Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

HOME

Home price

This data isn’t available yet

You’re a little early to the party. Check out other crypto for now.

Home Feed

The following content is sourced from .

What we play with is the bubble; without the bubble, what do we play with? Let's try to find the bubble code?

┈┈➤ What is a bubble? A bubble is an exponential effect.

As time goes on and funds flow in, the price of tokens accelerates.

A project worth 100,000 can become 1 million, 10 million, 100 million... or even more after going public; this is an exponential bubble.

┈┈➤ The base number is equally important.

The base number must be large enough for the exponential effect to be greater; 10^10=100 billion.

The base must be greater than 1; otherwise, 0.5^10=0.0009765625, which is basically zero...

The base number refers to the fundamentals of the project, such as technology, products, etc.

┈┈➤ The path to finding the bubble code.

A bubble without fundamentals is 0.01^n=0; this is the logic behind most MEME coins going to zero.

A fundamental without a bubble is just 10 at best; this is the state of some tech projects.

Studying technology and products is essentially about finding opportunities where the base number is greater than 1.

Want to get rich? Next, you need to study the operational capabilities of projects, looking for those that can drive the bubble index more!

┈┈➤ Examples and exploration of the bubble code.

╰┈⯈ Track-driven bubble $LINK

The first example is $LINK; the bubble drive of $LINK does not come from its own operations but from the entire DeFi track exploding with large-scale participatory narratives. Many DeFi projects have a demand for the oracle Chainlink, and at that time, Chainlink had almost no competitors in the market, leading to $LINK being crazily pursued in the secondary market, causing its price to far exceed actual demand.

Looking at the present, three hotspots can be identified:

First is the RWA in the financial sector,

Second is the AI that is hot from Web2 to Web3,

Third is the ZK that the Ethereum ecosystem is promoting.

▌RWA track demand

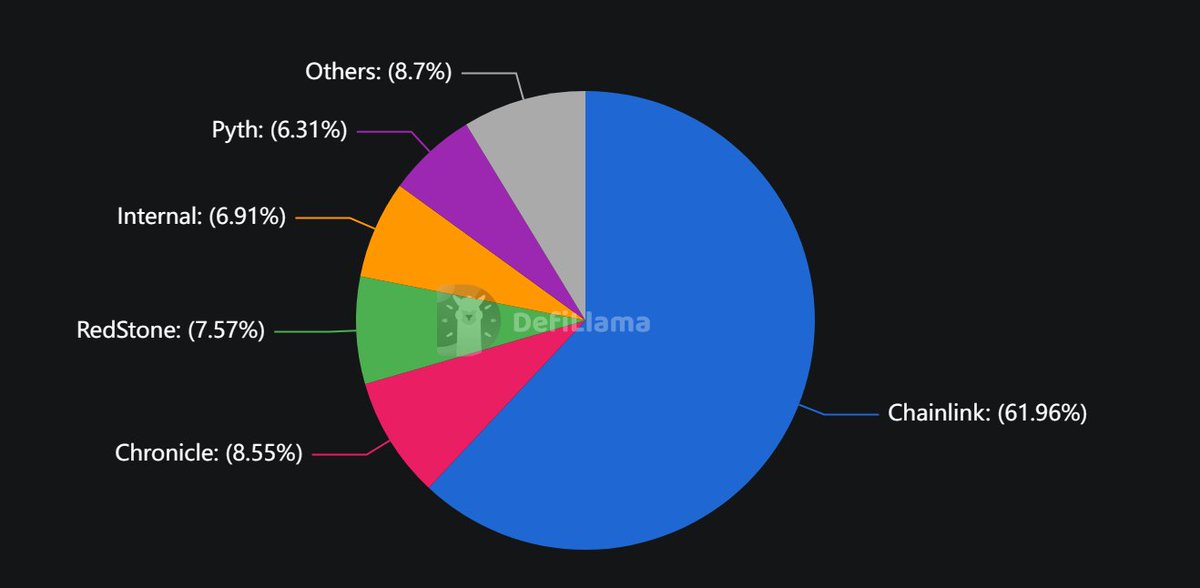

RWA products also need to use oracles; currently, two relatively hot oracles are ChainLink and @PythNetwork, both of which are related to RWA products.

In comparison, Chainlink holds a 61.91% market share, demonstrating a leading effect.

Pyth's market share is only one-tenth of Chainlink's, but the FDV of $Pyth is only one-thirteenth of $LINK. In comparison, it may have more potential.

▌AI track demand

The AI track is characterized by strong necessity and irreplaceability. I would choose AI Depin.

Compared to other types in the AI track that can be imitated, GPUs are scarce resources. For example, @AethirCloud ($ATH) has a strong core competitiveness and irreplaceability because it accommodates a vast global computing power.

The bubble-making ability of $ATH has already begun to reflect in its price.

▌ZK track demand

There are already several ZK Layer 1 or Layer 2 projects on the market, but these projects can only provide ZK proofs for their own chains.

However, there are two projects that provide ZK proofs for other Layer 1 and Layer 2.

If the ZK track explodes, other Layer 1/Layer 2 will not be able to update ZK proofs in a short time. Due to technical reasons, it may also be difficult in the long term. At this time, these two ZK infrastructures will be needed.

One is succinct $Prove, which has already been listed on Binance spot; currently, in terms of operations and price, it does not seem to have any bubble-making feeling.

In comparison, the other project @boundless_xyz may not be as popular as the former. However, in terms of operations, it may have a greater ability to "create bubbles." Boundless has implemented an ambassador program, with several KOLs promoting Boundless globally. Although Boundless has not yet issued tokens, it may be more promising in terms of "creating bubbles."

╰┈⯈ Celebrity-driven bubble $DOGE

This one goes without saying; it’s the bubble driven by Musk.

Similarly, in this round, we can focus on Trump.

▌This round driven by Trump

$WLFI should have products in the future, so it has a certain base; based on this, it may perform better under the influence of the Trump family.

Once liquidity is abundant after a period of interest rate cuts, and the altcoin season arrives, $WLFI and even $Trump may have opportunities for celebrity-driven sales. Of course, I believe that $WLFI has a larger "base."

Of course, what we are discussing here is not the present; it’s hard to say in the short term.

╰┈⯈ Product-driven bubble $AXS

In fact, the explosive DeFi in 2021, including Uniswap, belongs to this category.

The chain game launched by AXS attracted many users to participate. The game interface is very exquisite. Although the gaming experience is average, the visual enjoyment and profit effect are very attractive.

▌This round's Hyperliquid

Without a doubt, the product that is ideal and has a profit effect is none other than #hyperliquid $HYPE.

▌DefidotApp

In addition, @defidotapp $HOME should not be underestimated.

Although the DefidotApp product does not compete with Hyperliquid, in terms of community building, token model design, and marketing, DefidotApp is not inferior to Hyperliquid. Moreover, DefidotApp itself aggregates Hyperliquid's transactions, thus having the same trading depth. DefidotApp is part of its ecosystem.

Additionally, DefidotApp has launched on both Binance and Coinbase, facing a global market.

Of course, $HOME has an airdrop, so we need to pay attention to whether it can avoid the airdrop selling pressure during the altcoin season.

If there is no selling pressure when the altcoin season explodes, can $HOME take off like $SHIB followed $DOGE in 2021, following $HYPE?

╰┈⯈ Innovative narrative-driven $MANA

The innovative narrative of the metaverse track exploded in 2021; although it has almost disappeared now, $Mana and $Sand from that year also experienced a big bubble.

Some people categorize $AXS into this type, but $Mana and $Sand are in a virtual 3D environment, where participants can model or develop, and the way ordinary users can participate is relatively limited. In comparison, $AXS allows retail investors to participate, making it more like chain games and gamefi.

▌Chain abstraction

Chain abstraction is somewhat like the metaverse; it has innovative narratives and technical content.

However, as an infrastructure, chain abstraction currently lacks products with retail participation.

Except for $Parti. Particle is the earliest platform to realize chain abstraction products on the internet, and based on Particle, UniversalX is a chain abstraction DEX. In almost all chain ecosystems, users can use universal U and universal GAS to directly purchase assets from any chain, becoming a new generation of dog-fighting tools.

┈┈➤ In conclusion

There are many factors driving bubbles; forgive this article for not being able to summarize them comprehensively. For example, strong庄币 purely pulls the market, but it is difficult to layout coins like $MYX in advance. Everyone is welcome to supplement.

What this article wants to express is that in the face of the Federal Reserve's impending interest rate cuts and the upcoming monetary easing environment, we must first find projects with a "sufficient base" and then look for those that may create larger "exponential" bubbles.

The projects mentioned in this article include:

◆ RWA demand: $LINK\$PYTH

◆ AI track demand: $ATH

◆ ZK track demand: Boundless (not yet issued tokens)

◆ Celebrity-driven: $WLFI

◆ Product-driven: $HYPE\$HOME (this coin needs to pay attention to the timing of airdrop selling pressure)

◆ Innovative narrative: $Parti

Everyone is welcome to supplement.

TVBee

╰┈⯈Effort

The level of effort determines the lower limit, while talent determines the upper limit.

If you don't put in any effort, the lower limit is still zero. However, effort can also hit a bottleneck, and talent affects the upper limit.

╰┈⯈Projects

The technology of a project determines the lower limit, while operations determine the upper limit.

If the technology of a project is good, it is unlikely to perform poorly; if the technology is poor, the starting point will be even lower.

However, operations determine the upper limit; otherwise, no matter how good your technology is, it may not attract interest.

╰┈⯈Coins

The fundamentals of a coin determine the lower limit, while MEME ability (emotion) determines the upper limit.

Good fundamentals mean that there will be more support when the coin price drops, whether from faith or market cap management.

However, regardless of whether it's BTC, tech-based, or DeFi... all coins experience explosive growth through MEME-like emotional dissemination and MEME-like price increases.

If any of you are fans of DeFi and enjoy trading on perp-dex, you really can't miss @Defidotapp. A reputable name that stands out among DeFi projects still holding strong at this point!

Here are the reasons why @Defidotapp has garnered significant attention over the past year 👇

1️⃣ Rapid Growth

Starting as a modest project, as soon as Hyperliquid ignited the wave, Defi App immediately emerged as one of the top perp DEX built on HyperEVM, bringing a series of improvements to the DeFi experience: no gas fees, 1-click cross-chain swap, and eliminating bridge phishing risks along with various gamification mechanisms. In February 2025, they completed a seed round funding with 4 million USD and a valuation of up to 100 million USD.

Behind that success are strong funds like Mechanism Capital, along with media support from Cobie (Echo platform) - a testament to the project's credibility.

According to Hani, Defi App is not only for professional traders but also opens the door for newcomers, helping them access DeFi more easily, safely, and friendlier than ever.

2️⃣ Explosive Milestones

- Token Launch (TGE): 10/6/2025 TGE on top exchanges like Binance or Coinbase with a figure of 10 billion $HOME.

- Season 2 Degen Arena: Airdrop of 1 billion $HOME is currently ongoing, making Defi App one of the largest hot reward campaigns in the market today.

- Q3/2025 – Staking Boost: Hot staking program with up to 50% Bonus $HOME, along with a 3x XP mechanism unlocking airdrop of 1 billion $HOME.

3️⃣ Why is Defi App Special to Hani?

- "Quality" content: every media video on the website or X is artistic, engaging, turning complex DeFi concepts into a relatable, easy-to-understand experience. Hani particularly likes the slogan: "My grandma can use Defi App" – showcasing simplicity and accessibility for all generations. Hope the team continues to release more eye-catching, viral videos.

- Founder @0xUxDesign along with core team members like @bigironchris and @doranmaul always emphasize that for Defi App to go the distance, the core is a smooth UX, a strong community, and a long-term vision.

- User Experience Priority: With a friendly interface, the app feels like using a modern tech product, not just a tool for developers.

- Unique buyback mechanism: 80% of revenue is used to buy back $HOME, reducing inflation while creating a flywheel to maintain token price. The amount of $HOME bought back is then redistributed as Bonus $HOME, acting as a form of cashback for users – particularly attractive for long-term holders, becoming a strong motivation to drive the entire ecosystem.

- The Korean and Chinese communities are extremely vibrant with explosive volume, while the Vietnamese community, although only a little over a month old, has made quite an impression with many online and offline activities. Although this phase of development in Vietnam is quite challenging, I hope the team will keep steering steadily and continue to spread practical values for everyone.

4️⃣ Partnerships

Big players 🤭

- KaitoAI: integrating data & common rankings for traders → expanding analysis use cases.

- Nansen, Cookie3, Hyperliquid: all have strategic partnerships, bringing Defi App into the global DeFi ecosystem.

- Notably, Binance Listing Watch: many leaks suggest that $HOME is on the list for official listing.

5️⃣ Notable Metrics

- Price: $HOME is currently trading at $0.038.

- Mcap: 103.2 million USD.

- 24h Volume: ~ 17.4 million USD (top volume in mid-cap DeFi tokens).

- Holders: An impressive figure reaching ~77,000 addresses, with a total supply of 10 billion tokens (6.55 billion minted).

The latest developments in DeFi👇

Nasdaq filed with the SEC to bring tokenized stocks on-chain

Pendle surpassed $12b in TVL for the first time

Forward Industries raised $1.65 billion for its SOL treasury strategy

SEC Chair announced plans to make ICOs legal again

Native Markets, Ethena, Sky, Frax, Paxos, and Agora joined the race to get Hyperliquid's USDH stablecoin ticker

Avail launched 1-click cross-chain swaps via Avail Nexus

Falcon Finance announced its community sale on Buidlpad. The public sale for its token called $FF will start on Sept. 16

Anoma introduced its tokenomics and its token called XAN

MegaETH announced MegaUSD, its own stablecoin built in partnership with Ethena. MegaUSD will be backed by Blackrock’s BUIDL RWA fund

Ethena partnered with Binance to integrate USDe into the exchange. USDe will be available as collateral for futures trading, and it will also be listed for spot trading

DeFi App released a staking upgrade that gives HOME stakers up to 50% extra in Bonus $HOME. HOME stakers will also continue to earn XP multipliers

Resolv announced its Season 3 points program

INFINIT V2 public beta went live on HyperEVM

Linea released its token called LINEA and its airdrop claiming portal

Stripe introduced Tempo, a L1 blockchain for stablecoin payments

Turtle, the liquidity distribution protocol, expanded to Solana and TON

Multipli introduced Crystals - enabling yappers to monetize their yaps for Multipli. Crystals are earned based on the mindshare in the Multipli x Kaito leaderboard

If you enjoyed reading this, a like and a retweet would be much appreciated🫡

About Home (HOME)

Learn more about Home (HOME)

Top Strategies to Use Home Equity for Investment Property Purchase

Unlocking the Power of Home Equity for Investment Property Purchase Investing in real estate is a proven strategy for building long-term wealth, and leveraging home equity can be a game-changer for fu

Sep 06, 2025|OKX

Rising Home Prices and Regional Trends: Navigating the Housing Market in 2023

Towns TOWNS Price: A Comprehensive Guide to Market Trends and Insights Introduction: Understanding the Dynamics of Towns TOWNS Price The cryptocurrency market continues to evolve, and Towns (TOWNS) ha

Aug 04, 2025|OKX

OKX and Manchester City Celebrate Sleeve Partnership with AI-Generated ‘Year 3000’ Murals in Manchester Ahead of 2023-24 Home Opener

DUBAI, UAE, 18 AUGUST 2023 - OKX , a leading Web3 technology company and Manchester City's official sleeve partner, is proud to announce that it has transformed the passion of Manchester City fans int

Apr 24, 2025|OKX

Home FAQ

What is cryptocurrency?

Cryptocurrencies, such as HOME, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as HOME have been created as well.

Can I buy HOME on OKX?

No, currently HOME is unavailable on OKX. To stay updated on when HOME becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of HOME fluctuate?

The price of HOME fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.