Agent payments, stablecoins replacing banks, blockchain replacing existing payment systems

- Yield is not a means of appreciation, but a core part【current yields are a subsidy mechanism】

- The last mile of stablecoins is not fiat inflow and outflow, but becoming permissionless fiat; when you cannot destroy USDT, launching alternative or permissioned currencies is meaningless

- Banks filter clients, retail investors choose DeFi products

- Risk control and regulation need to be "programmable," integrated into existing business flows

- Regions have already been occupied by USDT, only scenarios remain; flow payments are more imaginative than cross-border payments, representing a brand new distribution channel, rather than a mechanical "+ stablecoin" attempt by existing giants

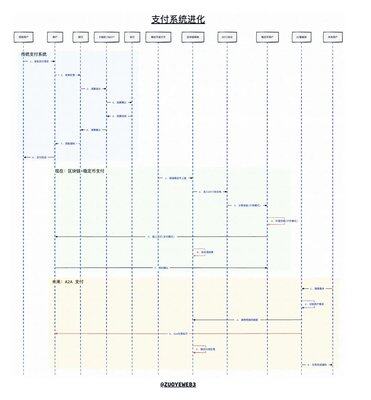

👇 Updated version of the payment system evolution chart

Stablecoin on-chain payments, clearing Web2 thinking

In 2008, under the shadow of the financial crisis, Bitcoin attracted the first batch of ordinary users disappointed with the fiat currency system, stepping out of the niche community of crypto punks.

At the same time, the term FinTech began to gain popularity around 2008, almost concurrently with Bitcoin, which may be coincidental.

It could be even more coincidental; in 2013, the first bull market for Bitcoin arrived, with prices breaking through $1,000, and #FinTech also began to mainstream. At that time, the once-glorious Wirecard and P2P later fell, while Yu'ebao defined the yield system of the internet era, and Twitter founder Jack's new payment solution Square was valued at over $6 billion.

This was not artificially manufactured; since 1971, the growth rates of gold prices and U.S. Treasury debt have been almost synchronized at 8.8% vs. 8.7%. After the gold dollar came the petrodollar; could the new energy dollar be stablecoins?

From a regulatory perspective, FinTech is the salvation of the banking industry, aiming to redo or supplement the financial system with internet thinking, hoping to recreate an internet-based financial system amidst the tangled political and business relationships.

Starting from the payment sector, it has become a global consensus, involving acquiring, aggregation, P2P, cross-border settlement, and micro-lending, crossing boundaries and mixed operations, creating endless prosperity or crises.

Unfortunately, the unintentional success of the willow tree has truly changed the banks and the traditional financial system behind them through blockchain practices, moving from the margins to mainstream, all happening outside of regulation.

Image description: Evolution of payment systems

Image source: @zuoyeweb3

## Payments Rooted in Code Rather Than Finance

Yield-bearing stablecoins using USDT for dividends serve as a maturity judgment marker.

Payments, for hundreds of years, have been centered around the banking industry; all electronic, digital, or internet-based transformations have been building bricks for the banking sector until the emergence of blockchain.

Blockchain, especially stablecoins, has created an inverted world, completely reversing the order of payments, clearing, and settlement. Only after confirmation can clearing and settlement occur, allowing the payment process to be completed.

In the traditional banking system, payment issues are essentially a bifurcated process of front-end transfers and back-end clearing, with the banking industry at the absolute center.

Under FinTech thinking, the payment process is about aggregation and B-end services, where the internet's customer acquisition mindset demands that no acquiring traffic be overlooked. Traffic determines the confidence of FinTech companies in facing banks; "Fake it till Make it"—networking and margin requirements are accepted as the final result.

In the blockchain mindset, stablecoin systems like USDT, with #Tron as the earliest stablecoin L1 and Ethereum as a large-scale clearing and settlement system, have achieved the "programmability" that should have been realized by the internet.

The lack of interconnectivity is an external manifestation of platforms competing for territory; the core issue is the insufficient degree of dollar internetization. Being online is always just a supplement to the fiat currency system, but stablecoins are a native asset form for blockchain. Any public chain's USDT can be exchanged with each other, and friction costs depend solely on liquidity.

Thus, based on the characteristics of blockchain, only after verifying that clearing and settlement can occur can payment confirmations be completed. Gas Fees are determined by market mechanisms, and once confirmed, they can flow in real-time.

A counterintuitive thought: blockchain did not give rise to stablecoin systems due to unregulated arbitrage, but rather the efficiency brought by programmability has shattered the traditional financial system.

Payments are an open system rooted in code rather than finance.

We can provide a counterexample: the reason traditional bank wire transfers take time is not merely due to compliance requirements and outdated network architecture; the core issue is that participating banks have a "retention" demand. Massive funds generate continuous returns, and users' time becomes passive compounding for the banking industry.

From this perspective, after the Genius Act, the banking industry is still frantically preventing yield systems from entering the banking system. The superficial reason remains yield, or paying interest to users would distort the banking industry's deposit and loan mechanisms, ultimately causing systemic crises in the financial sector.

The on-chain programmability of yield systems will ultimately replace the banking industry itself, rather than create more problems than the banking industry, as this will be an open system.

Traditional banking earns from the interest spread between user deposits and loans to businesses/individuals, which is the foundation of all banking operations.

The interest spread mechanism gives the banking industry the dual power to select users, allowing it to create #unbanked populations on one side and choose businesses that do not meet "standards" on the other.

Ultimately, the losses caused by triangular debts or financial crises created by banks are borne by ordinary users. In a sense, USDT is similar; users bear the risk of USDT, while Tether takes the issuance profits of USDT.

@ethena_labs and other YBS (yield-bearing stablecoins) do not rely on the dollar for issuance, nor do they operate under the traditional banking interest spread mechanism, but are entirely based on on-chain facilities like Aave and payment attempts using public chains like TON.

Currently, yield-bearing stablecoin systems have created a globally liquid payment, interest calculation, and pricing system, with the banking industry becoming the target of stablecoin transformation—not by altering the way payments are processed, but by changing the intermediary status of credit creation in the banking industry.

In the face of the offensive from yield-bearing stablecoins, small banks are the first to bear the brunt. Minnesota Credit Union has already attempted to issue its own stablecoin, and previous Neo Banks are rapidly moving on-chain, such as @nubank starting to reattempt stablecoins.

Even SuperForm and others are beginning to transform themselves into stablecoin banking systems, allowing users to share in the profits created by banks, thereby correcting the distorted banking system.

Image description: The impact of YBS on the banking industry

Image source: @zuoyeweb3

In summary, yield-bearing stablecoins (#YBS) are not merely a customer acquisition channel but a precursor to reshaping the banking industry. The on-chain migration of credit creation is a more profound transformation than stablecoin payments.

FinTech has not replaced the role of banks but has improved segments that banks are unwilling or unable to engage in. However, blockchain and stablecoins will redefine banks and currencies.

We hypothesize that #YBS will become the new dollar circulation system; payments themselves are synonymous with on-chain payments. Again, this is not a simple dollar on-chain transformation; unlike dollar internetization, on-chain dollars are part of the fiat currency system.

At this stage, the traditional payment system's view of stablecoins remains limited to clearing and cross-border areas, which is a completely erroneous established mindset. Please grant stablecoins freedom; do not embed them into outdated and obsolete payment systems.

Blockchain inherently does not distinguish between domestic and foreign, card/account, individual/business, or receiving/sending; everything is merely a natural extension and variation of transactions. As for stablecoin L1's enterprise accounts or privacy transfers, they are merely adaptations of programming details, still adhering to the basic principles of blockchain transactions: atomicity, irreversibility, and immutability.

Existing payment systems remain closed or semi-closed, such as #SWIFT rejecting specific regional clients, and Visa/MasterCard requiring specific hardware and software qualifications. A comparison can be made: the banking industry rejects unbanked individuals who do not generate high profits, while Square and Paypal may refuse specific customer groups, but blockchain welcomes all.

Closed systems and semi-open systems will ultimately yield to open systems; either Ethereum will become stablecoin L1, or stablecoin L1 will become the new Ethereum.

This is not blockchain engaging in regulatory arbitrage, but rather a dimensionality reduction brought about by efficiency upgrades. Any closed system cannot form a closed loop; transaction fees will diminish at various stages to compete for users, either by leveraging monopolistic advantages to increase profits or by using regulatory compliance to exclude competition.

In an open system, users possess absolute autonomy. Aave has not become the industry standard due to monopolization; rather, the DEX and lending models of Fluid and Euler have yet to fully explode.

However, regardless, on-chain banks will not be tokenized deposits of the banking industry but rather tokenized protocols rewriting the definition of banks.

Warning: replacing banks and payment systems will not happen overnight; #Paypal, #Stripe, and USDT are products from 20, 15, and 10 years ago, respectively.

Currently, the issuance volume of stablecoins is around $260 billion, and we will see an issuance volume of $1 trillion in the next five years.

## Web2 Payments Are Non-Renewable Resources

Credit card fraud handling largely relies on experience and manual operations.

Web2 payments will become the fuel for Web3 payments, ultimately completely replacing rather than supplementing or coexisting.

Stripe's participation in the future based on Tempo is the only correct choice; any attempt to incorporate stablecoin technology into the existing payment stack will be crushed by the flywheel—it's still an efficiency issue. On-chain YBS yield rights and usage rights are bifurcated, while off-chain stablecoins only have usage rights; capital will naturally flow towards appreciation tracks.

While stablecoins strip the banking industry of its social identity, they also clear the established thinking of Web2 payments.

As mentioned earlier, the issuance of stablecoins is gradually breaking away from mere imitation of USDT. Although completely breaking away from the dollar and banking system is still a distant goal, it is no longer a complete fantasy. From SVB to Lead Bank, there will always be banks willing to engage in crypto business, a long-term endeavor.

By 2025, not only will the banking industry accept stablecoins, but the major obstacles that have troubled blockchain payment businesses will gradually thaw. The sound of Bitcoin has already become the roaring sound of stablecoins.

• Inflows and outflows: No longer pursuing the finality of fiat currency, people are willing or inclined to hold USDC/USDT to earn yields, use directly, or preserve value against inflation. For example, MoneyGram and Crossmint are collaborating to handle USDC remittances.

• Clearing and settlement: Visa has completed $1 billion in stablecoin clearing volume, with Rain as its pilot unit, while Samsung is an investor in Rain. The anxiety of old giants will become the funding source for stablecoin payments.

• Large banks: RWA or tokenized deposits are just appetizers; considering competition with DeFi is not far off. The evolution is a passive adaptation of traditional finance, with internet alliances like Google AP2 and GCUL representing the unwillingness and struggle of old-era monopolists.

• Issuance: From Paxos to M0, traditional compliance models and on-chain packaging models are advancing simultaneously, but yield systems will be taken into account. Although Paxos's USDH plan has failed, empowering users and tokens is a common choice.

In summary, the competition for positioning in stablecoin on-chain payments has ended, and the combination race has begun, namely how to push the network scale effect of stablecoins globally.

In a sense, USDT has already completed pushing stablecoins into Asia, Africa, and Latin America. There is no new growth space in regions; it can only be "scenarios". If existing scenarios are to be enhanced by payment players "+ blockchain."

Then it can only seek new "blockchain+"/"stablecoin+" scenarios. This is the clever use of internet strategies in Web3, buying volume for growth, cultivating new behaviors, and the future will define today's history. Agentic Payment will definitely be realized.

After changing the banking industry and payment systems, let's delve into the future of payment systems under agent guidance. Please note that the following text completely disregards the situation of "+ blockchain" or "+ stablecoin"; it is entirely a waste of ink. The future will have no market space for existing payment giants.

Yield systems can incentivize end-users' usage, but new payment behaviors require accompanying consumption scenarios. For example, using cryptocurrency for consumption within Binance's built-in mini-program is reasonable, but using a bank card within WeChat's mini-program is quite strange.

Brand new scenarios, from the perspective of Google, Coinbase, and even Ethereum, can only be A2A (Agent 2 Agent), requiring no deep human involvement. Web2 payments are a non-renewable resource because in the future, payments will be ubiquitous.

In simple terms, in the future, people will have multiple agents handling different tasks, while MCP (Model Context Protocol) will configure resources or call APIs within agents, ultimately presenting us with agents matching and creating economic value.

Image description: A2A and MCP connection

Image source: @DevSwayam

Human behavior will be more about delegation rather than authorization; one must relinquish multidimensional data to allow AI agents to meet your intrinsic needs.

• Human value lies in authorization

• Machines operate tirelessly

Existing pre-authorization and pre-payment, buy now pay later, acquiring/issuing, clearing/settling will occur on-chain, but the operators will be agents. For instance, traditional credit card fraud requires manual processing, but agents will be smart enough to identify malicious behavior.

Standing under the existing payment stack and the "central bank—bank" system, one might indeed think the above ideas are unrealistic. However, do not forget that the digital yuan's "immediate payment and transfer" also stems from a yield perspective, ultimately compromising with the banking system.

It is not that it cannot be done; it is that it cannot be done.

Google is pulling in AP2 protocols built by Coinbase, EigenCloud, and Sui, which have already been highly integrated with Coinbase's x402 gateway protocol. Blockchain + stablecoin + internet is currently the optimal solution, targeting microtransactions. In its vision, real scenarios include real-time cloud usage, article paywalls, etc.

How to say, we can be sure that the future belongs to AI agents, transcending clearing and settlement channels, but the specific path of how it changes humanity remains unknown.

The DeFi sector still lacks a credit market, which is naturally suitable for corporate development. However, in the long term, retail or individual markets rely on excessive collateral mechanisms to become the main force, which is itself an abnormal phenomenon.

Technological development has never been able to imagine the path of realization; it can only outline its basic definitions. FinTech is like this, DeFi is like this, and Agentic Payment is too.

Caution: The irreversible nature of stablecoin payments will also give rise to new arbitrage models, but we cannot imagine their harmfulness.

Additionally, existing distribution channels will not be the core battlefield for the large-scale use of stablecoins. There may be a high usage volume, but it will damage its revenue potential in interacting with the on-chain DeFi stack. This is still a fantasy; the emperor will not use a golden hoe to dig vegetables.

Stablecoin payments must replace banks and existing distribution channels to be considered a Web3 payment system.

## Conclusion

The path I envision for the realization of a non-bank payment system: yield + clearing and settlement + retail (network effects) + agent flow payments (after breaking free from the self-rescue of old giants).

The current impact is still concentrated on FinTech and the banking industry, with little ability to replace the central bank system. This is not because it is technically unfeasible, but because the Federal Reserve still plays the role of the ultimate lender (the scapegoat).

In the long run, distribution channels are an intermediate process. If stablecoins can replace bank deposits, no channel can lock in liquidity. However, on-chain DeFi has no entry barriers and unlimited users. Will this trigger an even more violent financial crisis?

3.56K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.