Compute Labs Launches AI Infrastructure Tokenization Product with 30% APY Expected

On June 18, 2025, startup Compute Labs announced that it has partnered with NexGen Cloud, an enterprise-grade AI cloud service provider, to launch a $1 million "Public Vault" to open up industrial-grade GPU assets to investors through tokenization, with an expected annualized yield of 30% in the first year, and the proceeds will be paid in the form of stablecoin USDC.

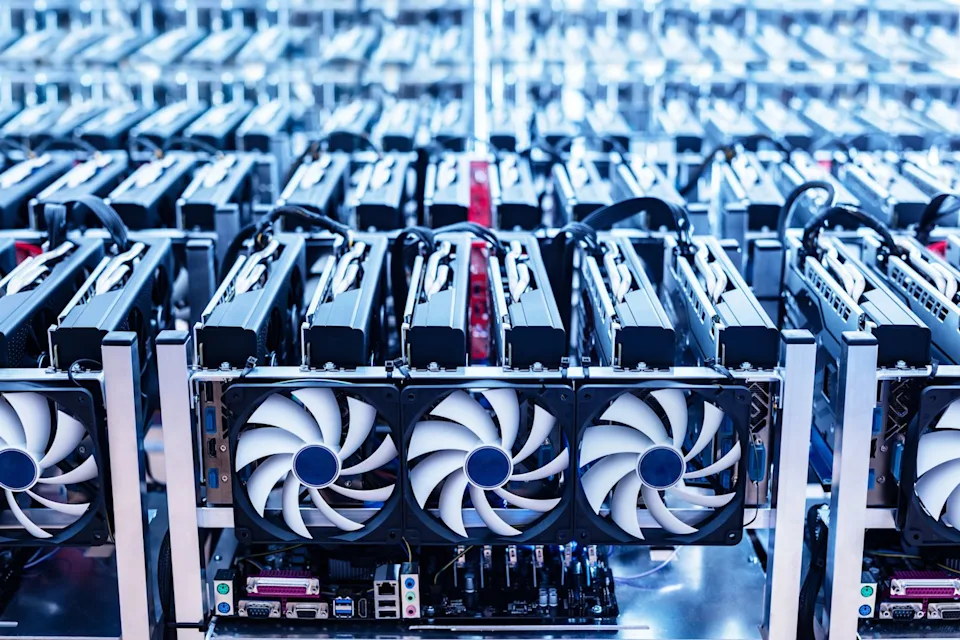

According to reports, the project will split and tokenize high-performance NVIDIA H200 GPUs, enabling investors to participate in the revenue distribution of enterprise-grade AI computing infrastructure at a cost starting at a cost of a few hundred dollars, without having to directly manage hardware or take technical operation and maintenance risks. The market price of each H200 GPU is about $30,000, and it is mainly used for AI model training and inference.

According to Compute Labs, this is the first time that real AI computing power revenue is directly returned to investors in the form of stablecoins, aiming to break the monopoly pattern of AI infrastructure by ultra-large cloud vendors such as AWS. Funds will be raised through NexGen Cloud's investment subsidiary, InfraHub Compute, and will be used to purchase GPU equipment, which will then be leased to data center operators with idle space through an agreement, and the rent will be returned to investors minus energy and hosting fees.

In terms of specific operation, the project adopts the token + NFT model for the registration of computing power ownership and income distribution, and Compute Labs charges a unified 10% fee, covering asset tokenization, management and income processing.

Nikolay Filichkin, commercial director at Compute Labs, said the target partners include small and medium-sized data centers, "mom-and-pop shops in the data center space." In addition, the project has received institutional investments from Protocol Labs, OKX Ventures, CMS Holdings, and Amber Group, among others.

Youlian Tzanev, co-founder and chief strategy officer of NexGen Cloud, said the model is expected to drive the AI market away from over-speculative and supply-demand-driven rational pricing by giving clear, tradable value to each unit of GPU compute cycle.