How much did you miss out on June 16 market key intelligence?

Featured

news1.AevoPre-Launch has been launched pump.fun (PUMP)

2.Buidlpad: The Sahara AI community investment phase has ended, raising more than $74.5

million3.Binance Alpha In the past 30 days, mainstream trading users are on the verge of losing

money4.By 9GAG The Hong Kong stock fan strategy acquired by Lianchuang announced the purchase of 2440 SOL, and the stock price rose by more than 20%

5.Binance's new Alpha (VELO) airdrop data: 40% of the accounts have been sold, and the single account income is about $

51Trending

topic: Overheard on CT(tg:@overheardonct),Kaito

POLYHEDRA

TODAY'S DISCUSSION OF POLYHEDRA HAS FOCUSED ON THE COLLAPSE OF ITS NETWORK TOKEN, $ZKJ, WHICH PLUMMETED BY MORE THAN 80% DUE TO ANOMALOUS ON-CHAIN TRADING AND LIQUIDITY MANIPULATION. The crash was related to the withdrawal of liquidity from large coin holders and the triggering of a liquidation waterfall, while superimposed on massive token unlocks. To stabilise the market, Binance announced that it will adjust the way Alpha Points are calculated. The incident sparked a widespread discussion about the sustainability of liquidity mining and the risks of speculative trading.

BYBIT's

BYBIT Today's BYBIT conversation revolved around the announcement of Byreal, its first on-chain decentralised exchange (DEX) deployed on Solana. Byreal is expected to go live at the end of the month and is seen as part of the trend towards the convergence of CEXs (centralised exchanges) to DeFi (decentralised finance). CEXs such as Coinbase, Binance, and BYBIT are actively launching "on-chain CEX" solutions. Byreal uses a hybrid model of RFQ and CLMM routing to improve liquidity and transaction efficiency. There is widespread community interest in how the move will impact the competitive landscape of CEXs and DEXs, believing that it will help bridge the gap between traditional finance and DeFi.

BNB's

Twitter discussion today focused on its role in the Binance ecosystem, specifically the liquidity pool performance associated with Binance Alpha. The recent high-frequency trading of the ZKJ and KOGE tokens on Binance Alpha has caused wild volatility, triggering a significant drop in price. The incident highlights the risks of liquidity mining and the potential for market manipulation. In addition, there was discussion about the utility of BNB as a Father's Day gift, its stable transaction fees, and its use in several DeFi projects. The overall sentiment is divided, with some users concerned about its long-term value and others bullish on its potential as a strategic asset for Binance.

COINBASE

Coinbase has been in the spotlight for sponsoring a U.S. military parade, sparking mixed reviews among netizens. There is a view that this move is in line with the patriotic feelings of the United States and is a strategic public relations operation; Some critics argue that this is contrary to the spirit of decentralisation advocated by the crypto community. In addition, Coinbase's recent move in the integration of DEX trading and validation pools is also interpreted as a key step towards further convergence and development towards CeFi + DeFi, cementing its core position in the crypto industry.

article

1."$Launchcoin Ecological Recovery, Inventory of Five Potential Projects of Believe Platform".

Since May, $Launchcoin has almost exploded to achieve a 300-fold increase, and the ICM (Internet Capital Market) concept it represents has swept the major communities on the chain and become a new direction for market funds to chase. However, traders soon realised that most of the leading tokens ($goonc, $startup) and other high-capitalisation leading tokens are narrative-led projects, lacking real product support, which is contrary to the original intention of the BELIEVE platform.

And with the frequent deletion of some projects and the loss of contact with the founder, the market has questioned the sustainability of the platform ecology represented by $Launchcoin. Subsequently, some high-quality projects gradually stood out with the recovery of the currency price with their clear product logic and stable operation rhythm, which not only regained the trust of the community, but also drove the sentiment of the platform's currency $Launchcoin to recover, making its market value exceed $200 million again. Therefore, digging deeper into the projects with real growth potential in the Believe ecosystem has become a critical path to find alpha. This article will focus on five potential projects, analyse and summarise.

2. The Stablecoin Privacy Paradox: How to Prevent Corporate Finances from "Running Away"? No

hacking required. No internal permissions are required. All you need is public blockchain data and a few lines of Python script. This is the stablecoin privacy paradox of 2025. Stablecoins are gaining success. The data is staggering: stablecoin usage on Base is no longer a niche experiment. Token Terminal's analysis shows that in the first quarter of 2025 alone, total L2 transactions reached about $3.81 trillion – a record high and outpacing the early growth curve of mainstream credit card networks. In this context, this article discusses the privacy issues of the stablecoin track.

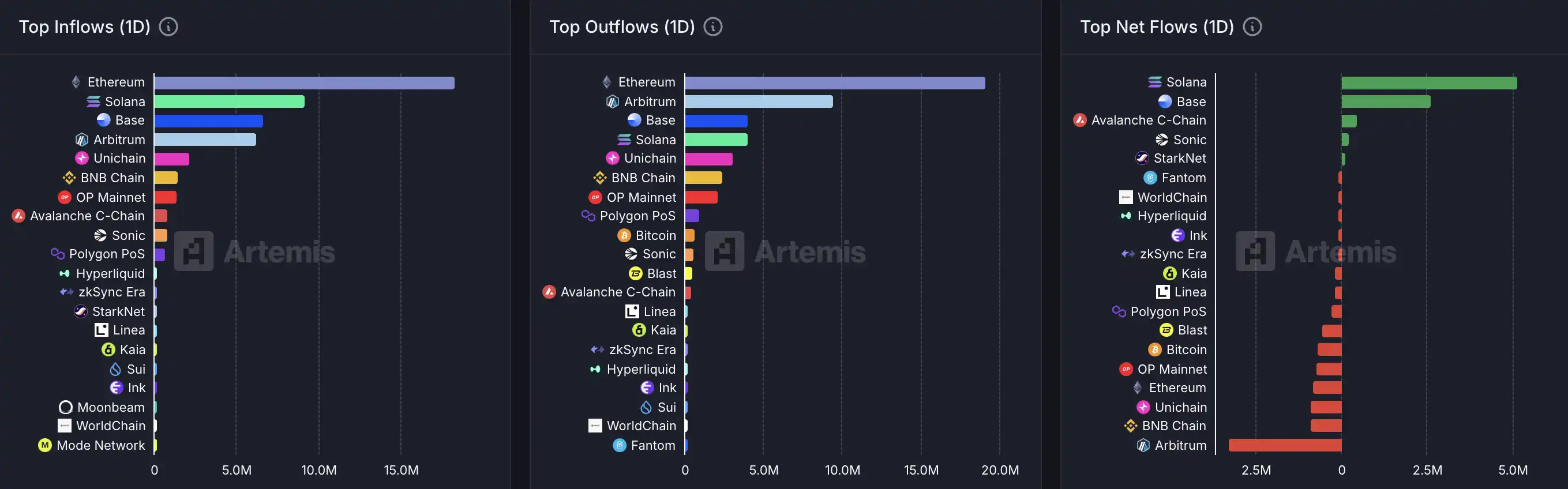

On-chain data

on-chain fund flow on June 16