After looking at this $UXLINK governance vote, my reaction is that it seems like a strategic signal, doesn't it? Unlocking 4.5% in advance, yet placing it in a multi-signature wallet for custody, not using it, and being transparent and verifiable. Normally, the project team would be most afraid of being questioned about a dump, but this action is equivalent to revealing their cards in advance. It seems that this is to prepare chips for cooperation with top exchanges and potential listing companies. In other words, this unlocking is to reserve space for the future, rather than for cashing out right now. From the perspective of strategic reserves, in addition to $BTC and $UXLINK, $BNB should also be included. Is it to diversify risks while binding the ecosystem? After all, relying solely on BTC is too singular, and depending only on one's own token is unstable. Behind the entire proposal, it seems to be answering a question: Should UXLINK move towards true ecological cooperation? If...

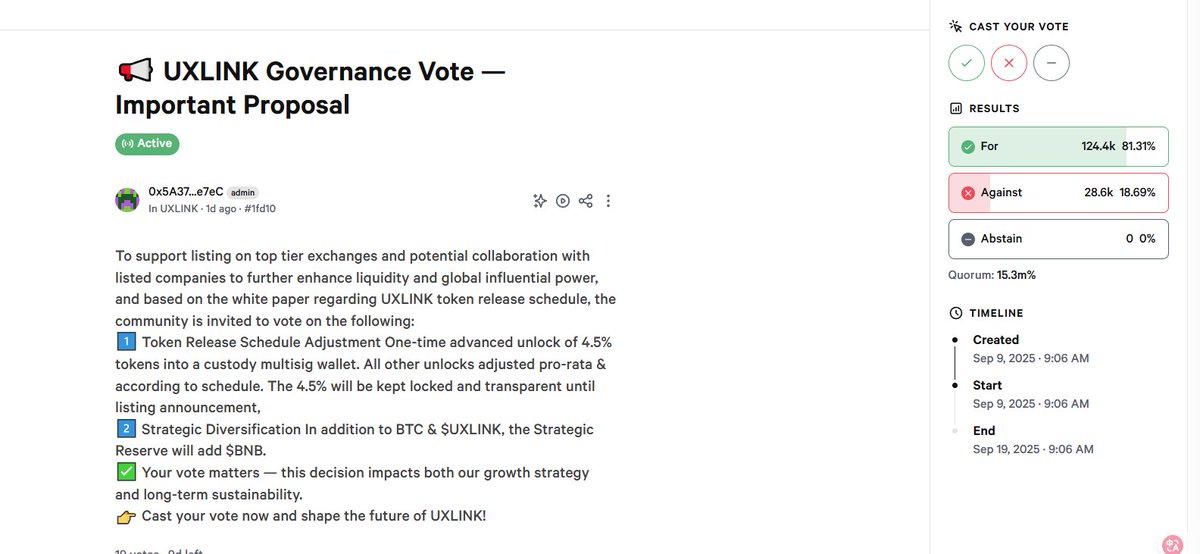

📢 UXLINK Governance Vote — Important Proposal

To support listing on top tier exchanges and potential collaboration with listed companies to further enhance liquidity and global influential power, and based on the white paper regarding UXLINK token release schedule, the community is invited to vote on the following:

1️⃣ Token Release Schedule Adjustment One-time advanced unlock of 4.5% tokens into a custody multisig wallet. All other unlocks adjusted pro-rata & according to schedule. The 4.5% will be kept locked and transparent until listing announcement,

2️⃣ Strategic Diversification In addition to BTC & $UXLINK, the Strategic Reserve will add $BNB.

✅ Your vote matters — this decision impacts both our growth strategy and long-term sustainability.

👉 Cast your vote now and shape the future of #UXLINK !

11.79K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.