Odds of Cardano Price Reaching $3: These 3 Signs that Say Yes

Key Insights:

- Cardano price jumped 33% weekly and 12% daily, showing strong momentum.

- Whales bought 200M+ ADA as OBV, and open interest spiked.

- ADA price fractal from 2021 points to $3 if $1.34 breaks.

Cardano (ADA) price is rising again. In just 7 days, its price went up more than 33%. Over the past 24 hours alone, the Cardano price jumped over 11%.

That’s a big move for any cryptocurrency. Many other coins have gone up, but then quickly corrected. Cardano seems to be holding strong. So now the crypto community is asking: Can ADA reach $3 this time? A few clear signs say yes.

A big reason for the excitement is news about a possible Cardano ETF.

ETF means Exchange Traded Fund. It lets big and small investors buy Cardano like a stock. You don’t need a crypto wallet. You don’t need to use a crypto exchange. It becomes easy for anyone to invest in ADA.

Grayscale, a large investment company, has filed to create this Cardano ETF. This shows they think more people want to invest in Cardano long-term, even without direct crypto exposure.

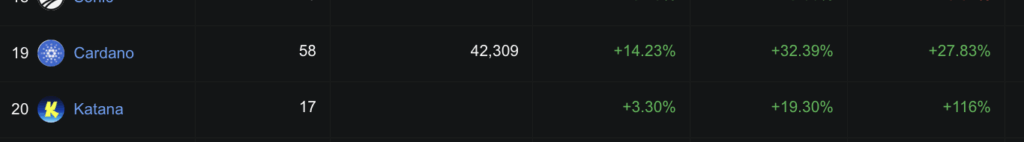

In the past week, activity on Cardano DeFi apps has gone up over 32%. More users are joining, and the number of active wallets is rising fast. More real-world use often supports a price rally.

Whales Buying, Volume Up, Cardano Price Dips in Short Term Though

The next reason ADA looks strong is the whale buying spree.

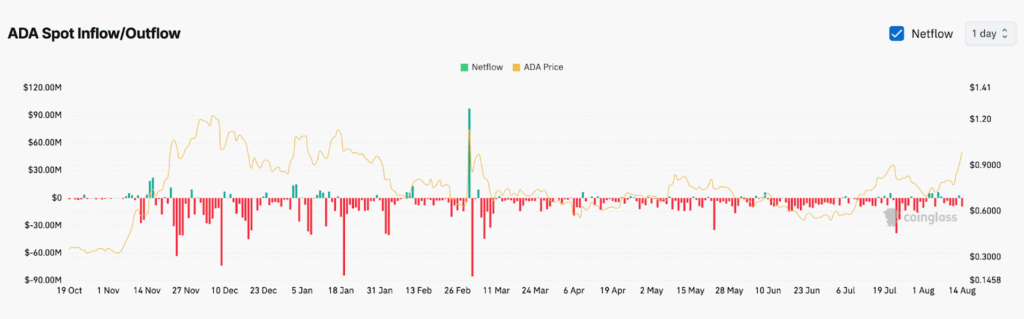

Whales are wallets that hold a lot of ADA. These are people or firms with deep pockets. When they buy, it often means they believe the price will go up.

In the last few weeks, whales bought over 200 million ADA. That’s a big sign. They do not buy this much just to sell it soon. Most whales buy and hold for a longer time.

Also, many traders are taking ADA off exchanges. That is called a negative net exchange flow. It means people are sending coins to wallets, not to exchanges. That usually means they want to keep it and not sell quickly.

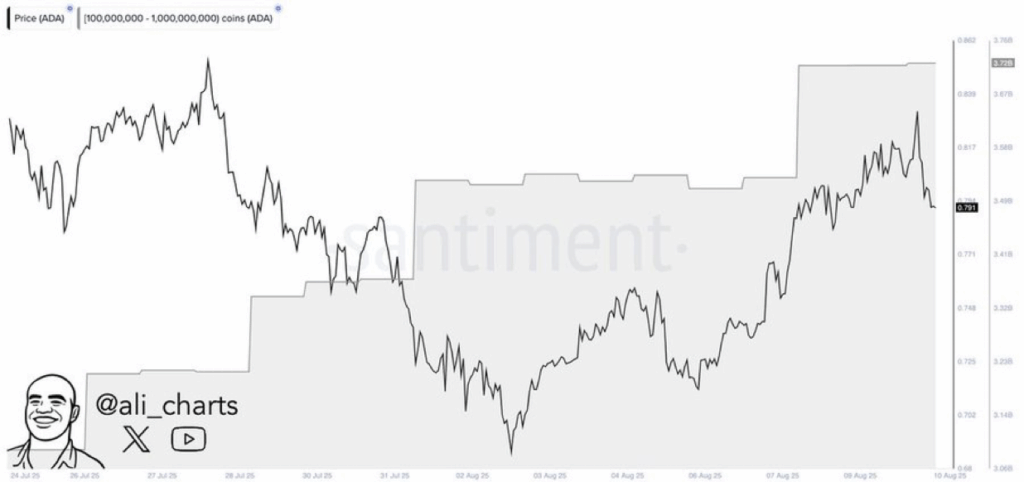

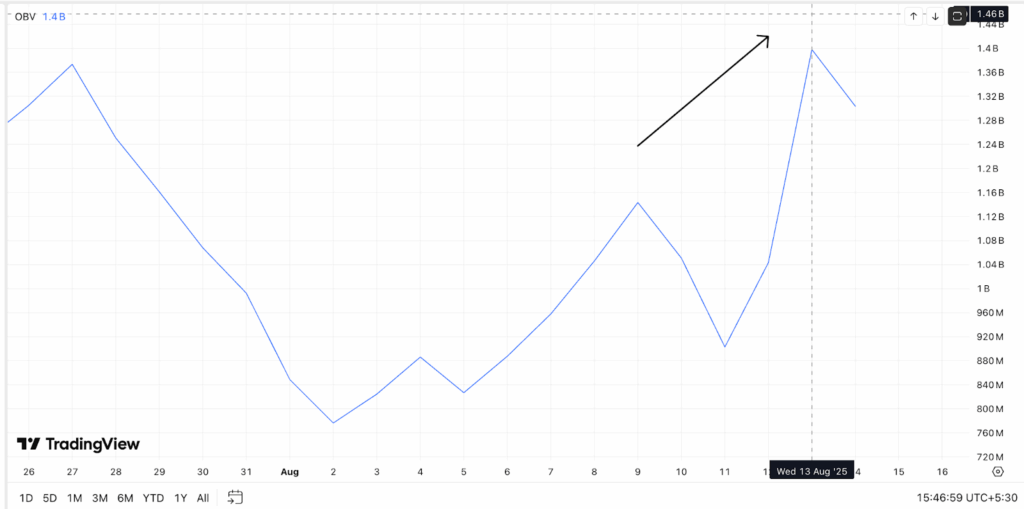

We also need to check volume. High price with low volume can be fake. But ADA’s rally is backed by rising OBV, or On-Balance Volume.

OBV is a tool that adds volume on days the price goes up and subtracts volume when the price drops. If OBV goes up, it shows buying interest is real.

Cardano’s OBV has made new highs. So, the rally seems strong and backed by real buyers.

Open Interest is also up. It means more traders are placing bets on ADA using futures contracts. That usually means growing excitement. ADA’s open interest is close to its yearly high.

A Familiar Cardano Price Pattern May Point to $3

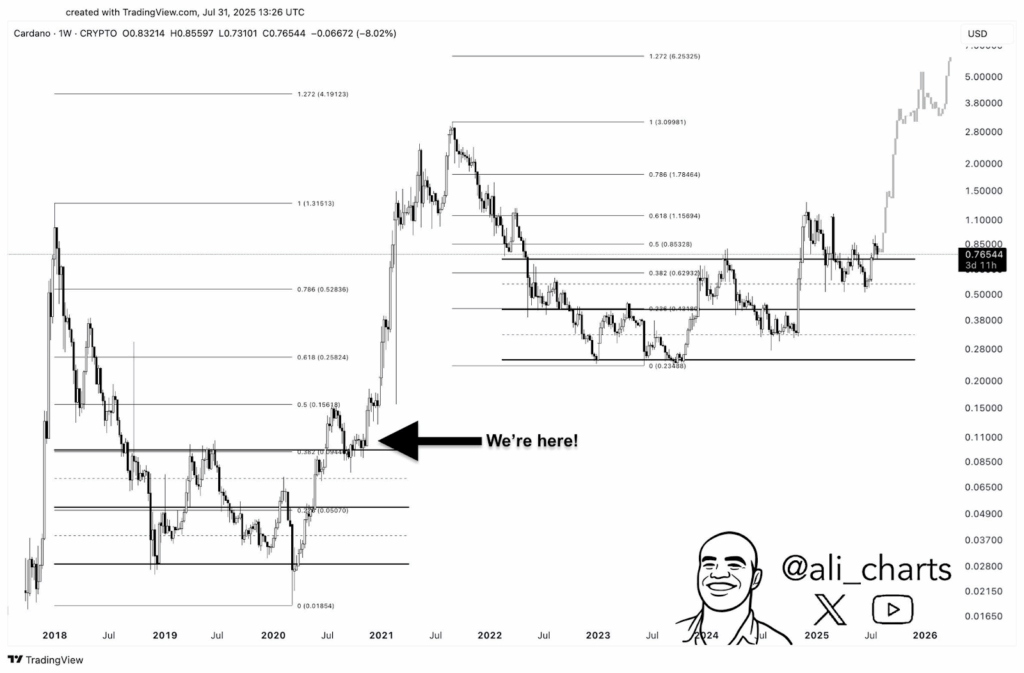

ADA’s chart looks like it did back in 2021, when it shot up big. This kind of setup is called a fractal. A fractal is a pattern that repeats itself over time.

Back in 2021, ADA broke above a resistance level, then jumped by over 200%. Right now, the chart shows a similar pattern forming again.

The most important number now is $1.34. This is called a resistance level. If ADA can go above this level and stay there, traders may expect a big rally.

Based on the old pattern, the next big target could be $3. That might not happen in one day.

ADA’s price rally is not just random. It has support from ETF news, DeFi growth, and whale buying. The chart looks like 2021 again. If $1.34 breaks, $3 may be the next stop.

Yet, if the rally cools down and the Cardano price falls under $0.78, the bullish view might slow down a bit.

The post Odds of Cardano Price Reaching $3: These 3 Signs that Say Yes appeared first on The Coin Republic.