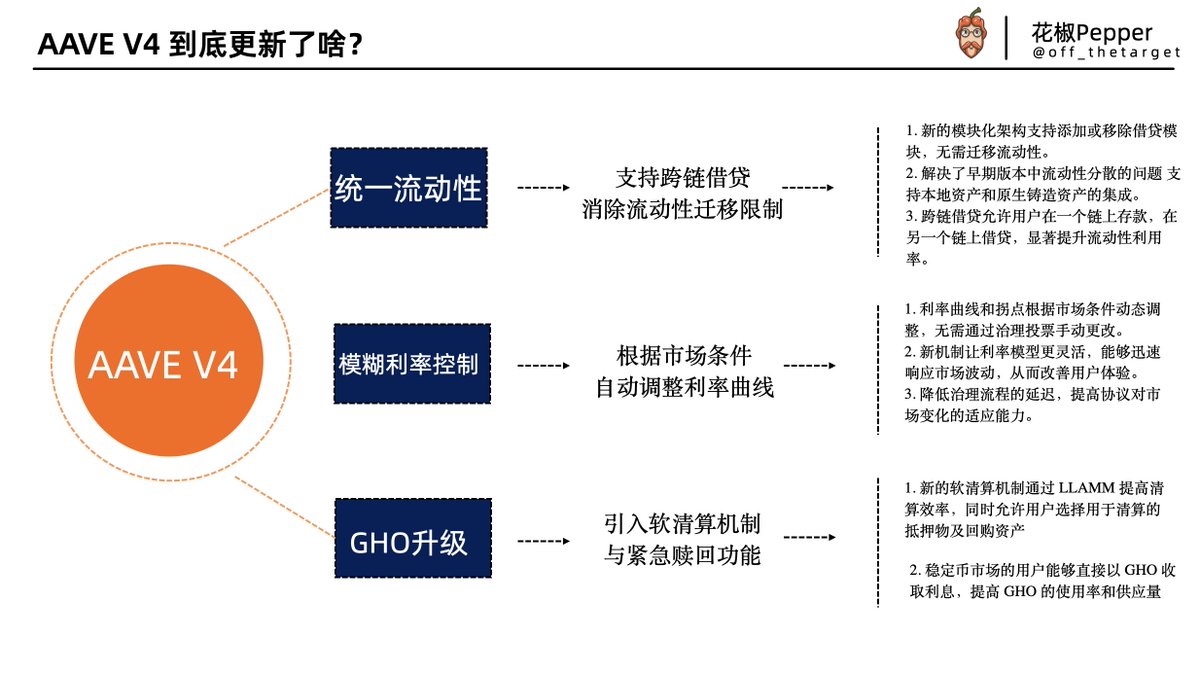

The first is a unified liquidity layer. The biggest headache for V3 before was the problem of cross-chain migration of liquidity, and it took half a day to toss each upgrade. V4 directly engages in a chain abstraction architecture, and the modular design allows the lending module to be plugged and unplugged at any time, so there is no need to toss liquidity migration.

Cross-chain lending, where you deposit money in Arbitrum and borrow money in Optimism - this kind of gameplay was previously only possible with cross-chain bridges like LayerZero, which is also the focus of this liquidity "chain" abstraction

The upgrade of GHO is also critical. Now the market value is 220 million, an annual growth of 53%, but I always felt almost meaningless before. The soft liquidation mechanism (L-LAMM) copied from crvUSD is really smart, users can choose their own liquidation portfolio, and they can also repurchase collateral with any asset on Aave - this design is a little more flexible than Curve

The interest rate model is also automated, so there is no need to wait for the DAO to vote. Previously, the borrowing cost of WBTC and wstETH was fixed, but now it is dynamically adjusted according to market liquidity. ETH continues to be the benchmark asset without premium, and other assets will have to pay a premium depending on the liquidity situation

The V4 clearing engine has also been upgraded to support variable clearing factors and batch liquidation, and to be honest, it is not easy for Aave to balance security and innovation so well.

Especially given its size, any changes should be made with caution. Now that even asset delisting and treasury management are automated, the burden of DAO governance has been reduced a lot.

It can be seen that Aave is determined to make his own stablecoin...

Show original

20.55K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.