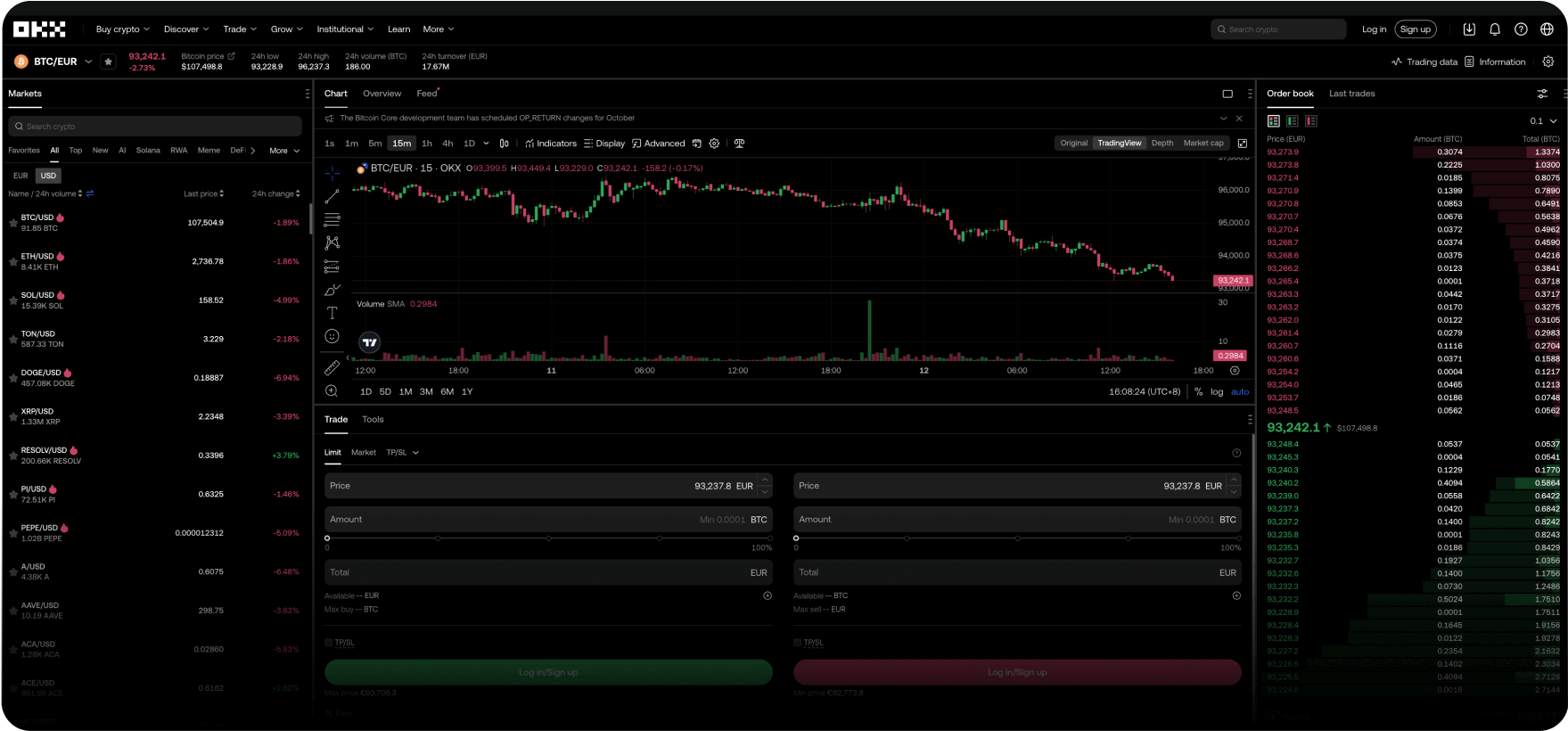

Twoje globalne konto w dolarach cyfrowych

Ciesz się najniższymi opłatami, szybkimi transakcjami, wydajnymi API i nie tylko.

Będziemy z Tobą na każdym etapie

Od dokonania pierwszej transakcji kryptowalutowej do stania się doświadczonym traderem — przeprowadzimy Cię przez ten proces. Nie ma nieistotnych pytań. Żadnych nieprzespanych nocy. Zaufaj swoim kryptowalutom.

Trener Pep Guardiola

Wyjaśnia „zwariowaną formację piłkarską”

Napisz system na nowo

Witamy w Web3

Snowboardzista Scotty James

Sprowadza całą rodzinę

Pytania? Mamy odpowiedzi.

Jakie produkty oferuje OKX?

Jak kupić Bitcoin i inne kryptowaluty na OKX?

Gdzie ma siedzibę OKX?

Czy mieszkańcy Unii Europejskiej mogą korzystać z OKX?