New assets in the cryptocurrency circle: Will the stock token market be the next flashpoint?

Author: XinGPT

Recently, companies such as Robinhood, a U.S. listed company, and Kraken, a cryptocurrency exchange, have launched stock token businesses.

Robinhood is leading the wave of equity token innovation

Fintech giant Robinhood has launched its highly-anticipated Stock Tokens in the European Union, aiming to provide European users with a new way to trade stocks. This innovative service allows users to buy and sell derivatives that track stock prices in US dollars, and the euro conversion is automatically done by Robinhood in the background, but a 0.1% exchange fee is charged.

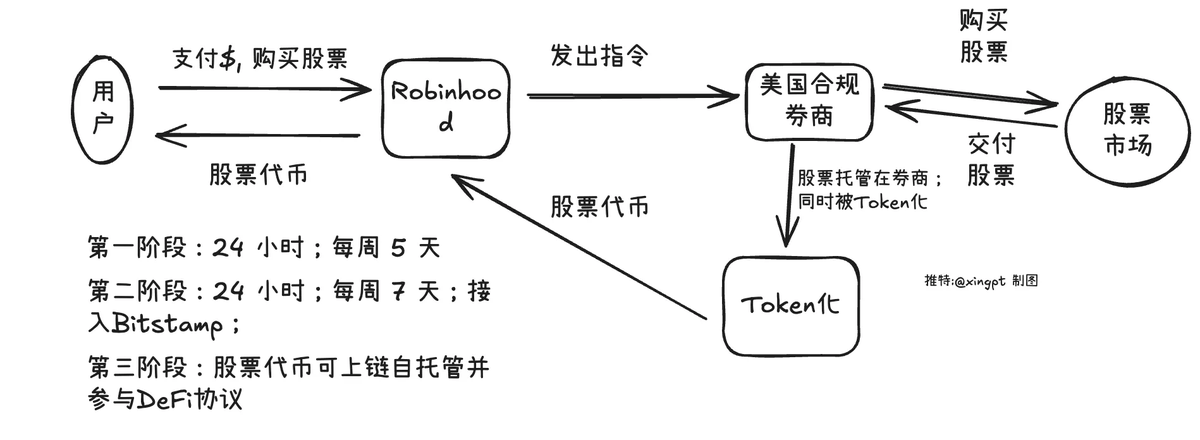

The stock tokenization process is shown in the following diagram:

1. Hosting and mapping mechanisms

The core mechanics of Robinhood's stock token lie in its unique custody and mapping approach. These tokens are price-following derivatives (note that they are not a mapping of securities) and their underlying assets are securely held in Robinhood's European account by a US-licensed institution. Robinhood Europe is responsible for issuing these contracts and recording them on the blockchain. It is worth noting that due to the derivative nature of stock tokens, the corresponding securities can only be held in custody in Robinhood accounts and cannot be redeemed directly by users.

2. Regulatory compliance under the EU MiFID II framework

Robinhood stock tokens are offered as derivatives contracts under the MiFID II (Markets in Financial Instruments Directive II) framework. The Bitstamp exchange, which Robinhood previously acquired, holds an MFT (Multilateral Trading Facility) license, which is in line with the EU's licensing requirements for companies that provide derivatives trading services. This means that Robinhood's services are regulated in the European Union, providing users with a certain level of compliance. However, it is important to note that the Robinhood stock token is currently only available in the EU region and is not tradable in the United States.

3. Transaction Hours and Corporate Actions

In terms of trading hours, the first phase of Robinhood stock tokens is available for trading five days a week from Monday 02:00 CET/Daylight Saving Time to Saturday 02:00.

In the case of corporate actions (e.g., dividends, dividends, splits, etc.), Robinhood will execute on behalf of you:

-

Position adjustments: For operations such as stock splits, reverse splits, ticker symbol changes, or splits, the number of your stock tokens may be automatically adjusted in your account to reflect changes in the underlying stock.

-

Cash distributions: For events such as mergers, acquisitions, liquidations or delistings, you may receive cash distributions denominated in euros based on the event.

-

Dividends: Cash dividends will be processed automatically. You will receive dividends paid in euros and will be shown as a cash distribution in the transaction history. There are no exchange fees for dividend payments, but withholding taxes may apply depending on your region.

-

In terms of capital turnover, the funds obtained from the sale of stock tokens can be used immediately for trading and can be withdrawn on T+1 day.

4. Stock tokens are on-chain

The issuance of Robinhood's stock tokens leverages blockchain technology, which is based on the Arbitrum blockchain in the early stage, and plans to migrate to Robinhood's own Layer 2 blockchain in the future. This shows Robinhood's commitment to leveraging blockchain technology to improve transaction efficiency and transparency.

Robinhood's launch of the stock token will undoubtedly provide European users with more diversified investment options. However, as a new type of derivative product, users still need to fully understand its mechanism, risks and relevant regulatory requirements before participating in trading.

5. Entering the private equity market: OpenAI and SpaceX tokenization

As part of its broader cryptocurrency rollout plan, Robinhood has made private equity accessible through blockchain technology for the first time, introducing tokenized shares of OpenAI and SpaceX to European users. This milestone move is made possible by the EU's more flexible regulatory environment, which gives ordinary investors access to these private company shares, which are normally only available to insiders and high-net-worth investors.

Kraken is designed to be more open to Crypto Native

1. Escrow and Mapping Mechanisms

-

Custodian mechanism: xStocks is the responsibility of Backed Finance for the purchase and custody of real shares or ETF assets, deposited with compliant third-party custodians (such as Alpaca Securities in the US, InCore Bank in Switzerland, and Maerki Baumann). Each xStocks token is pegged to the underlying asset 1:1, and the custody process is strictly supervised to ensure asset security and transparency. The website highlights that Backed Finance's Proof of Reserves mechanism is regularly verified by Chainlink to ensure that tokens match real assets.

-

Mapping mechanism: xStocks are SPL tokens based on the Solana blockchain and represent fractional ownership of the underlying stock or ETF. The tokenization process is achieved through smart contracts, where prices are synchronized in real-time with traditional markets through Chainlink oracles. Users can transfer xStocks to a Solana-compatible wallet (e.g., Phantom) to use as trading, liquidity mining, or collateral in decentralized finance (DeFi) protocols (e.g., Raydium, Jupiter, Kamino). In particular, the official website states that xStocks can be redeemed at any time for the cash value of the underlying asset, and the settlement process is fast and efficient.

-

Additional details: xStocks supports fractional ownership, with a minimum investment threshold as low as $1, which is suitable for retail investors. Tokenization eliminates the cumbersome process of traditional brokers, reducing the cost and delay of cross-border investments.

2. Regulatory Compliance License

-

Compliance framework: Kraken and Backed Finance actively work with global regulators to ensure xStocks comply with local laws and regulations. The official website clearly states that Kraken implements a strict KYC and AML process, and all users are required to pass identity verification. The issuance and trading of xStocks is subject to Backed Finance's regulatory framework, the terms of which can be found in the backed.fi's Base Prospectus.

-

Regional restrictions: xStocks is currently only available to non-US clients and does not support users in markets such as the US, Canada, UK, EU, and Australia, with target markets including Europe (in parts), Latin America, Africa, and Asia. The official website does not explicitly mention users in Chinese mainland, but the X post indicates that users in Chinese mainland are not restricted from registration and need to be further verified.

-

Regulatory Challenges and Prospects: The official website acknowledges that tokenized securities face a complex international regulatory environment. Kraken is in communication with regulators with plans to gradually expand supported jurisdictions, and Kraken emphasizes its compliance-first strategy to mitigate legal risks.

-

Additional details: Kraken holds a MiCA (Crypto Asset Market Regulation) license in the European Union, which supports its compliant operations in Europe and could set the stage for future expansion of xStocks in parts of Europe.

3. Transaction Hours and Corporate Actions

-

Trading Hours: xStocks supports 24/5 trading (Monday to Friday), breaking through the traditional U.S. stock market limit of 9:30-16:00 (EST). The official website confirms that xStocks can be traded on the Kraken platform or on the Solana chain through compatible wallets such as Phantom. During the market break (weekends and U.S. holidays), on-chain trading will continue to take place, and prices may fluctuate like a "predictive market" based on the last closing price provided by Chainlink oracles and market supply and demand. Kraken plans to trade 24/7 in the future.

-

Handling of corporate actions: The official website clarifies that xStocks holders do not enjoy the voting rights of traditional shareholders or the right to participate in shareholders' meetings. Dividends are indirectly distributed through the token price adjustment mechanism, which is equivalent to airdropping equivalent tokens to users according to the proportion of their positions to ensure the transmission of economic benefits. Other corporate actions (e.g., stock splits, mergers) are handled by Backed Finance, and the number or value of tokens is adjusted accordingly to reflect changes in the underlying assets.

-

Additional details: The official website emphasizes that xStocks' on-chain transactions support instant settlement (T+0), which greatly improves efficiency compared to the T+2 settlement cycle in traditional markets. Participation in the DeFi ecosystem (e.g., collateral at Kamino Lend) further enhances the flexibility of xStocks, but liquidity pool depth may be limited during the market break, so be wary of slippage risks.

4. Supported blockchains and issuances

-

Supported blockchains: xStocks is currently based on the Solana blockchain and uses the SPL token standard. According to the official website, Solana was selected as the initial platform due to its high throughput (thousands of transactions per second), low transaction cost (about $0.01 per transaction), and mature ecosystem (supporting DeFi protocols such as Raydium and Jupiter). Kraken and Backed Finance plan to expand xStocks to other high-performance blockchains such as Ethereum or Arbitrum in the future to improve interoperability and market coverage.

-

Issuance: xStocks, issued by Backed Finance, will launch the first 60 U.S. stocks and ETFs, including Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), Microsoft (MSFT), Google (GOOG) and SPDR S&P 500 ETF (SPY). According to the official website, Kraken will list xStocks on the platform from June 30, 2025, and plans to continue to increase the types of assets supported. xStocks are available on both Bybit and Solana DeFi platforms (e.g., Raydium, Kamino Swap), expanding market coverage.

-

Background and Ecology: Backed Finance was founded by the original DAOStack core team and invested by Coinbase and other institutions, focusing on tokenized financial assets. The xStocks offering is supported by partners such as Chainlink (price oracle), Raydium, Jupiter, and Kamino, forming the "xStocks Alliance" that provides liquidity, technology, and ecosystem integration for the token. The official website emphasizes that xStocks is not only Kraken's business expansion, but also a milestone in the integration of traditional finance and blockchain.

-

Additional details: The official website points out that the issuance volume of xStocks is dynamically adjusted and is linked to the purchase and redemption of the underlying assets. Users can trade xStocks in fiat, crypto, or stablecoins (such as USDT) through the Kraken platform, with an investment threshold as low as $1, which is suitable for retail investors around the world.

In contrast, Robinhood has better coverage of compliance and mainstream populations, and provides unlisted stocks; Kraken, on the other hand, covers more regions and supports native on-chain transactions and DeFi protocols, making it more crypto native. To use a misguided analogy, Robinhood is taking a bit like USDC, while Kraken is aiming for USDT; A temple, a grassroots.

For startup teams, participating in the issuance of new stock token assets may not necessarily be able to compete with two large companies, but at present, there are two types of opportunities:

-

The coverage of subdivided groups or regions, similar to the logic of replacing Tiger Brokers, cannot be covered by traditional brokerages, but can be reached by crypto;

-

Financial product innovation, in the stock token is included in the asset pool, entrepreneurial teams can provide new derivative assets and trading strategies to differentiate from large exchanges, such as highly leveraged contracts, leveraged ETFs, etc.