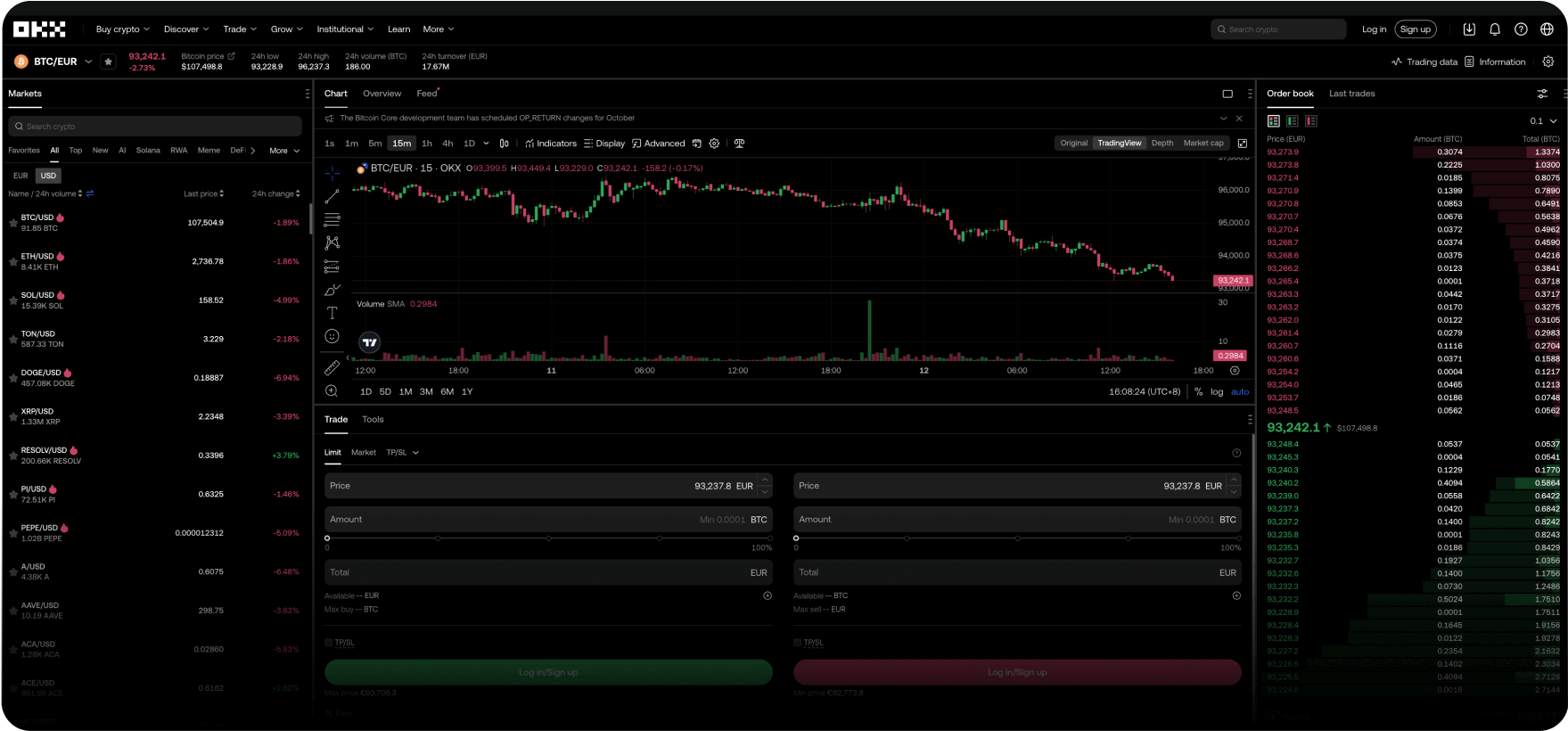

Il tuo conto globale in dollari digitali

Usufruisci delle nostre commissioni più basse, di transazioni super veloci, di API potenti e altro ancora.

Sempre al tuo fianco

Saremo sempre al tuo fianco per guidarti nel processo, dalla tua prima operazione di trading fino a quando diventerai un trader esperto. Nessuna domanda è stupida. Puoi dire addio a dubbi e preoccupazioni. Fidati delle tue criptovalute.

Allenatore Pep Guardiola

Spiega una "formazione di calcio pazzesca"

Riscrivi il sistema

Ti diamo il benvenuto su Web3

Snowboarder Scotty James

Porta tutta la famiglia

Domande? Noi abbiamo le risposte.

Quali prodotti offre OKX?

Come faccio ad acquistare Bitcoin e altre criptovalute su OKX?

Dove si trova la sede di OKX?

I residenti dell'Unione europea possono usare OKX?