Circle is about to be listed, which targets are worth paying attention to?

world's second-largest stablecoin giant, filed a prospectus at the end of May to list on the Nasdaq at an estimated valuation of $5.4 billion.

Unexpectedly, a few days later, perhaps because of the popularity of the stablecoin + RWA concept, Circle announced that it had raised its valuation from $5.4 billion to $7.2 billion.

Since the beginning of this year, the RWA concept has been significantly different from previous years, the favourable stablecoin policy of the United States and Hong Kong, China, the attention of Wall Street to the RWA project represented by BlackRock, and the current situation of a lot of old money entering the stablecoin, so that the concept of RWA and stablecoin quickly went out of the circle, and even the stablecoin concept of Hong Kong stocks and A-shares has risen to the limit.

As the third giant in the cryptocurrency industry to have a native NASDAQ IPO (after Coinbase and Antalpha), what are the relevant targets in the cryptocurrency circle that can be speculated?

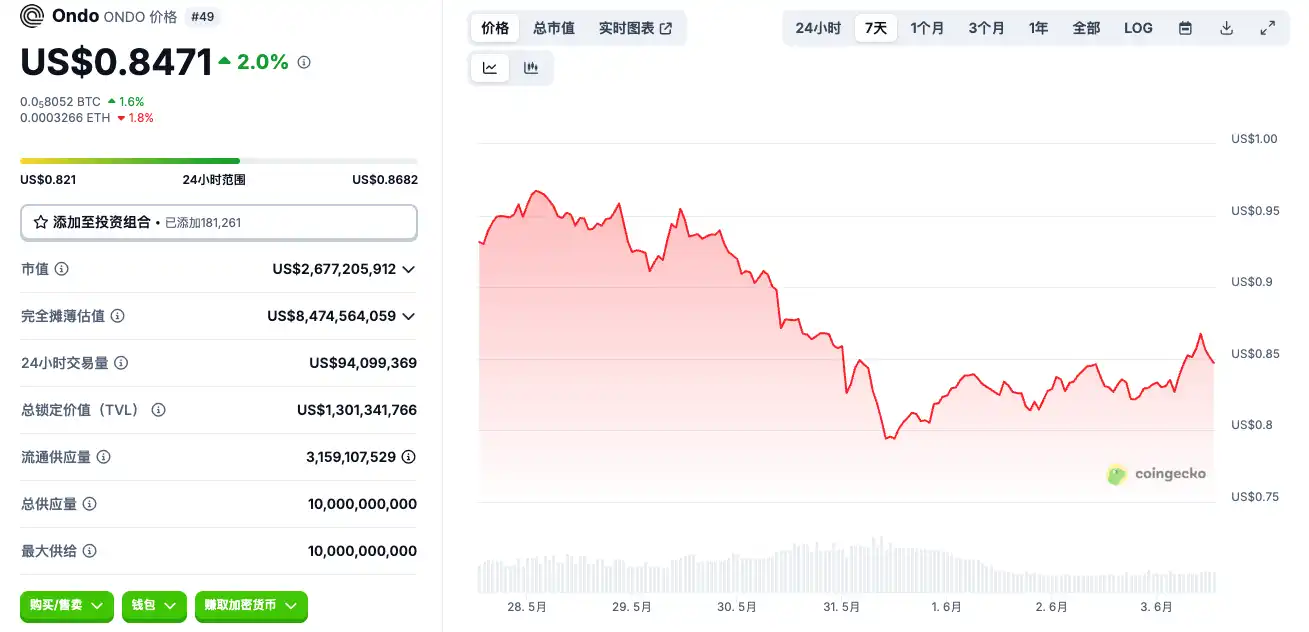

ONDOBlackRock

announced at the end of May that it had bought 10% of its shares in the Circle IPO to become the new shareholder of Circle, and BlackRock's most important partner on the RWA track is Ondo. OUSG, a U.S. bond token issued by Ondo, uses the BlackRock BUIDL fund as one of the core underlying assets, and users buy OUSG equivalent to indirectly holding a share of the BlackRock U.S. Treasury fund.

The problem is that the market cap is a bit high, though, and ONDO now has a market cap of $2.6 billion.

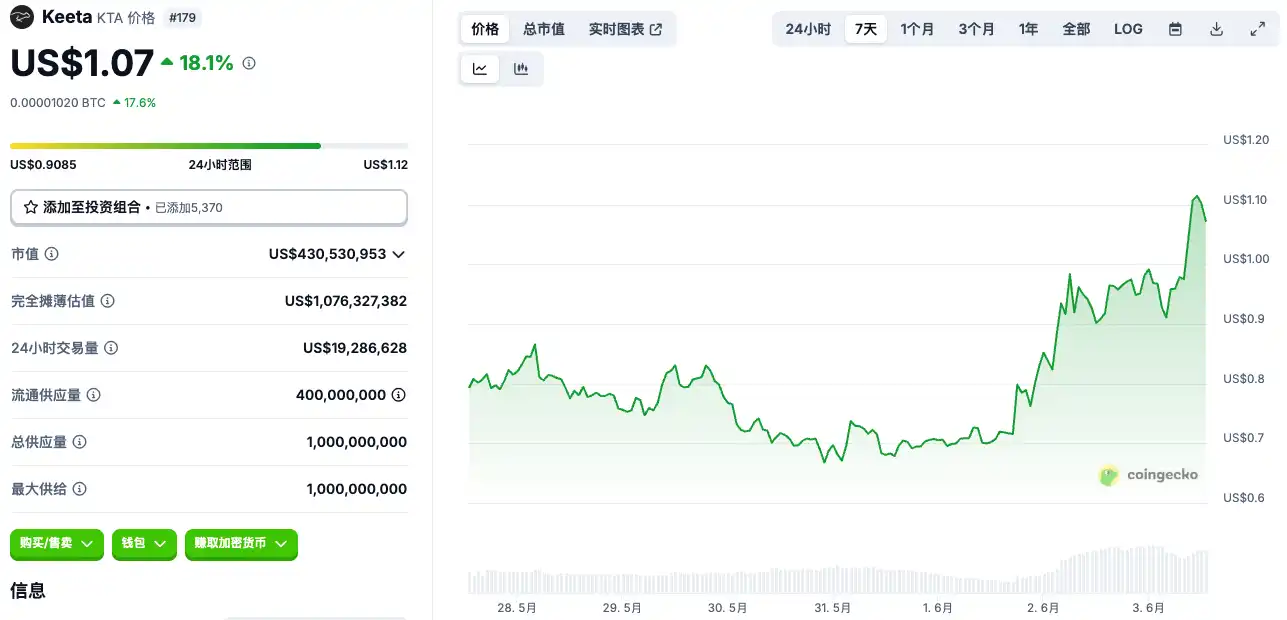

KTA

Needless to say, the close relationship between Coinbase and Circle goes without saying, so in addition to the benefits of COIN, the listing of Circle can also explore the public chain Base. Funding has already given the answer, and the RWA public chain KTA issued on Base is 10 times a month and now has a market capitalisation of $400 million. In hindsight, Base+RWA+small market capitalisation, it is indeed very suitable for funds to choose KTA as a leader.

ENA

Although it has nothing to do with Circle, it is the most preferred target for the stablecoin concept, and it has also experienced a lot of speculation. Coinbase urgently put ENA on the shelf a few hours ago, and it seems that it is also anticipating the movement of funds. With a market cap of $1.9 billion, it seems to be slightly better than ONDO.

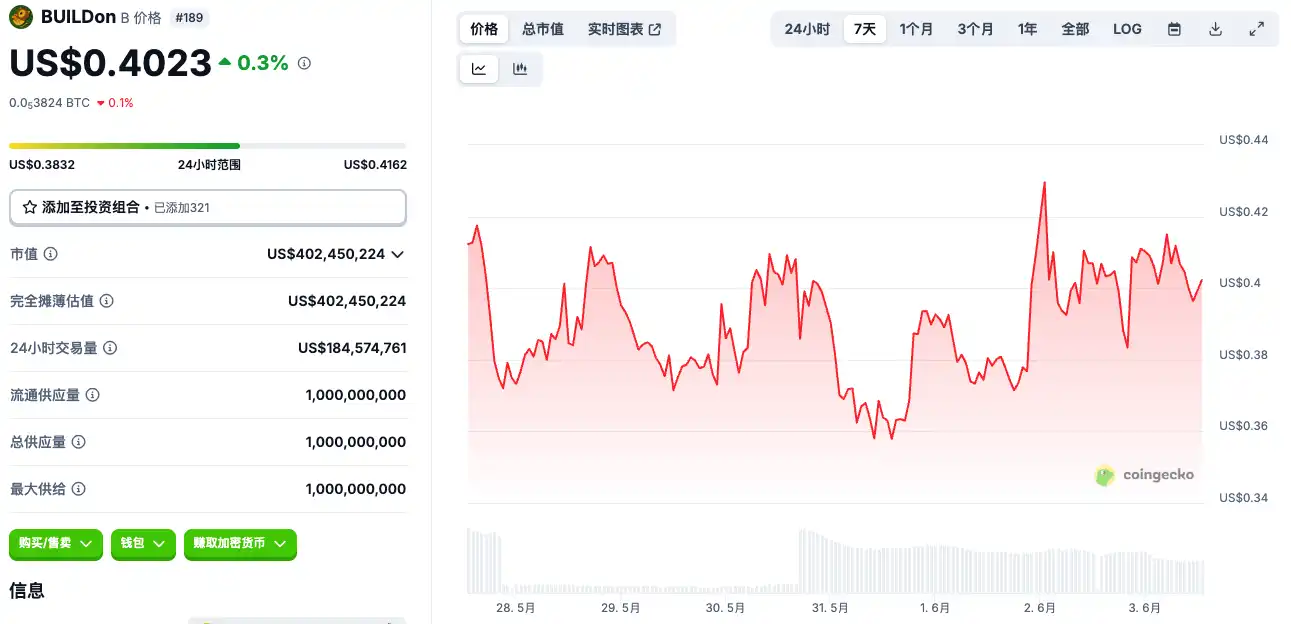

B

This is a very secretive route. Previously, Rhythm BlockBeats asked @vapor 0x to do some USDC analysis, mainly because the additional issuance of USDC is different from the past, but I don't know where these dollars go, which is very strange.

@vapor 0x combed through and concluded that from January 2024, Circle's treasury address will continue to transfer USDC to Binance, most likely in preparation for the IPO and increase activity. "Even more dramatically, on January 31, 2024, the same day as the first large USDC transfer, the Binance Earn platform launched a limited-time offer including USDC, and the overlap in timing is almost impossible to coincide," he said.

Therefore, with the blessing of USDC+USD 1, BSC's B, a $400 million stablecoin meme, I don't know if it will be selected by funds.