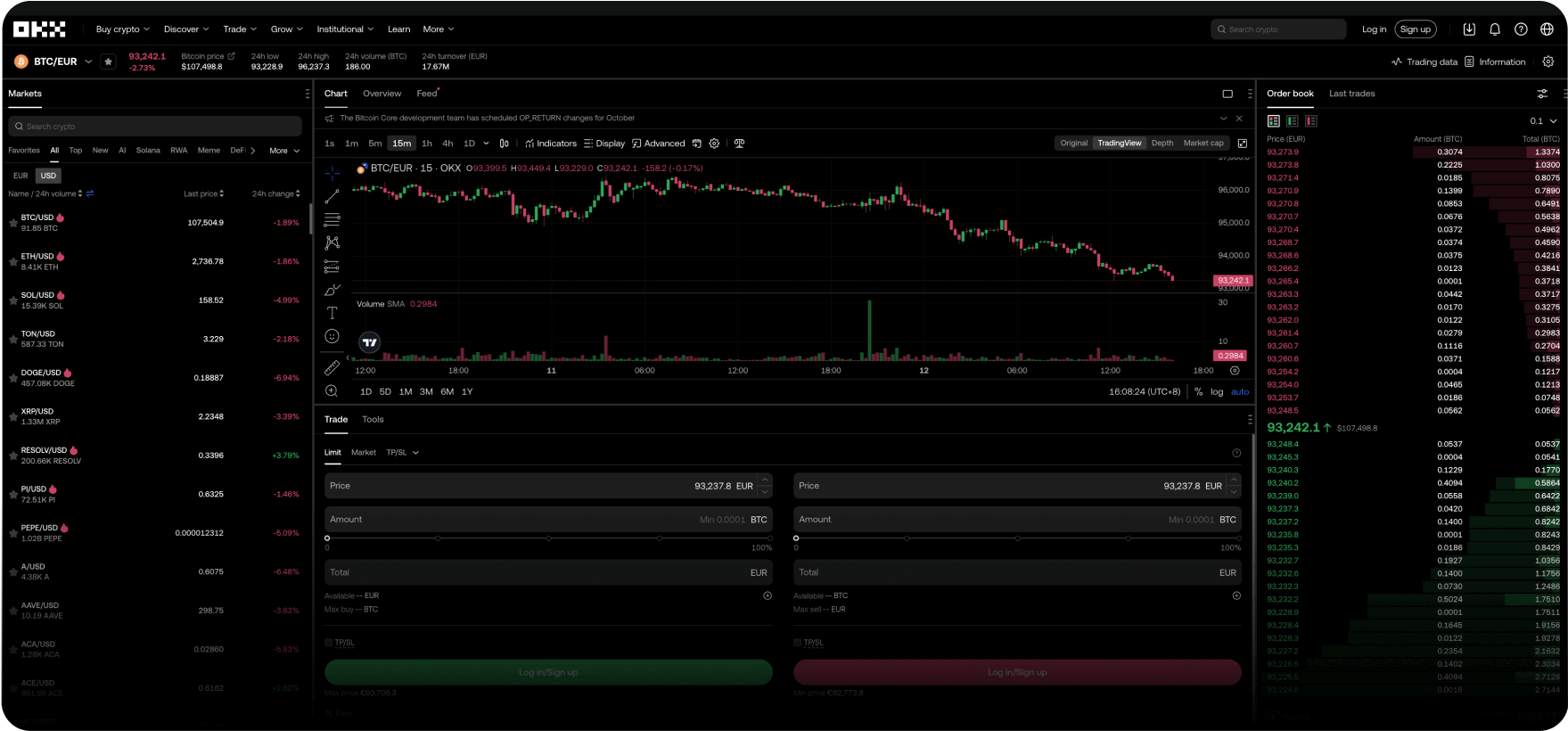

Je wereldwijde account in digitale dollars

Profiteer van onze laagste tarieven, snelle transacties, krachtige API's en meer.

Ondersteuning bij elke stap die je zet

Van het maken van je eerste crypto-handelstransactie tot het worden van een doorgewinterde trader, wij begeleiden je door het proces. Geen vraag is te onbelangrijk. Geen slapeloze nachten. Heb vertrouwen in je crypto.

Coach Pep Guardiola

Legt 'bizarre voetbalopstelling' uit

Laten we het systeem opnieuw schrijven

Welkom bij Web3

Snowboarder Scotty James

Haalt het hele gezin erbij

Vragen? Wij hebben de antwoorden.

Welke producten biedt OKX?

Hoe koop ik Bitcoin en andere cryptocurrency's op OKX?

Wat is OKX in een notendop?

Kunnen inwoners van de Europese Unie OKX gebruiken?