Beyond the Checkout Page: Who Will Build the Economy for Agentic Commerce?

Preface

The AI driven wave of transformation is quietly reshaping the foundational pillars of the business world, as articulated in AI 2027: It is projected that post 2025, artificial intelligence will increasingly resemble autonomous agents rather than mere assistants. We are currently at the turning point where agents are evolving from unreliable tools into fully autonomous intelligent entities.

Readers who pay attention to recent developments in AI and Fintech will observe that, since the latter half of 2024, those web2 giants such as PayPal, Visa, Mastercard, Stripe, and Amazon have been strategically positioning themselves in a new game of "agentic commerce" and "agentic payments." The underlying rationale is obvious: the conventional commercial world is recognizing an emerging trend that the widespread adoption of agentic interfaces is poised to disrupt the commercial logics and production relations established over the past three decades on GUI paradigms of the internet. We might see a significant paradigm shift where core elements of traditional e-commerce operations, advertising and marketing strategies, and financial payment settlement mechanisms are being fundamentally reshaped, and an entirely new category Agentic Commerce will arise.

It seems like many people in crypto are still unaware of this paradigm shift which is comparable in magnitude to the transition from horse drawn carriages to steam engines, or from PC based internet to mobile internet. We believe this revolution of agentic commerce extends far beyond a mere intelligent augmentation of "e-commerce," as it is often superficially perceived.

This article aims to demystify the transformative wave of agentic commerce originating from the fintech world, offering a clear perspective for crypto readers with a stake in this revolution.

I. What is Agentic Commerce?

Drawing from insights across key players like Stripe (which rolled out Stripe Issuing), Visa (introducing Intelligence Commerce), Mastercard (launched Agent Pay), and Coinbase (launched the x402 payment protocol), we can define agentic commerce and agentic payments:

Agentic Commerce represents an AI agent driven business model where AI agents act on behalf of users to handle a range of tasks—from product searches and option comparisons to personalized recommendations and seamless purchase completions. These agents interact directly with e-commerce platforms, manage transactions, and oversee the entire shopping journey, all geared toward delivering a more tailored, secure, and effortless experience. The most popular cases include Amazon's "Buy for Me" feature (empowering AI agents to source and buy from third party brands) and OpenAI's "Operator" tool (which automates online shopping tasks end to end).

Right now, Agentic Commerce is still an emerging field with limited public business or commercial data available. According to the report from Gartner in 2024, fewer than 1% of e-commerce businesses or merchants have integrated agentic AI into their operations or services. But interest is surging: a 2025 e-commerce survey reveals that at least 90% of e-commerce players are eager to explore and incorporate agentic AI into their business models.

Apparently, this market is still nascent. Why are payment giants piling in aggressively by launching tailored products for agentic scenarios well before agentic commerce hits mainstream adoption? What massive opportunities are they spotting on the horizon?

1.1 Human Users Shift from Executors to Delegators, with Key Business Decisions Moving Upstream from the Checkout Page to the Intent Layer

Traditional online shopping resembles browsing a meticulously designed virtual supermarket. Consumers personally peruse shelves, compare items and eventually check out with the entire process centered around "active exploration." Merchants optimize for seamless flows through polished interfaces, precise recommendations and swift payments to minimize any user hesitation.

Now, imagine a new world of Agentic Commerce. You no longer need to browse e-commerce sites one by one, compare value propositions or manually place orders. Just simply issue a vague directive to your AI assistant, such as "Buy me a pair of running shoes." The AI springs into action, scouring countless merchants, filtering products, analyzing prices, reviews and logistics and even factoring in supply chain sustainability. Throughout this process, you might not touch a screen once or input a single password.

Source: The checkout page is dead.

The pivotal shift lies here. Users evolve from executors to delegators while core commercial behaviors upgrade from click streams to intent streams. Consumption is no longer a series of discrete choices but a holistic authorization toward end goals.

As business decisions migrate from the checkout page to the intent layer, existing commercial systems face cascading disruptions. From marketing to user growth strategies, decades of e-commerce logic built on human behavior analysis get upended by AI agents' rational decision making:

A/B testing: AI can compare dozens of options in milliseconds, rendering two weeks' tests on button icon colors for conversion rates obsolete.

Personalized recommendations: All legacy algorithms based on human browsing history become ineffective. Recommendation models must be rebuilt on AI decision logic.

Cart recovery: In AI decisions, there won't be human-like "hesitation" or "abandonment" for different reasons. Cart abandonment rates and associated optimization strategies will become historical artifacts (the current global average cart abandonment rate is 70% on average).

Conventional marketing relies on the attention economy. Stunning images, emotive video ads, "flash sale" red buttons: all laced with psychological tactics to trigger human impulse buys. In contrast, AI lacks impulses. It's a purely rational decision machine focused solely on things like whether API responses are clear and parameters complete. It coldly compares product specs, historical pricing, delivery times, user reviews and even supply chain carbon footprints. No more "mindshare capture" in future.

In future Agentic Commerce marketing, the focus shifts from crafting eye-catching ads to building machine readable trust resumes. "Product-Agent Fit" might replace "Product-Market Fit." Whether your product can be easily indexed, understood and recommended by mainstream AI agent ecosystems will determine its survival.However, before agents rapidly reasoning through human-delegated goals, generate intents and hurtle toward completing commercial actions, they'll slam into a solid wall: traditional payment systems.

II. Why Traditional Financial Systems Serve as a Speed Bump for Agentic Commerce

AI agents can flawlessly execute information gathering, analysis and decision making. However, as they approach the final step in closing the commercial loop, they collide with a formidable barrier: the financial payment infrastructure we've constructed over decades, explicitly tailored for human users.

At its core, the modern payment and risk management ecosystem functions as an "anti-automation system." Its foundational design philosophy presupposes that automation inherently signals fraud.

Let's review each stage of our current payment workflows:

CAPTCHA: Deploys puzzles that machines struggle to solve, verifying "human" status.

SMS verification or two-factor authentication: Presumes access to a physical device for receiving codes and manual entry, a process that's profoundly challenging for automated programs.

3D Secure: Mandates a redirect to a separate banking page for entering a distinct transaction password, entirely derailing any automated sequence.

Behavioral risk analysis: Sophisticated systems scrutinize mouse trajectories, typing cadence, device fingerprints, and other distinctly "human" traits to authenticate transactions.

In the era of Agentic Commerce, these security safeguards morph into constraints. They impose interrogations akin to "Prove you're human" effectively halting the autonomous agents we deploy.

Consequently, the future of payments transcends the checkout page and evolves into a protocol. This shift heralds a revolution in trust and authorization frameworks. We require an innovative digital credentialing system enabling users to issue secure, programmable authorizations to their AI agents, complete with defined scopes, expiration timelines and monetary caps.

Agentic Payments embody this protocol, representing the ultimate settlement phase in Agentic Commerce. Here, AI agents leverage secure, efficient mechanisms such as tokenized credentials, to conduct transactions on users' behalf. This approach guarantees seamless and protected processes, often incorporating user-defined limits and oversight to uphold trust and security. For instance, Mastercard's Agent Pay introduces Agentic Tokens to facilitate AI-driven subscriptions and recurring payments. PayPal's Agent Toolkit empowers AI agents to manage payment workflows. Visa's Intelligent Commerce initiative provides comparable capabilities for developer integration. Stripe offers analogous tools, exemplified by its collaboration with Perplexity: users interact via Perplexity's interface to receive holistic recommendations and product selections for home redecoration. Upon user approval of the plan, the agent seamlessly handles automated payments, settlements, and fulfillment through Stripe's agentic backend.

At this point, the rationale behind why incumbents like Visa and Mastercard are racing to deploy Agentic Commerce adapted solutions becomes evident. They are vying to establish the standards for the next generation of machine native payment protocols. This contest is about commandeering the foundational infrastructure of tomorrow's business landscape, with the ultimate goal of restoring payments to their purest form: the frictionless transfer of value.

III. Challenges in Building a Financial Infrastructure for Agentic Commerce

Core Challenges: Trust, Intent, and Automation

The dilemma in constructing Agentic Payment systems isn't merely a matter of technical implementation.

1."Who Can Act": From Authentication to Authorization

In the payments domain, the focus for end-users traditionally lies on authentication rather than authorization. When you click "buy" on an e-commerce site, you explicitly grant permission. There's little room for dispute since you manually enter card details and deliberately click the button. Thus, traditional payment systems center on "identification." Their core question is: "How do I confirm the operator is really you?" This is the essence of identity verification.

However, in the emerging era of AI agent-driven commerce, payments face a transformative shift. Authorization becomes the critical element in the process. This authorization dynamic is far more complex and compelling. Unlike the straightforward "click-to-buy" model of legacy e-commerce, user directives are no longer clear-cut. Humans express payment intents in diverse ways. Adding further complexity, when a payment request is initiated, it raises the question: Who exactly are we authorizing? The human user, the AI agent, or the company behind the agent?

Key authorization challenges in potential agentic payment scenarios include:

Identity Phantom: How should we classify the "transaction requester"? Is it the end-human user, the AI model, the agent application developer, or the server hosting it? We lack a verifiable identity standard tailored for "machines." This gap risks turning every link into a security vulnerability.

Authorization Boundaries: How do we securely delegate financial permissions to an AI? Defining and enforcing precise boundaries—such as amounts, timelines, and merchants—presents new challenges. Ensuring these authorizations are tamper-proof and resistant to abuse is equally critical.

Liability Attribution: When an agent makes an error or is maliciously exploited, resulting in losses, determining responsibility becomes highly complex. Unclear accountability remains the greatest obstacle to widespread adoption.

2. "What to Do": The Intent Verification Gap

The intent verification issue extends from authorization challenges. It arises from the fundamental tension between the probabilistic nature of LLMs and the deterministic requirements of financial systems. The payment layer cannot eliminate AI hallucinations. However, a well-designed financial system must effectively bridge the gap between AI outputs and users' true intentions.

Traditional payments process "payment orders" such as "Pay $50 to merchant X," assuming the instruction is clear and accurate. In contrast, agentic payments deal with "transaction intents," like "Get me a medium oat milk latte." The system must be able to validate the final payment directive by aligning it with the original natural language intent.

We don't need a payment system that can "read AI minds." Instead, we require one reinforced with robust guardrails. Structured data, strict API-level rules, or smart contract logic can constrain AI actions. These measures ensure executions remain within user-defined safe zones. For instance, a rule capping spending at $10 in a coffee shop could prevent hallucinations that lead to excessive or incorrect transactions.

3.Machine-Native Fund Custody and Payment Settlement Approaches

Traditional payment systems are inherently anti-automation. Their GUI-oriented security measures act as shackles, obstructing full autonomy in agentic commerce scenarios. To address this, we need a new suite of machine-native payment APIs and settlement networks. These should include the following features:

Programmatic-First Design: All interactions must occur through structured APIs. This eliminates the need to simulate human GUI clicks.

Frictionless Settlement: Transactions should be executed with near-zero latency and minimal costs. This is especially critical for micro-transactions that power the machine economy.

Data Portability: Transactions need to carry rich, structured metadata. This enables automated reconciliation, auditing, and advanced financial services, moving far beyond the basic transaction amounts and merchant names used in traditional payments.

The Path Forward: Three Stages Toward Autonomous Finance

To tackle the challenges outlined, the industry is charting a progression from "assisted" to "agent-driven" to fully "autonomous" systems. These three stages clearly illustrate the distance we still need to cover to achieve a true agentic economy.

Stage One: Human-Supervised Assisted Agents

This is the dominant model today. AI serves as an advanced "auto-fill tool," handling tedious front-end tasks but hitting the brakes at critical junctures, relinquishing final control to humans.

Implementation: Agents manage front-end tasks like search, price comparison, and form filling. However, at the pivotal payment stage, they pause and return control to the user. For example, an agent might pre-fill credit card details but require manual entry of the CVV code. Alternatively, it could guide users to a PayPal or Stripe login page for final authorization.

Core tech: This approach relies on browser automation (mimicking human actions) or pre-filled credentials via systems like Apple Pay or Google Pay.

Pain Point: The experience feels disjointed. The efficiency gains from agentic automation come to an abrupt halt at the final step, falling short of true end-to-end automation.

Stage Two: Controlled Agents Within Authorized Boundaries (Agent as a Proxy)

This is the battleground where payment giants like Visa, Mastercard, and Stripe are fiercely competing. They are working to create a "controlled digital wallet" for AI agents, centered on virtual cards and dedicated payment APIs. Users can generate one or more virtual cards for their agents, each with strict constraints. These cards can have limits on single or total spending, restrict usage to specific merchant categories (e.g., only for airline tickets), and include expiration dates.

Implementation: Agents initiate payments by calling these virtual cards through specialized APIs, such as Stripe's Order Intent API, with minimal user intervention. The collaboration between Perplexity Pro and Stripe exemplifies this approach, enabling seamless transactions within the chat interface.

Core Tech: This model shifts the trust paradigm from relying on an unpredictable AI to trusting a tightly parameterized payment instrument controlled by the issuing institution. It's a smart mechanism for risk transfer.

Pain Point: This approach is currently the most practical for widespread adoption. It integrates seamlessly with existing credit card systems, requiring no changes from merchants. Users, who don't directly interact with the virtual cards, experience minimal disruption. However, as agentic commerce expands into more natively agentic scenarios, such as B2B agentic business, the model's limitations surface. The programmability of authorization data is constrained. The data capacity of card-based systems is restrictive, potentially stunting growth. Also, some industry researchers like Idan Levin point out that solutions like Stripe's virtual cards still depend on the traditional "manual card detail entry" paradigm. Techniques like screen scraping or headless browser automation can create a seamless experience. Yet, these methods introduce elevated technical and compliance risks. Additionally, Stripe's fee structure, with a fixed $0.35 per transaction plus a 2.5% surcharge, is poorly suited for the ultra-micro-transactions essential to the agentic economy.

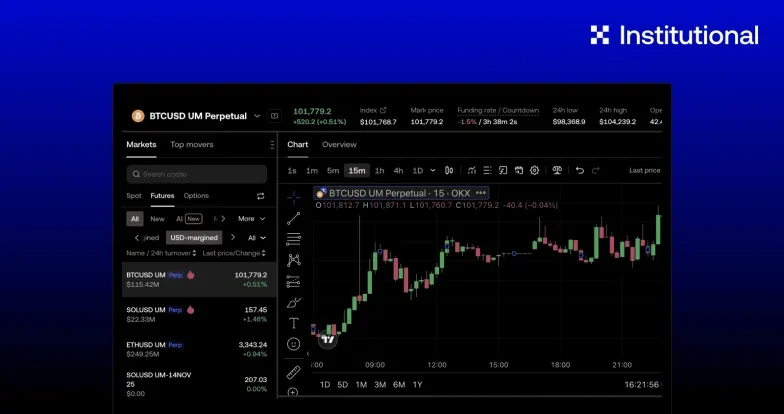

Take the 2025 partnership between Stripe and Perplexity as an example (please see the diagram above). Users can issue commands within Perplexity's interface to have the AI source products and complete purchases via Stripe's tailored agentic payment services, streamlining the entire procurement process.

Notes:

Stage 1 (Initial Binding): In the first phase, users engage in a standard Stripe Checkout process. This step accomplishes more than just completing a purchase. It securely binds the user's payment information and grants funding authorization to the platform, settling into the Stripe Balance. This binding serves as the foundation for all subsequent seamless interactions.

Stage 2 (Subsequent Frictionless Payments): This represents the core workflow. When users issue a new command, the platform—such as Perplexity—avoids interrupting them. Instead, it directly requests a one-time-use virtual card from Stripe Issuing. This card comes with stringent risk control rules, including limits on amounts and merchant categories.

Stripe's Role in the Payment Chain:

Stripe Checkout: Acts as the secure entry point. It captures the user's payment details and authorization.

Stripe Balance: Functions as the platform's funding pool. All subsequent virtual card payments are drawn from this pool.

Stripe Issuing: Serves as the "engine" of the process. It generates controlled payment instruments (virtual cards) on demand. This transforms unpredictable AI behavior into deterministic, manageable payment events.

Merchant Verification: Merchants don't verify the AIs ownership directly. Stripe's backend validates the virtual card's limits and expiration. It ensures the transaction comes from an authorized platform. If a breach occurs, like a hacked Perplexity Pro, Stripe's Webhook and controls detect anomalies and halt transactions.

Stage Three: Autonomous Economic Actors with Native Wallets

This represents the ultimate evolution of Agentic Commerce. It's also where crypto plays a pivotal role. AI agents transcend their role as appendages of human accounts. They become independent digital economic participants with their own wallets and identities. These agents engage autonomously in a new economic network designed specifically for machines. Let's brainstorm a potential technical framework for this stage:

Implementation:

Authorization via Policy Layer: Humans grant permissions through smart contracts. Instead of directly authorizing AI, users deploy a governance or policy-based smart contract. This contract sets boundaries for AI's actions. For instance, AI can only access funds when specific conditions are met simultaneously.

Core Security Vault (Trusted Execution Environment or TEE): The AI's decision-making logic and its native on-chain wallet private key are encapsulated within a TEE, a secure hardware enclave inaccessible to the outside world. Inside the TEE, the AI's decision engine generates a payment decision. This decision is passed to the wallet module within the TEE. The wallet module signs the transaction using its private key.

Transaction Execution and Settlement: Signed transactions are broadcast from the TEE. They are sent to a blockchain or interact with other AI agents, such as those representing merchants in the future.

IV. Agentic Payment Projects Analysis

In the agentic payment field, projects are primarily focused on tackling three critical challenges. These include ensuring secure and effective authorization. They also involve guaranteeing that AI agents operate within user-defined boundaries. Additionally, they emphasize enabling seamless payment settlement.Below is a concise analysis of three key players we picked: Skyfire, Payman, and Catena Labs.

Skyfire | Payman | Catena Labs | |

Core problems to resolve | Authorization | Intent Verification Gap | Authorization |

Core abstraction | Verifiable AI agentic native identity / Portable credential | Human natural language to secure agentic financial actions / Intent parsing, policies definition and evaluation | Composable, cryptographically verifiable commercial Identity & credentials |

Key Technical Differentation | Decentralized and portable agentic native credential and ID | Payman encapsulates most functionalities within a streamlined payman.ask() function, which, in the background, is resolved into calls to a series of specific API endpoints corresponding to actions such as querying balances, creating or listing payees, retrieving policies, initiating payments, and approving requests. | Deep integration of W3C decentralized identity standards (DIDs & VCs) for both identity and cryptographically-secure payment receipts. |

Primary Problem Solved | Agent-to-Agent authorization problem | Human-to-Agent command & control (Intent verification gap problem) | Building the foundational, open-standard trust and transaction layer for the entire agent economy, addressing both identity and paymen problemt. |

Key Commerical Focus (high prority use cases) | Agentic B2B business.Their first technical demo is a buyer agent use Skyfire to discover the data seller (via MCP) and finish the payment autonomously | AI payroll (automatically pay employees), autonomous reimbursements, multi-agent approvals and tipping, AI native wallets for apps, end-user OAuth access to manage their wallets | Providing both a regulated "AI-Native Financial Institution" as a service, and the open-source Agent Commerce Kit (ACK) for the community to build interoperable solutions for B2B, micropayments, and Agent-to-Human commerce. |

Agent identity and verification | Identity: KYA and Pay Tokens protocol leverages a mature open standard of web authentication (JWT and JWKS) with asymmetric encryption to ensure secure, verifiable, and tamper-proof AI agent identities and transactions.

Verification: Stateless and independently verifiable. Skyfire as the authorization server who own private keys to issue Agent ID (KYA/JWT) to the network's agents and anyone else such as merchants can do the verification independently using the public key (Pay/JWKS). | Identity: Payman acts as the authorization server, managing and verifying all API access through the standard OAuth 2.0 protocol. It does not issue independently verifiable ID (like JWTs) to agents. Instead, it grants a temporary, opaque Access Token to legitimate applications or agents.

Verification: Stateful and requires online verification model. No third party like merchant can independently verify the authenticity or permissions of this Access Token. The verification authority rests exclusively with Payman's central servers. | Identity: Truly decentralized and self-sovereign, based on W3C Decentralized Identifiers (DIDs). Authority and capabilities are conveyed through Verifiable Credentials (VCs) issued by multiple, distinct authorities (e.g., the owner, a financial regulator, a service provider).

Verification: Decentralized and independently verifiable. A relying party verifies an agent's identity and claims by cryptographically checking the digital signature on the presented VCs against the public keys listed in the issuer's DID document. |

Fund Custody Model | Centralized & Custodial

For now keep the fund custody centralized and simple (like Stripe) and how the act of paying happens between machines is what they focus and reinvent. All balances are held and managed in Skyfire's central ledger | Centralized & Custodial

For now keep the fund custody centralized like Skyfire and Stripe. All balances are held and managed in Payman's central ledger | Flexible: Supports both custodial (via Payment Services) and potentially self-custodial models. Crypto-native |

Core Advantage and uniqueness | Efficiency, low cost and programmability. Machine-to-machine communication is lean with low settlement costs. Enables complex, automated business logic which is very align with the requirements in agentic B2B business use cases | Simplicity and developer experience. Its ask() function abstracts away immense complexity, making it extremely easy for developers to add powerful, policy-governed financial features to any AI application using natural language. | Architectural vision, openness, and modularity. It provides a robust, future-proof, and composable framework for the entire ecosystem to build upon, fostering true interoperability rather than a single, proprietary solution. Its use of DIDs/VCs creates a powerful foundation for trust. |

Fundraising | $9.5m total raise from Coinbase, Circle Ventures, a16z CSX etc in 2024 | $13m total raise from Visa, Circle, Coinbase etc | In 2024 a16z, Coinbase, Circle etc invested $18m |

Skyfire focuses on defining a standardized "authorization" protocol for Agentic Commerce. The team focuses on future B2B agentic use cases. They identify the primary obstacle in autonomous B2B transactions between AI agents, such as purchasing data or making API calls, as the lack of a widely verifiable, machine-native identity. To address this, Skyfire's core product is a machine-native authorization protocol built on established, open internet identity standards like JWT/JWKS. The technical logic involves Skyfire acting as a trusted centralized authority. It issues encrypted, time-bound, and scope-limited "payment credentials" for all agents registered on its network. These credentials can be independently and offline verified by third-party services. This enables efficient, low-cost, and programmable machine-to-machine commercial interactions without compromising security. Ultimately, this lays the foundation for an open agentic B2B network.

Payman takes a different approach from Skyfire's focus on inter-agent protocols. Instead, it targets the "human-to-agent command and control" challenge, addressing the Intent Verification Gap discussed earlier. The team sees that, with the explosion of AI applications, developers urgently need a solution that radically simplifies complex financial operations. This solution must also be securely embeddable into any application as a "financial capability layer." Payman's core product is an abstract function, payman.ask(), backed by a sophisticated system for defining financial intents and executing transactions. Its technical logic encapsulates intent parsing, policy enforcement, risk control, and banking integrations into a powerful natural language interface. Developers can empower their AI assistants or automation tools with robust financial capabilities using a single line of natural language code. Current use cases highlighted by the team include AI-driven payroll, automated expense reimbursements, and multi-agent approval workflows.

Catena Labs also concentrates on resolving the authorization challenge in agentic commerce. The team aims to build an open, compliant, and crypto-native trust and transaction infrastructure for the agentic economy. They argue that overcoming the AI agent's "identity crisis" and "transaction barriers" requires moving beyond credentials issued by centralized entities. Instead, a truly decentralized identity standard is essential. Catena Labs' core product is an open-source protocol framework called the Agent Commerce Kit (ACK). This framework deeply integrates W3C's decentralized identifiers (DIDs) and verifiable credentials. It comprises two key standards: the identity layer (ACK-ID) and the payment layer (ACK-Pay). Notably, their authorization solution leans toward a decentralized approach for issuing permissions, rather than relying on a single entity to define them.

Besides these three players, there are also other projects providing agentic payment solutions such as Nekuda.ai, Nevermined, Crossmint etc.

V. Monetization Models for Agentic Commerce

Agentic commerce will impose structural disruptions on the foundational pillars of the internet economy over the past two decades. These pillars include e-commerce and search engine advertising. To comprehend this transformation, we require a novel theoretical framework. This framework can be termed the "Intent Layer Theory.

"In the past, value was generated at two primary points. These points are the entryways for discovery, such as Google search, and the endpoints for transactions, such as Amazon's checkout page. Ben Thompson's "Aggregation Theory" perfectly elucidates how platforms aggregating users, or traffic, attained immense pricing power. In the agentic era, the core of value is shifting upstream. It moves from "discovery" and "transaction" to "intent expression and execution." The new center of pricing power is the intent layer. This layer refers to the interaction interface between users and their preferred AI assistants. All commercial logics and production relations established over three decades on GUI paradigms will be dismantled. An entirely new, multi-layered commercial ecosystem is emerging.

Companies possessing mainstream AI assistants, such as OpenAI, control the gateways to user intents. They serve as the gatekeepers of this new ecosystem. Analyses of their business models are abundant in the market. Their primary monetization paths include transaction commissions or affiliate marketing (Commission/Affiliate Model), premium feature subscriptions (Subscription Model), and platform APIs as products (API-as-a-Product). A lot of articles have discussed it, so we will not elaborate further.

Challenges and Opportunities for Merchants and Service Providers in Agentic Commerce

For businesses selling goods and providing services, the competitive focus will shift from managing users to serving machines. This change will directly weaken the direct connections between consumers and brands. Future loyalty may no longer target a specific e-commerce platform or brand. Instead, it will center on the AI assistant that best understands the user and the company behind it.

From UX Optimization to API (MCP) Optimization: Merchants' competitive edge will no longer rest on website visual design. It will not depend on user experience either. Instead, it will depend on the AI-readability of their products and services. Is your product data structured? Are your APIs stable? Are they efficient and well-documented? Can AI retrieve pricing and inventory information accurately in real time? These elements will create new moats. Merchants must package their operations into machine-readable protocols. This allows AI agents to discover them. It enables comparison. It facilitates invocation. Those interested in MCP have held many discussions on this topic this year.

Pay-for-Performance Bidding: Merchants will stop buying keyword ads. They will pay intent layer platforms instead. The goal is to become preferred suppliers in specific domains. They aim to be certified suppliers as well. Examples include purchasing economy class flights. Another is reserving Michelin-starred restaurants. Merchants pay fees only when the AI assistant accepts their proposal. This must lead to actual sales or valid leads.

API-First Services: Enterprises can wrap their core capabilities into standard APIs. Examples encompass logistics. They include design. Content creation is another. Legal consulting fits too. These APIs can be sold directly to other AI agents. The agents invoke them. They turn into functional modules in the machine economy. Pricing uses a pay-per-use model. It can also be on-demand.

The commercial barriers built by companies with established "network effects" in traditional chains may be breached. Markets will become more open. Stronger market forces will drive changes in commercial pricing models. More dynamic and flexible pricing structures will emerge. Agents will require clear cost-benefit information for decision-making. Traditional pricing models in the business world will also transform.

Business Paths for Financial and Trust Infrastructure Providers

In Agentic Commerce, the primary challenge lies in authorization and intent verification before transactions initiate. On one hand, systems must address trust issues in agent-to-agent interactions. This involves providing AI agents with verifiable digital identities. Such identities ensure the legitimacy and security of interactions. Currently, most agentic payment companies emphasize solving this aspect. This could give rise to business models similar to AI identity authentication as a service. Providers might charge for issuing and verifying AI identity credentials. They could also offer enterprise-level AI identity management platforms to generate subscription revenue.

On the other hand, systems need to bridge the intent gap between vague human directives and machine-executable financial operations. This requires safely converting natural language into precise API calls. Such a need spawns financial-capability-as-a-service models. Providers can encapsulate these capabilities into APIs or SDKs. They charge based on call volume or transaction flows. Alternatively, they provide solutions for specific scenarios like AI-automated reimbursements.

Beyond authorization and intent verification, the final challenge is constructing a truly machine-native infrastructure for payment settlement and trust. This infrastructure must support automated transactions. Traditional financial rails are designed for humans. They face cost and efficiency bottlenecks when handling AI-driven high-frequency, micro-value, programmable transactions. Technical solutions vary across providers. Options include virtual card schemes, payment APIs, or equipping agents with on-chain wallets. However, their business logics may converge in commercial models. The core revolves around powering and trusting automated value flows. Fees could come from transaction revenue shares or per-use charges. Additionally, offering value-added services could strengthen moats. Examples include programmable dynamic risk controls tailored to AI behaviors, automated compliance and audit tools, or cross-asset liquidity management solutions.

VI. The Ultimate Infrastructure: Why Crypto Is the Ideal Partner for Agentic Commerce

Why Stripe and Visa's Solutions May Not Represent the Endgame

As outlined earlier, major payment giants are deploying solutions that better suit agentic scenarios without overhauling existing financial infrastructure. However, such approaches remain transitional middle ground options, still distant from the endgame of fully autonomous agentic payments.

Lack native APIs for payments optimized for machine interactions. Virtual cards, while promising, still depend on manual entry of details like card numbers, expiration dates, and CVVs into merchant interfaces. These systems prioritize human-centered designs over programmatic ones. Relying on screen scraping or headless browsers to mimic human actions introduces legal ambiguities and technical vulnerabilities, creating both engineering and compliance obstacles.

Anti-automation tools remain widespread across most websites. CAPTCHAs and anti-bot systems block agent-driven transactions. They frequently require human intervention to bypass. Fraud detection algorithms often flag automated activities. This leads to transaction rejections. It can also cause account locks or suspensions.

Compliance frameworks center on human users. They rely on explicit consent through graphical user interfaces. Users must manually accept terms. They also complete specific workflows. Automating these steps usually violates website terms of service. PCI DSS imposes strict rules on handling card data in agent software. It tightly regulates storage. It controls transmission. It also governs processing.

In summary, the core challenges with solutions from traditional payment companies lies in their attempt to adapt machine behaviors to frameworks designed for humans. They fail to provide fundamentally machine-native solutions.

Crypto as Native Infrastructure for Agentic Commerce

Crypto technology, particularly self-custodial wallets and public-private key systems provide a machine native solution. It leverages open standards like DIDs to assign each AI agent an independent and verifiable digital identity. This approach fundamentally resolves the identity phantom problem inherent in traditional centralized systems. Authorization moves beyond rigid and opaque backend rules. Instead, smart contracts enable a programmable, granular, and fully transparent mechanism. Users can set tamper-proof authorization directives for AI agents. These directives include multiple conditions, such as specific amounts, merchant categories, and validity periods. This level of control far exceeds traditional financial tools. It significantly reduces trust risks.

During payment execution, an AI agent with an on-chain wallet achieves true automation and seamless transactions. It no longer needs to mimic human behavior to fill out credit card details. Instead, it interacts directly with blockchains via APIs. This eliminates substantial friction from legacy payment processes. Stablecoin-driven low-cost transactions make high-frequency, micro-value payments between AIs economically viable. Traditional payment rails struggle to match this capability. Crucially, blockchain payments and settlements occur as atomic and real-time operations. This bypasses the complex clearing and reconciliation processes of traditional finance. It also lays the foundation for real-time economic interactions between AI agents. All transactions are recorded on immutable chains. This creates publicly auditable trails. These trails offer unprecedented transparency and trust assurances for post-transaction tracing and dispute resolution.

Potential Risks of AI Agents with Crypto Wallets

Granting AI agents control over crypto wallets introduces notable technical and operational risks. The primary threat involves attacks on AI systems. An agent or its runtime environment could be compromised. Managed private keys might be stolen. To mitigate this, agents should not hold complete private keys. Technologies like MPC or TEE can distribute or programmaticize key management and transaction authorization. This eliminates single points of failure. Other vulnerabilities include tampered authorization intents during transmission or theft of a user’s authorizing wallet. Robust intent verification mechanisms are essential. Multi-factor authentication at critical steps is crucial for comprehensive security.

Beyond technical hurdles, legal and regulatory ambiguities pose a significant barrier. Current legal frameworks, which are designed for human actors, struggle to define the legal status of AI agents. This creates a liability vacuum. When smart contract vulnerabilities or AI hallucinations result in asset losses, assigning responsibility becomes complex, as determining whether the user, developer, or platform is accountable proves challenging. Although crypto’s on-chain transparency and traceability offer a robust foundation for accountability, achieving widespread adoption requires close collaboration with regulators, who must develop new legal and compliance frameworks tailored for machine-to-machine economies.

VII. Final Thoughts

From first principles, what is required to create a sovereign economic agent?

An Independent Identity: The agent owns and controls its identity. It is not issued or revocable by a centralized platform. Decentralized identities (DIDs) provide this capability.

A Self-Custodial Wallet: The agent can hold and transfer value without needing intermediary approval. Public-private key cryptography and self-custodial wallets enable this functionality.

A Programmable Rule Framework: The agent operates under transparent, tamper-proof, and programmatically enforceable rules. Smart contracts deliver this structure.

Based on this reasoning, we can make predictions about the future:

Next 3-5 Years: Solutions led by Traditional Payment Giants will dominate the early market.Controlled-agent solutions, like virtual cards from Stripe and Visa will likely dominate in the short term. Their success stems from a clear advantage: exceptional backward compatibility. AI agents can instantly transact with millions of merchants already integrated with credit card systems. No major ecosystem changes are needed on the merchant side. This overcomes the early market’s chicken-and-egg dilemma. It quickly transforms AI’s execution capabilities into tangible commercial value. For application developers prioritizing rapid deployment, this approach offers the least resistance and the fastest results. Yet, it may only act as a transitional phase, preparing the market for the emergence of a new machine-economy commercial paradigm.

Beyond 5 Years: The value of machine-native solutions will shine, marking a turning point.

As Agentic Commerce scales exponentially, the core pain points of second-stage solutions will become increasingly intolerable. Their reliance on traditional card networks will expose critical limitations, particularly for emerging agentic-native economies like B2B agentic and agent-to-agent interactions. Key issues include inflexible authorization systems, which we’ve extensively discussed as critical. Additionally, constructing agentic IDs with sufficient portable identity data proves challenging. High transaction fees, especially for trillions of micro-transactions, pose another barrier. Slow cross-border settlements further hinder progress. These constraints will significantly impede the growth of the agentic economy. At that point, the market’s focus will naturally shift toward alternatives that align more closely with a machine-native economy. Crypto’s infrastructure—stablecoins, smart contracts, decentralized identities, and verifiable credentials will transcend being merely a better payment channel. It will emerge as the only technological paradigm capable of delivering sovereignty essential for true autonomous economic actors.