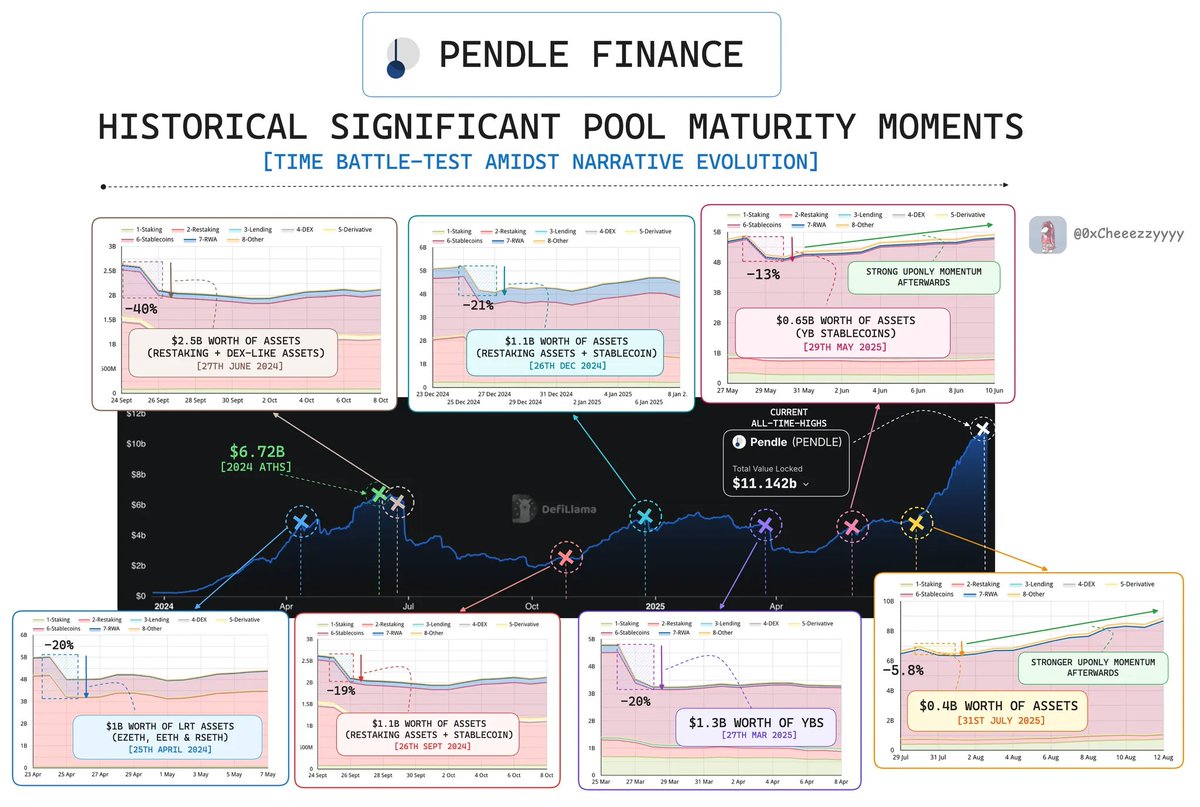

On Pendle Maturities: An End to Stronger New Beginnings In DeFi, few events spark more uncertainty than asset maturities. This is most apparent on @pendle_fi's V2 yield tokenised pools. In the case of large pool(s) maturities, we're talking about unwinding $$$ billions which represents a large % of its TVL. But in Pendle’s case, history tells a different story: maturities aren’t a concluding event, but rather they’re catalysts. Why so? Each cycle has proven Pendle’s resilience, reinforced its design & paved the way to higher growth. Over time, Pendle has seen multiple large maturities, each exceeding $500M-$2.5B. And in every case, the system has absorbed the shock & come back stronger: • 25th April 2024: $1B in restaking assets matured ( $ezETH, $eETH, $rsETH) *TVL fell from $5B → $4B (-20%) •27th June 2024: $2.5B matured across restaking + DEX assets (GLP) *TVL dropped from $6.2B → $3.7B (-40%) [The largest drawdown recorded] •26th Sept 2024: $0.5B matured (restaking +...

2.5万

77

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。