Cena Curve DAO Token

w USD

Informacje o Curve DAO Token

Zastrzeżenie

OKX nie udziela rekomendacji dotyczących inwestycji ani aktywów. Musisz dokładnie rozważyć, czy handel lub posiadanie aktywów cyfrowych jest dla Ciebie odpowiednie w świetle Twojej sytuacji finansowej. W przypadku pytań dotyczących konkretnej sytuacji skonsultuj się ze swoim doradcą prawnym, podatkowym lub specjalistą ds. inwestycji. Aby uzyskać więcej informacji, zapoznaj się z warunkami użytkowania i ostrzeżeniem o ryzyku. Korzystając z witryny internetowej strony trzeciej („TWP”), akceptujesz, że wszelkie korzystanie z TPW będzie podlegać warunkom TPW i będzie regulowane przez te warunki. O ile nie zostało to wyraźnie określone na piśmie, OKX i jego podmioty stowarzyszone („OKX”) nie są w żaden sposób powiązane z właścicielem lub operatorem TPW. Zgadzasz się, że OKX nie ponosi odpowiedzialności za jakiekolwiek straty, szkody i inne konsekwencje wynikające z korzystania z TPW. Pamiętaj, że korzystanie z TPW może spowodować utratę lub zmniejszenie Twoich aktywów. Produkt może nie być dostępny we wszystkich jurysdykcjach.

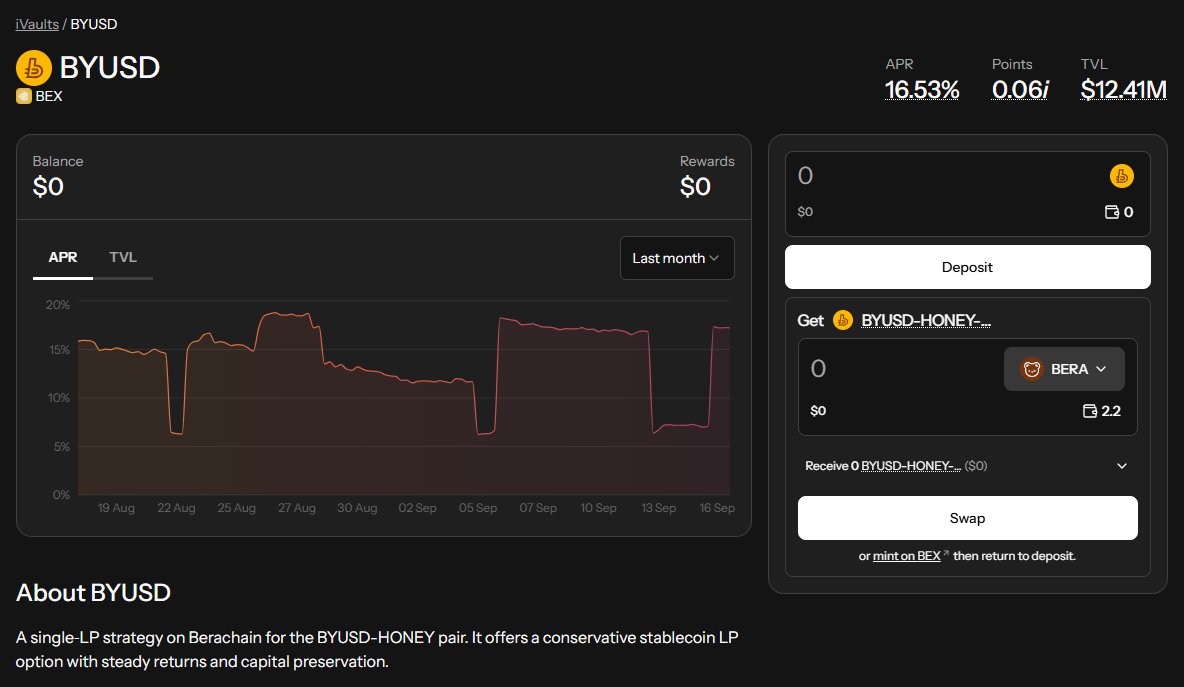

Wydajność ceny Curve DAO Token

Curve DAO Token na mediach społecznościowych

Przewodniki

Utwórz bezpłatne konto OKX.

Zasil swoje konto.

Wybierz swoją kryptowalutę.

Najczęściej zadawane pytania Curve DAO Token

Curve DAO zarządza Curve Finance, umożliwiając użytkownikom głosowanie nad kluczowymi zmianami w projekcie. Aby jednak głosy miały znaczenie, użytkownicy muszą najpierw mieć udział finansowy w projekcie.

Oprócz możliwości zarządzania, posiadacze CRV mogą zarabiać poprzez wydobywanie płynności i staking. Ponadto otrzymują część opłat transakcyjnych.

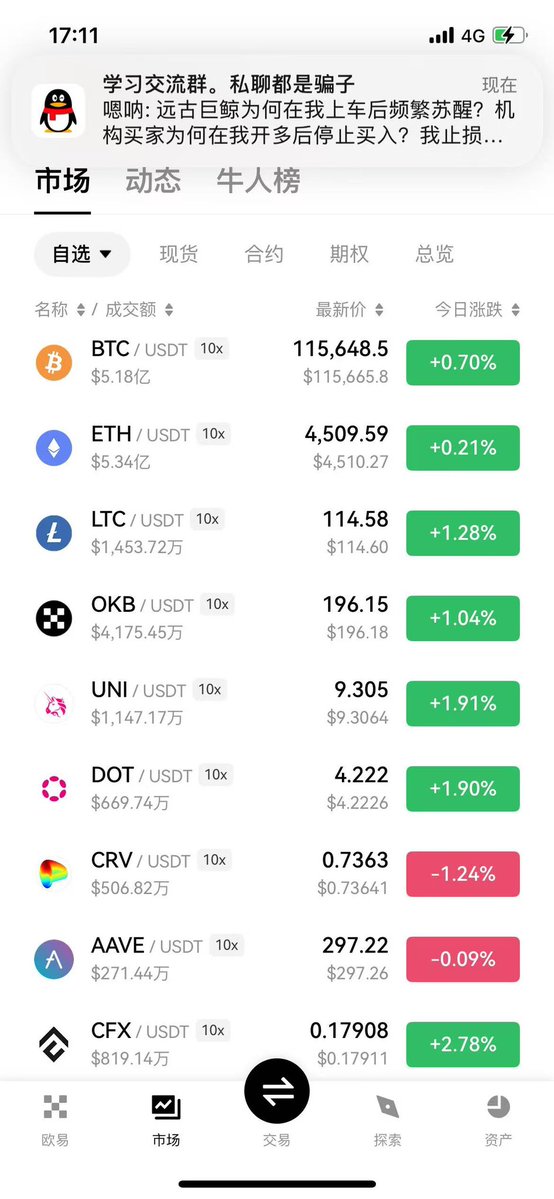

Z łatwością kupuj tokeny CRV na platformie kryptowalutowej OKX. Dostępne pary handlowe w terminalu handlu spot OKX obejmująCRV/BTC,CRV/USDCorazCRVUSDT.

Możesz także kupować CRV w ponad 99 walutach lokalnych, wybierając „Zakup ekspresowy„ opcja. Inne popularne tokeny kryptowalutowe, takie jakBitcoin (BTC),Tether (USDT)orazMoneta USD (USDC), są również dostępne.

Alternatywnie możesz zamienić swoje istniejące kryptowaluty, w tymXRP (XRP),Cardano (ADA),Solana (SOL)orazChainlink (LINK), dla CRV bez opłat i bez poślizgu cenowego za pomocąFunkcja OKX Convert.

Aby wyświetlić szacunkowe ceny przeliczenia w czasie rzeczywistym między walutami lokalnymi, takimi jak USD, EUR, GBP i inne, odwiedź stronęKalkulator przelicznika kryptowalut OKX. Wymiana kryptowalut o wysokiej płynności OKX zapewnia najlepsze ceny dla zakupów kryptowalut.

Pogłąb wiedzę o Curve DAO Token

Curve Finance to zdecentralizowana giełda (DEX) dla stablecoinów, wykorzystująca automatyczny kreator pieniądza (AMM) do zarządzania płynnością. Jego unikalne podejście polegające na skupieniu się wyłącznie na pulach płynności dla stablecoinów i aktywów wrappowanych, takich jak wBTC i tBTC, pozwoliło mu się wyróżnić. W drugiej połowie 2020 r. Curve Finance stało się wiodącym graczem w dziedzinie zdecentralizowanych finansów (DeFi). Podkreślając swoje zaangażowanie w decentralizację, w sierpniu uruchomiła własną zdecentralizowaną autonomiczną organizację (DAO), wprowadzając CRV jako swoją natywną kryptowalutę.

Czym jest Curve DAO?

Curve DAO, opracowane przez Curve Finance, to projekt, który umożliwia zbiorowe podejmowanie decyzji przez jego społeczność. Ten DAO jest zbudowany przy użyciu narzędzia Ethereum Aragon, łączącego kilka inteligentnych kontraktów niezbędnych do zdeponowania płynności. Posiadacze tokenów CRV mogą głosować w sprawach związanych z projektem lub sugerując zmiany.

Zespół Curve Finance

Curve Finance zostało założone przez Michaela Egorova, który pełni również funkcję CEO. Egorov, doświadczony gracz w przestrzeni kryptowalut, był współzałożycielem NuCypher w 2015 roku i odegrał kluczową rolę w różnych innych przedsięwzięciach kryptowalutowych, w tym w zdecentralizowanym banku znanym jako LoanCoin.

Jak działa Curve DAO?

Token zarządzający CRV ułatwia podejmowanie decyzji przez społeczność. Tokeny są dystrybuowane w oparciu o wkład płynności i czas posiadania, zapewniając sprawiedliwy system, w którym większe zasoby CRV przekładają się na bardziej znaczącą siłę głosu. Ten model motywacyjny, który zachęca do zaangażowania finansowego, szybko stał się standardem DeFi, wzmacniając pozycję Curve jako DEX i wspierając rozwój społeczności DAO.

Tokenomika CRV

Wprowadzony 13 sierpnia 2020 r. token CRV zyskał na znaczeniu podczas boomu DeFi. Odzwierciedlając trendy w branży, Curve Finance przeniosło zarządzanie społecznością do struktury DAO. Z 3,30 miliarda wybitych tokenów CRV, tylko 871,7 miliona jest w obiegu od lipca 2023 roku. Podstawową funkcją CRV jest ułatwianie zarządzania społecznością, chociaż staking i wydobywanie płynności są również znaczącymi przypadkami użycia tokena.

Dystrybucja CRV

CRV jest dystrybuowany w następujący sposób:

- 62 procent dla dostawców płynności

- 30 procent dla akcjonariuszy

- 3 procent dla pracowników projektu

- 5 procent zarezerwowane dla społeczności

Ujawnienie ESG