4E Labs|Robinhood Brings U.S. Stocks On-Chain, What Does This Mean for Crypto?

Author: X Mere

Over the past few years, the crypto industry has been trying to connect with real-world assets (RWAs), but most of them have stayed at the tokenization of "niche assets" such as bonds, real estate, and art. And Robinhood's latest move may be the watershed of "on-chain mainstream assets" in the true sense.

ANew Era of U.S. Stock Tokenization: Robinhood's Crypto Breakthrough and Global AmbitionsOn

June 30, 2025, Robinhood launched an epoch-making tokenized stock trading service in Cannes, France, allowing EU users to trade U.S. stocks through crypto for the first time This is a substantial step forward in the integration of equity securities and Web3. In this plan, Robinhood will issue more than 200 mainstream U.S. stocks and ETFs into 1:1 pegged on-chain tokens (Stock Tokens), including Apple, Nvidia, Tesla, Google, etc.; At the same time, it includes indirect token exposure products of unlisted companies such as OpenAI and SpaceX.

As a brokerage with a U.S. securities license and EU MiCA compliance qualification, this move is not only a technical breakthrough, but also a tipping point for the integration of traditional finance (TradFi) and crypto finance (DeFi).

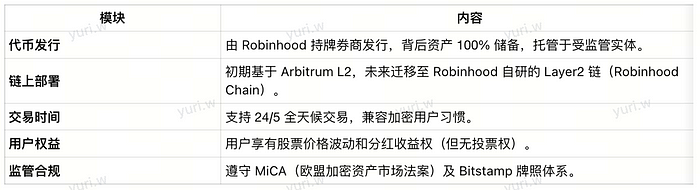

1. Robinhood Stock Tokenization Mechanism

🚨 Note: Tokenized stocks ≠ traditional stocks. OpenAI and SpaceX have officially stated that they are not cooperating with Robinhood, and that this type of asset is only an indirect simulated position and has no equity relationship.

2. Technical Path and Ecological

Layout Phase 1: Deploying Stock Tokens on Arbitrum

- uses Arbitrum as the infrastructure to quickly integrate with EVM, Ethereum wallet, DEX and other functions.

- All tokens can be viewed on-chain records (e.g. etherscan).

- The liquidity pool plans to connect to protocols such as Uniswap and SushiSwap.

Phase 2: Building Robinhood Chain (Layer 2)

- Robinhood Chain is planned to be launched by the end of the year, built on zk technology (or OP Stack).

- Realize the closed loop of Robinhood ecological assets (Stock Token, stablecoins, derivatives, RWA, staking services, etc.).

- Users don't need to switch wallet addresses to achieve "on-chain wealth management" on Robinhood Chain.

3. Regulatory Path: Fine-Grained

Paul Atkins, former chairman of the SEC, recently said, "Tokenized securities are an inevitable trend, and more clarity is needed at this time." This statement is seen by the market as one of the signals of the direction of deregulation.

4. Global Competitive Landscape: Platform Technology, Liquidity, and Regulatory Gaming

Why is Robinhood's "Licensed Broker Identity + Token Custody" model theoretically with stronger legal endorsement and user trust barriers

?

We dismantle Robinhood's stock tokenization + Layer2 strategy from six levels and the far-reaching impact it has had on the crypto industry.

1. RWA's first "mainstreaming": Making on-chain assets truly accessible to global investors

Real World Assets (RWA) has been a hot topic for on-chain asset expansion. However, in the past, most projects revolved around real estate, private bonds or art, and there were problems such as high cognitive thresholds, poor liquidity, and vague pricing mechanisms.

Robinhood directly introduces the world's most liquid, recognizable, and traded asset class – US equities – and maps them to on-chain tokens.

👀 Compare influence: you tell people "I bought art tokens", and no one understands; But to say "I bought Apple stock (AAPL) on-chain", almost everyone knows what it is.

This marks a new era of more mass, higher frequency, and more compliant RWA.

2. Compliance Demonstration: The first real-world model for institutional-grade on-chain asset

issuanceRobinhood is a US-licensed broker-dealer and one of the first compliance platforms to pass the EU's MiCA framework. This means:

- Stock tokens are not "shadow assets", but "on-chain mappings" backed by real stock custody and subject to regulatory protection;

This is very likely to become a standard path for financial giants such as BlackRock and Fidelity to enter the chain in the future, establishing a set of compliance templates for institutional-level funds to "test the waters of DeFi".

3. A revolution in the onboarding path for users: A natural transition from a stock trading app to an on-chain asset

Robinhood, once known as the "enlightenment tool for retail investors in U.S. stocks", has now begun to guide tens of millions of Web2 investors into Web3:

- Users can trade on-chain assets through Robinhood's account system without the need for wallet plug-ins;

- Support traditional payment methods for depositing, shielding complex processes such as wallets, mnemonics, and GAS fees;

- Deliver on-chain financial services through a familiar UI/UX.

This is a truly "low-threshold, high-value" user entry channel, which is expected to become the new main force of Crypto customer acquisition.

4. Layer2 New Paradigm: Not Game, Not DeFi, It's "On-chain Wealth Management"

Unlike the previous Layer2 scaling for NFT or DeFi, Robinhood Chain has a clear positioning: to serve on-chain wealth management scenarios.

- Hold stock tokens, crypto assets, and stablecoins on the chain at the same time;

- Realize diversified operations such as financial management, lending, dividends, and reinvestment;

- Provide hundreds of millions of users with a complex investment experience of "traditional wealth management + on-chain assets".

This is an unprecedented Layer2 narrative angle that has the potential to redefine the L2 paradigm.

5. Global trading hours restructured: U.S. stocks can also trade 24 hours a day?

Traditional U.S. stocks can only be traded in EST, and if you miss it, you have to wait a day. After the stock token is launched, users can achieve almost 24/5 trading liquidity on the chain, and even up to 7x24 in the future.

This is especially friendly to investors in non-US time zones such as Asia, the Middle East, and Africa, and truly achieves

"accessible access to the world's best assets for anyone, at any time".

This may also gradually affect the traditional market mechanism - causing the mainstream securities market to start to consider the possibility of optimizing the trading structure brought about by "on-chain".

6. DeFi underlying asset quality jump: market capitalization, liquidity, and trust have comprehensively improved

thecurrent DeFi market, with a large number of collaterals being ETH, stETH, LSD tokens or platform tokens, which are volatile and cyclical.

Equity tokens, on the other hand, will:

- become a more robust collateral base;

- Provide stronger endorsement support for stablecoins;

- Provide more room for creation of on-chain derivatives (e.g., options, ETFs).

This has a substantial effect on the "anti-cyclical and anti-credit risk ability" of the entire on-chain financial system.

At the end

, Robinhood's stock tokenization and Robinhood Chain are not just a product iteration or chain construction, but more like a gong to the crypto industry:

"The golden age of on-chain finance will no longer be limited to native assets, but will fully embrace the world's mainstream financial assets."

Crypto is no longer the antithesis of the financial system, but is reconstructing the logic of global asset trading with blockchain technology. In the past, we had expected BlackRock to do this, or Coinbase, Binance to do it. But now, Robinhood is the first to take a key step to break through the triple loop of compliance, users, and assets. This will be the "front door" for Crypto to enter the mainstream financial ecosystem, rather than a detour or smuggling.