After Spark, Sky bets on Grove, RWA upstart debuts?

By Alex Liu, Foresight News

The Sky ecosystem (formerly MakerDAO) launched Grove Finance, a new decentralized finance protocol, on June 25 and received a $1 billion initial funding grant from the Sky ecosystem to drive investments in tokenized credit assets, primarily collateralized loan vouchers (CLOs).

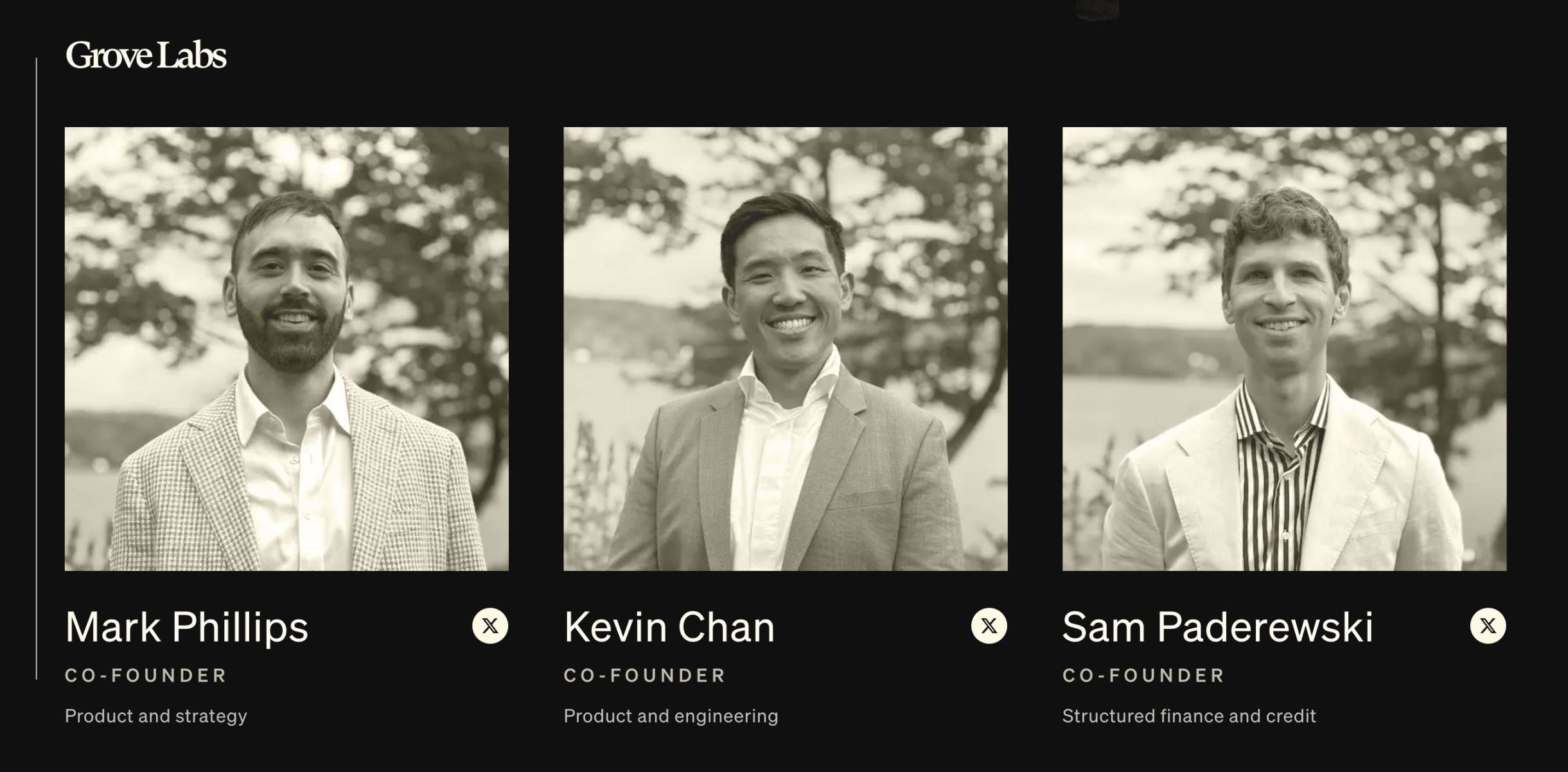

Grove is incubated by Grove Labs, a division of blockchain institution Steakhouse Financial, and its co-founders include Mark Phillips, Kevin Chan, and Sam Paderewski, among others. The core team has a rich background in traditional finance and DeFi, and has worked for Deloitte, Citigroup, BlockTower, Hildene and other institutions.

Steakhouse Financial has previously played a key role in bringing real-world assets (RWAs) to the Sky ecosystem, so the launch of Grove is seen as another important attempt by Sky to connect more traditional credit markets to DeFi.

Grove's product positioning and technology architecture

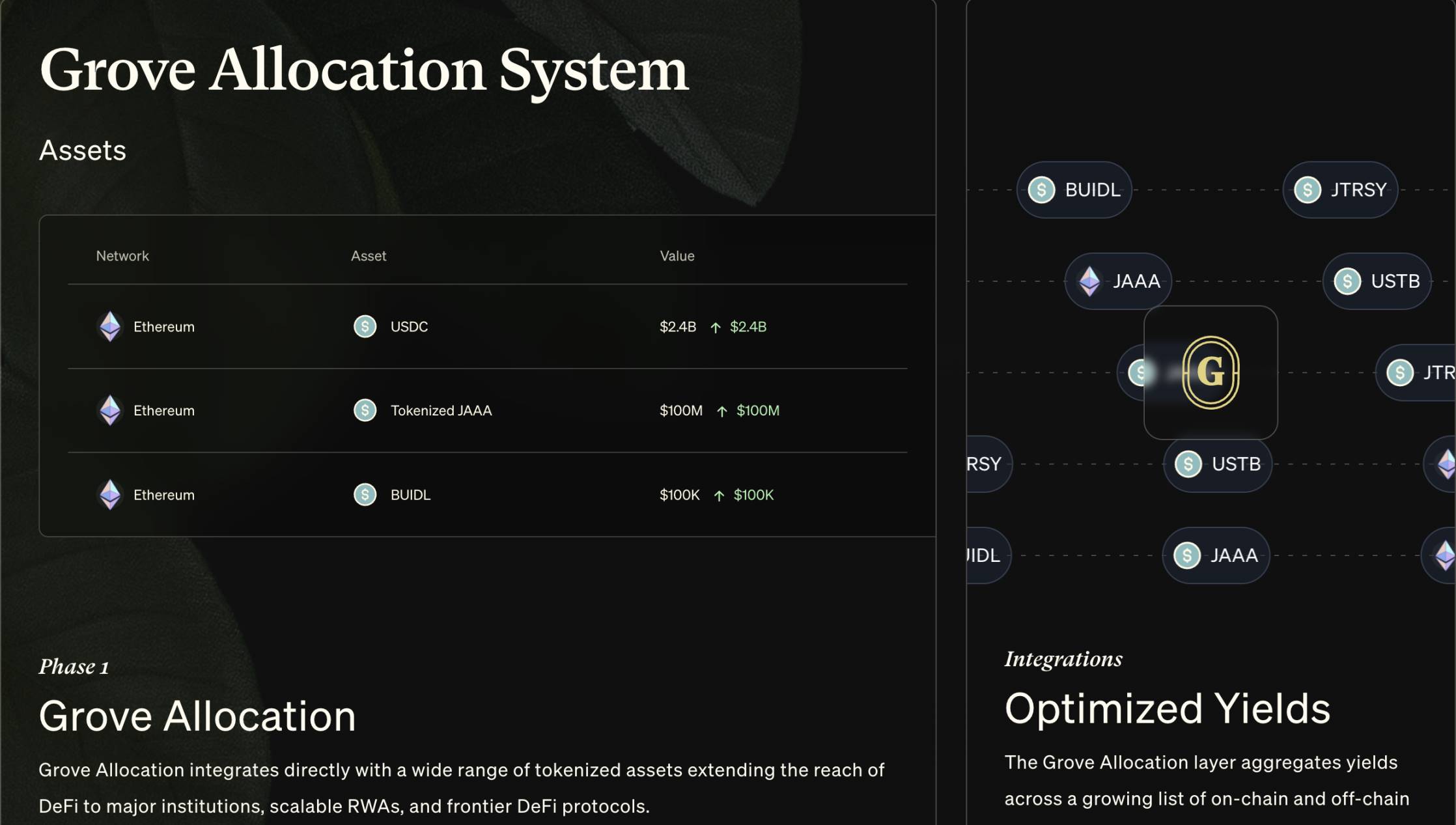

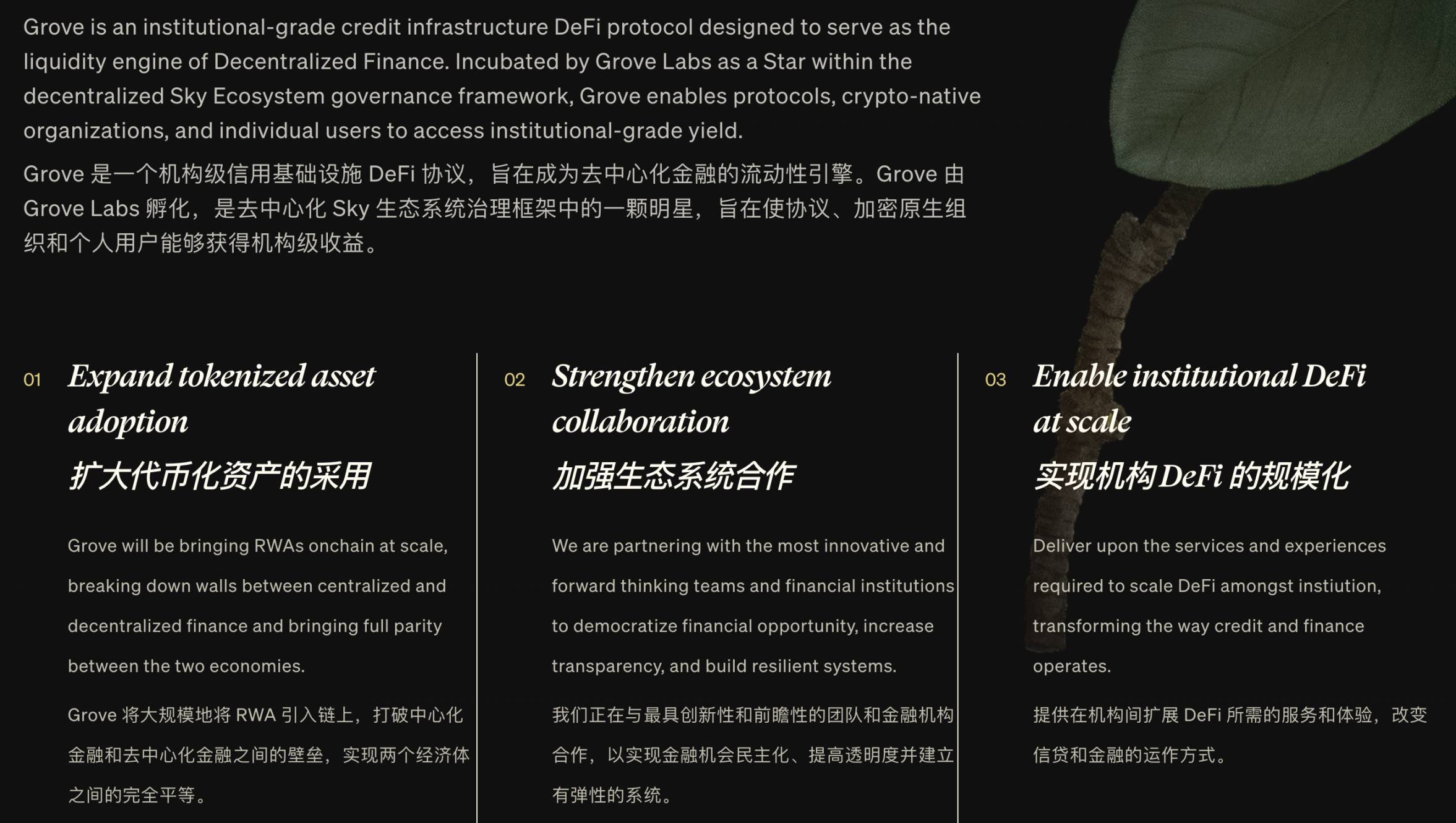

Grove is committed to building an "institutional-grade credit infrastructure" that functionally connects decentralized finance with the regulated traditional credit asset market. The protocol allows DeFi projects and asset managers to route idle funds through on-chain governance and invest in credit products that have undergone strict compliance (currently focusing on AAA-rated CLO strategies) to earn yields independent of crypto market volatility.

According to reports, the Sky ecosystem will invest start-up capital in the Anemoy AAA-rated CLO Strategy Fund (JAAA), managed by Janus Henderson (Aberdeen Standard Investments), which was launched in partnership with the Centrifuge platform and is the first AAA-rated CLO strategy to be tradable on-chain.

The Grove Protocol operates in an open-source, non-custodial form, aiming to build a "DeFi-traditional financial capital channel" to improve capital efficiency, reduce transaction friction, and provide programmatic and diversified fund allocation capabilities for asset managers and DeFi protocols. According to official information, Grove can establish new global distribution channels for asset managers, provide high-end on-chain capital partnerships for various protocols/DAOs, and enhance credibility and sustainability for the entire DeFi ecosystem.

In a nutshell, Grove's technology architecture revolves around on-chain governance and automated capital routing, transforming stablecoins or other idle capital held by crypto protocols into institutional-grade credit asset investments to optimize returns and risks.

Similarities and differences between Grove and Spark

The Spark protocol in the Grove ecosystem and the Spark protocol in the Sky ecosystem both belong to the autonomous sub-unit (subDAO, also known as "Star") under MakerDAO's (Sky) "Endgame" transformation plan, but the positioning and mechanism of the two are obviously different.

Launched in 2023, Spark is the first Star in the Sky ecosystem, featuring a revenue engine of "stablecoins + RWAs". Relying on the DAI/USDS stablecoin reserve issued by Sky, Spark has launched products such as SparkLend, Spark Savings and Spark Liquidity Layer (SLL). Users can deposit USDS, USDC, or DAI to participate in lending or farm earnings, and allocate funds to asset pools such as DeFi lending, CeFi lending, and tokenized treasury bonds through the dynamic risk engine, so as to obtain relatively stable income.

Deployed across multiple chains, Spark currently manages more than $3.5 billion in stablecoin liquidity, and has launched its native governance token, SPK (and airdropped to the community), where users can earn additional rewards by staking SPK, participating in governance, and Community Boost. With an emphasis on transparency and auditability, the Spark team targets a slightly higher level of return than U.S. Treasuries to meet the need for risk-adjusted returns

In contrast, Grove is more focused on large amounts of institutional-grade credit. Its first deployment of US$1 billion to connect with Aberdeen's AAA-rated CLO fund demonstrates that Grove is targeting users with larger capital and higher income stability requirements, such as asset managers and DeFi protocols. Grove has just been launched, and it is too early to launch a governance token, and its incentive mechanism is mainly reflected in allowing DeFi projects to "revitalize idle reserves and obtain returns on higher-quality assets".

To put it simply, Spark can be seen as a yield product for ordinary stablecoin holders in the Sky ecosystem, while Grove is an infrastructure protocol that builds on-chain credit channels for large-scale projects and institutions. Both are part of Sky's "Endgame" strategy, which focuses on introducing real assets on-chain: Spark enriches stablecoin yields with RWAs such as treasuries, and Grove enriches DeFi asset allocation with credit assets such as secured loans.

It can be seen that Grove is on the RWA track, focusing on completing the institutional credit puzzle outside the Spark system.