Quick Explain & Personal Though on Pendle's @boros_fi

1. Funding rates are periodic payments between long and short prep traders. If the market is bullish (perp price > spot), longs pay shorts (positive funding rate)

2. Boros "tokenizes" these funding rates into assets called Yield Units (YU). Example: 1 YU-ETH = the funding yield from 1 ETH notional in Binance's ETH/USDT perp

3. If you think funding will go up ▶︎ Long YU. If you think funding will go down ▶︎ Short YU.

4. Use Case Example: Ethena, which relies on positive funding for stablecoin yields, can short YUs to lock in rates and protect against drops

---- thoughts:

1. This product is targeting the funding rate arbs and protocol, but not normal retail user. I don't think much retails really care about how much they are paying to the funding rate. For funding rate stablecoin protocol like Ethena, they may have huge demand on "Short YU", not sure about the liquidity for them to hedge if buy side is not enough.

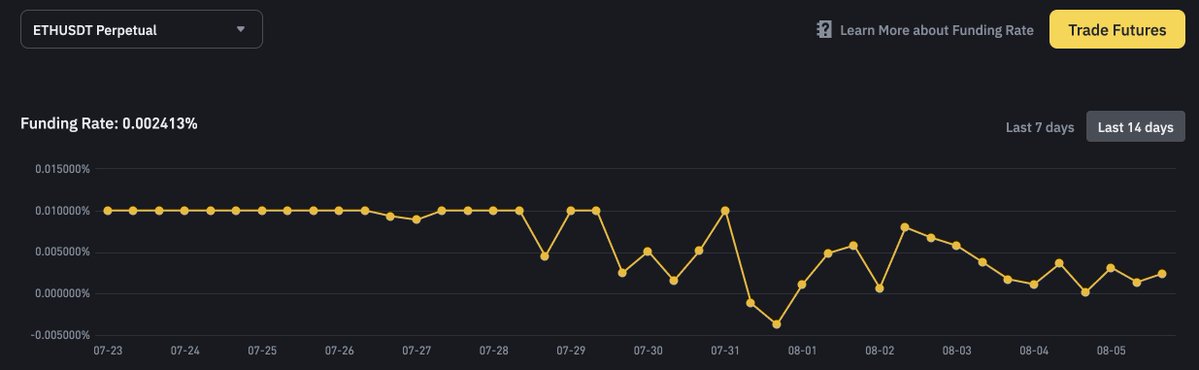

2. Funding rate formula can be adjusted by CEX. From below chart, you can actually observe the recent funding rate for $ETH is pretty consistent to stay on/below 0.01%, even during a bull market. Exchange generally now encourage more AUM so they tend to not make their funding rate too high.

The result is more smart users (who actually who play with trading funding rate) will also likely to sell YU as well. So I'm not too sure who will be the buy sides of YU.

3. Pendle Team always deliver a great product, I'm a pendle user and I'm willing to trust them have a proper mechan on this product, including risk control.

Afficher l’original

14,68 k

86

Le contenu de cette page est fourni par des tiers. Sauf indication contraire, OKX n’est pas l’auteur du ou des articles cités et ne revendique aucun droit d’auteur sur le contenu. Le contenu est fourni à titre d’information uniquement et ne représente pas les opinions d’OKX. Il ne s’agit pas d’une approbation de quelque nature que ce soit et ne doit pas être considéré comme un conseil en investissement ou une sollicitation d’achat ou de vente d’actifs numériques. Dans la mesure où l’IA générative est utilisée pour fournir des résumés ou d’autres informations, ce contenu généré par IA peut être inexact ou incohérent. Veuillez lire l’article associé pour obtenir davantage de détails et d’informations. OKX n’est pas responsable du contenu hébergé sur des sites tiers. La détention d’actifs numériques, y compris les stablecoins et les NFT, implique un niveau de risque élevé et leur valeur peut considérablement fluctuer. Examinez soigneusement votre situation financière pour déterminer si le trading ou la détention d’actifs numériques vous convient.